3Yr old activities

75 Everyday Activities For 3 Year Olds

| 75 Comments

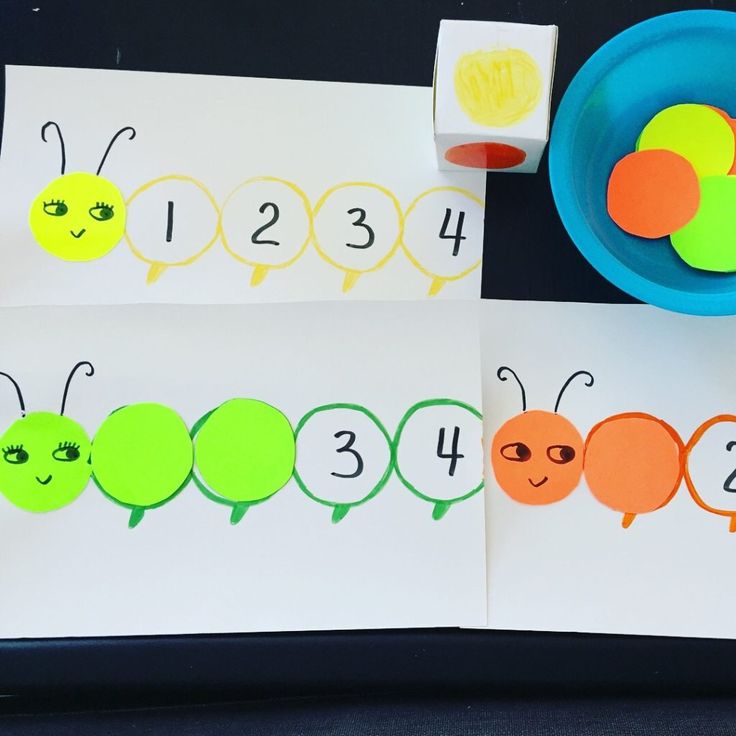

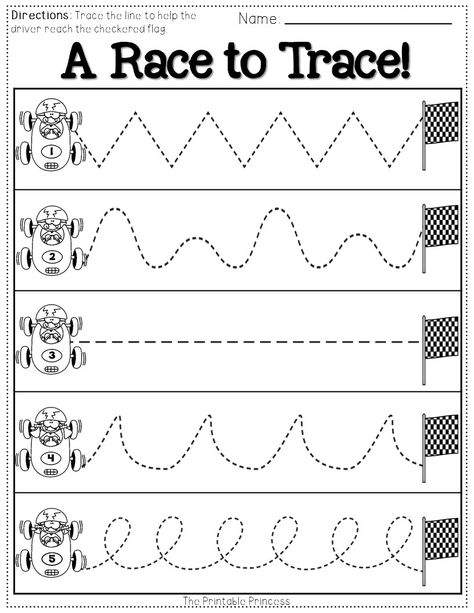

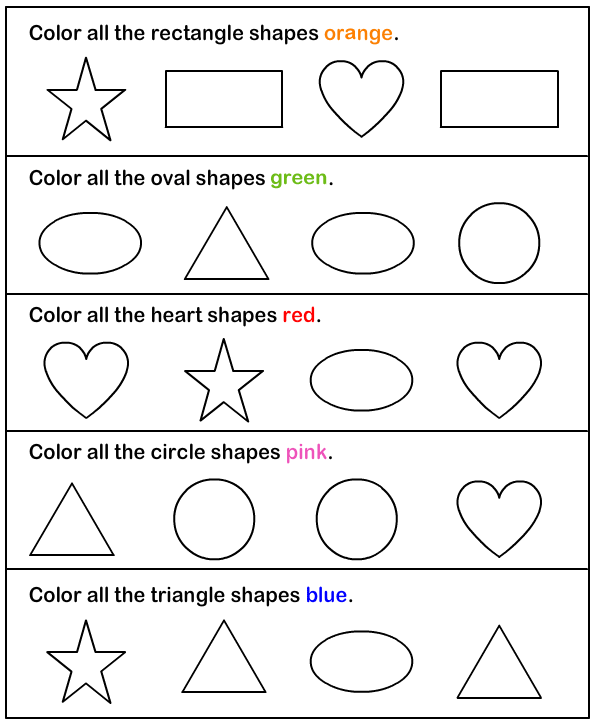

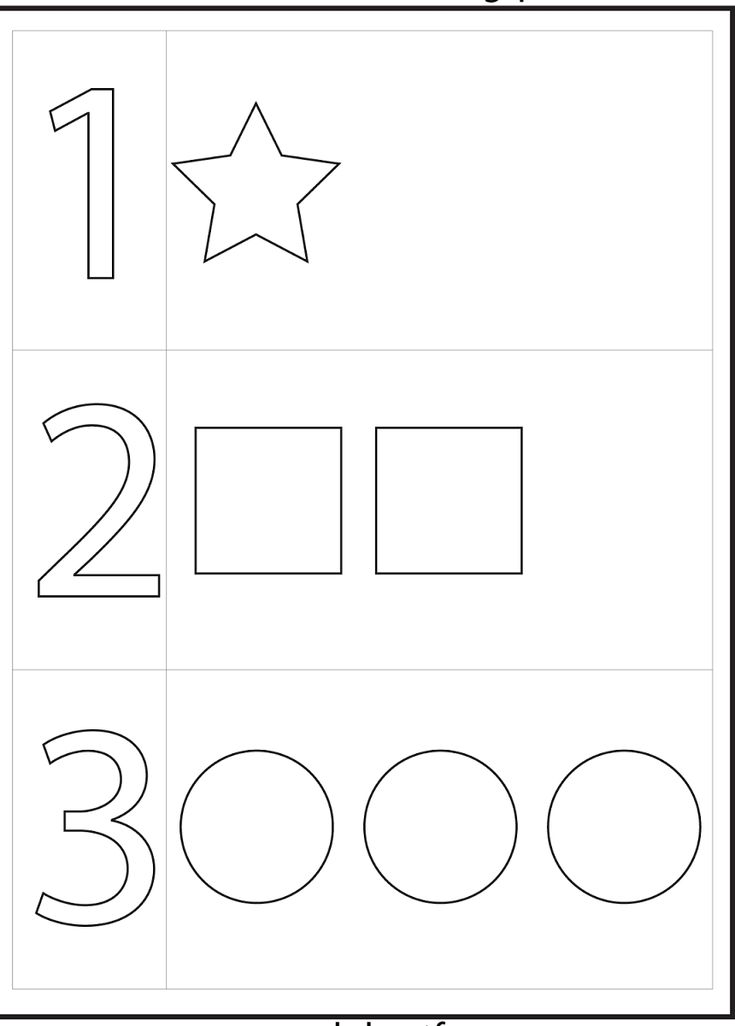

What are your favorite activities for 3 year olds? These simple activities aren’t just for 3 year olds, they are great activities and preschool learning games for older kids too! Don’t miss my new book Everyday Preschool, it’s the best book for parents who want to make sure their child is learning every day.

Finding the right activities for 3 year olds should be easy… but it isn’t. This summer my daughter and I have had a lot of time to play. Extra time in fact because she decided when she turned 3 to give up naps. With her brother home from school for the summer, my attempts at forcing the issue have been met with refusal. I am going to try again in a month when her brother returns to school but in the meantime, she has quiet time, earlier bedtimes and lots of simple activities like these peppered throughout the day. For more specific games for 3 year olds check out our post here with our favorites!

If you have a younger child check out our similar list of 75 TV Free Activities For Toddlers. These 3 year old activities have been the bulk of what we’ve done this summer. Big projects are fun but day in and day out this is what we do.

This post contains affiliate links.

Fun Activities for 3 year olds

- Playdough sculptures with dry spaghetti.

- Fill a table with books and read, read, read.

- Doodle with smelly markers on cardboard from your recycle bin.

- Play doctor with dolls.

- Take a walk and hunt for colors.

- Play with puzzles.

- Look at family photos together.

- Create with peel and stick jewels.

- Read through catalogs.

- Build a fort.

- Play eye spy with a favorite book.

- Eat lunch outside.

- Play in a box.

- Paint with watercolors.

- Play with stickers.

- Play sports in the yard.

- Play-Doh and sequins.

- Play The Cupcake Game.

- Play Simon Says.

- Make a balance beam out of painter’s tape and walk it!

- Play in a kiddie pool.

- Color with Color Wonder markers and coloring sheets.

- Water some plants

- Play with Magic Nuudles.

- Play with Play-Doh and Duplo together.

What are some easy things to do with a 3 year old? Keep reading!

- Play with a light table ( easy DIY here ).

- Play with cold cooked spaghetti.

- Cook together.

- Play with water, rice, beans, gravel, etc… in your water table .

- Play with the hose.

- Dress up some dolls.

- Take silly pictures together.

- Play hide and seek.

- Cuddle.

- Play with stamps.

- Make some window clings .

- Paint your toenails with kid-safe nail polish.

- Run Through the sprinkler.

- Write in a journal with markers, stamps, and crayons.

- Go to the beach.

- Learn about emotions with Mr. Potato Head.

- Go to the library.

- Read with a sibling.

- Call Grandma ( or Aunty, Uncle… you get the picture.

)

) - Help clean.

- Play dentist with dolls.

- Finger paint.

- Draw with chalk on black construction paper.

- Go to a local elementary school and play at the playground.

What are the best activities for 3 year old ?

- Play dress-up.

- Take markers and paint onto the porch for art outside.

- Duplo

- Play School

- Mix sidewalk chalk and other toys for pretend play outside.

- Bubbles.

- Scrap paper collages. All you need is some paper and glue!

- Hunt for magnets with a magnetic wand in a bowl of uncooked oatmeal or rice.

- Jump in puddles. I don’t know of a better activity for a 3 year old than this one!

- Build a tower out of recycling.

- Wash the car.

- Backyard nature hunt. Tape painter’s tape sticky side out on a window or wall and have your child stick what they find on it.

- Take some pictures.

- Have a tea party.

- Practice cutting with playdough!

- Make a ramp with cardboard and drive matchbox cars down it.

- Read books outside.

- Play-Doh with pipe cleaners.

- Wash push cars, scooters, and bikes.

- Go for a hike.

- Play with Play-doh and egg molds.

- Play airplane or train with your kitchen chairs.

- Wash windows with water and vinegar.

- Turn snack bars into shapes and practice using a knife at the same time.

- Play alone. Yes, it’s more than OK, it’s awesome to let kids play alone. Let your 3 year old think up their own activities. We don’t need to entertain them 24/7 !

What is your family’s favorite everyday activity? Not listed? Add it in the comments and tell us why your kids love it!

Need more activities to do with 3 year olds?

A

Filed Under: 75 activities for 3 year olds, Age Preschool, Age: Toddlers, Preschool Activities | 75 Comments

Like this post? Share it with a friend!

Become an Email Subscriber

Sign up above and receive all new No Time for Flashcards posts directly in your email inbox.

You may also like these posts

Next Post: Dollar Store Salt Tray { Alphabet Activity }

Previous Post: Nature Cuttings – Outdoor Scissor Skills Activity

Trackbacks

50+ Easy Things To Do At Home with Your 3 Year Old

What To Do at Home with Your 3 Year Old

Being at home with a 3 year old can be hard when you are not prepared.

Most pediatric guidelines recommend less than 1 hour of screen time a day. So what on earth do you do the 4-5 hours you may have at home with them?!?

To help you get through your day I have come up with a list of 50+ fun and easy things you can do throughout the day with them.

Most of these items do not require any preparation and use items you already most likely have in your home. The clean up for most of these activities is nothing or very minimal.

How To Use This List

Obviously you aren’t going to do everything on this list. So go through the list, choose about 10-15 things you think your preschooler would like to do.

Chances are there will be a few they will like more than others. So it’s a good idea to go armed with several activities in case one falls through.

Ready? Let’s get started!

50+ Things To Do at Home with your 3 year old

1. Finger painting with water on cardboard.

2. Cut junk mail with scissors.

3. Foil Puzzle Presents.

4. Melt ice with warm water and eye dropper or turkey baster.

5. See how much water a diaper or pull-up can hold.

6. Use eye dropper to decorate a diaper or pull up with coloured water.

7. Tear a sheet into small squares. Draw on them. And then glue them together onto another sheet.

8. Play restaurant.

9. Place plastic wrap around a bowl using an elastic band and let them poke holes in it with their fingers.

10. Place a cardboard tube on their arm and use it to hit a balloon like a bat.

11. Fill sink with water and give them some large beads to put in the water.

12. Fill sink with water and add pom poms.

13. Fill sink with water and bubbles and add a few non-bath toys.

14. Have a dance party to their favourite Disney soundtrack.

15. Have a dance party to your favourite dance songs.

16. Build a pillow and blanket fort.

17. Take a bath with plastic balls.

18. Build a Book Rainbow.

19. Play dress up with your shoes.

20. Read a book lying down on the floor.

21. Play dress up with daddy’s old ties.

22. Teach them how to play rock, paper, scissors.

23. Stick some paper to the stairs and have them draw on the stairs.

24. Stick paper under a chair and have them colour a picture there.

25. Play in bath tub in swimsuit with toys.

26. Look at your child’s baby book.

27. Paint a colouring book with watercolours.

28. Have a toga party with swaddling blankets or towels.

29. Bake muffins together.

30. Make fruit kebabs and eat them.

31. Snuggle on the floor looking up at the ceiling pretending you see clouds shaped like different animals.

32. Play hide and go seek.

33. Have tickle fight.

34. Have a pretend wedding.

35. Cover rocks with shaving cream and have them clean them off.

36. Paint with a potato masher or spatula or other kitchen utensils.

37. Paint Lego or Megabloks.

38. Wash paint off Lego or Megabloks with soap and water.

39. Take a magnifying glass (pretend, real or handmade) and go looking for bugs.

40. Play with balloons.

41. Make faces on plate with their snack. (For instance cut up some fruit and have them make faces on their plate with the pieces of fruit.)

42. Play pretend telephone with 2 cups over your ears.

43. Make car ramps using books or cardboard on a couch or stairs.

44. Eat lunch on the floor picnic style.

45. Make funny faces in the mirror or smartphone.

46. Put several puzzles in a bin and then have your 3 year old search for pieces and put them all together.

47. Play pretend firefighters.

Play pretend firefighters.

48. Build a tower using toilet paper and tissue boxes.

49. Take mattress off their crib and use it as a tumbling mat. For added protection, arrange pillows all around and set safety ground rules.

50. Have them ‘read’ their favourite books to you.

51. Blow bubbles outside, no matter the weather.

52. Use a measuring tape to measure your body parts such as arms and legs.

53. Dress up for lunch.

WILL YOU TRY ANY OF THESE ACTIVITIES WITH YOUR 3 YEAR OLD? Pin it for later!

1.3.2. Restrictions on the period under review \ ConsultantPlus

Annexes to this document do not apply as the forms sent by letter N ED-4-2 / 356 of the Federal Tax Service of Russia dated January 15, 2019 are implemented in the Applied Subsystem "Control Work" of the Automated Information System "Tax-3" @.

1.3.2. Restrictions on the checked period.

The period for which the audit is carried out must consist of an integer number of tax periods for all taxes and fees for which the audit is scheduled. At the same time, an on-site tax audit may be scheduled not earlier than the deadline for submitting tax returns for the last tax period for all taxes for which the audit is scheduled.

At the same time, an on-site tax audit may be scheduled not earlier than the deadline for submitting tax returns for the last tax period for all taxes for which the audit is scheduled.

When conducting an audit on several or all taxes and fees (regardless of the wording of the subject of the audit), it is recommended to establish a single period for which the audit is carried out, while the period for checking the legality of tax amounts claimed for reimbursement, transfer of taxes by tax agents to the budget may not coincide .

As part of an on-site tax audit, a period not exceeding three calendar years preceding the year in which the decision to conduct an audit was made (the depth of an on-site tax audit) may be audited (paragraph two of paragraph 4 of Article 89of the Code). Paragraph three of clause 4 of Article 89 of the Code provides for the only exception from this rule - if a taxpayer submits an amended tax return, the period for which the amended tax return is submitted is checked within the framework of the relevant on-site tax audit.

When applying paragraph 4 of Article 89 of the Code, the following must be taken into account:

1) the norm is applied if a taxpayer submits an amended tax return for a period exceeding three calendar years preceding the year in which such a declaration is submitted;

2) the norm grants the tax authority the right to conduct an on-site tax audit for the period for which an amended tax return has been submitted;

3) the time of submission of the amended tax return (during the on-site tax audit, before it, after it) does not matter for the application of the norm. At the same time, it matters whether an on-site tax audit was previously carried out for that tax and for the period for which an updated tax return is submitted, since paragraph 4 of Article 89The Code does not give the tax authority the right to conduct a repeated field tax audit on the same grounds.

When specifying the period for conducting an audit of newly created organizations, tax authorities should take into account that, in accordance with paragraph 2 of Article 55 of the Code, for organizations established after the beginning of the calendar year, the first tax period is the period from the date of establishment of the organization until the end of this year, and if the establishment of an organization on a day falling within the time period from December 1 to December 31, the first tax period for it is the period from the date of establishment to the end of the calendar year following the year of establishment. In this case, the day of establishment of the organization is recognized as the day of its state registration. With regard to those taxes for which the tax period is set as a calendar month or quarter, the indication of the first tax periods is made in accordance with the periods agreed upon when the organization was created by the tax authority at the place of registration of the taxpayer (paragraph 4 of Article 55 of the Code).

In this case, the day of establishment of the organization is recognized as the day of its state registration. With regard to those taxes for which the tax period is set as a calendar month or quarter, the indication of the first tax periods is made in accordance with the periods agreed upon when the organization was created by the tax authority at the place of registration of the taxpayer (paragraph 4 of Article 55 of the Code).

Tax audit for more than three years

Yulia Vasilyeva

Head of the group for accreditation of foreign missions

In some cases, Russian law allows on-site inspections in cases where the deadline has passed the three-year mark.

Deviation from the legal norms in such cases entails liability. The tax inspectorate has the right to monitor the actions of organizations by organizing inspections (desk, field). Their purpose is to monitor the implementation of tax regulations. This important provision is fixed in Art. 87 of the Tax Code of the Russian Federation. In the course of a cameral event, tax controllers consider payments for the period indicated by the taxpayer in his declaration (clause 1, article 88 of the Tax Code of the Russian Federation). This happens without the participation of the enterprise.

87 of the Tax Code of the Russian Federation. In the course of a cameral event, tax controllers consider payments for the period indicated by the taxpayer in his declaration (clause 1, article 88 of the Tax Code of the Russian Federation). This happens without the participation of the enterprise.

Field control involves the visit of the inspector to the office and review of reports. In accordance with the norms of the law (clause 4, article 89 of the Tax Code of the Russian Federation), the period of a tax audit is 3 years, no more. The period under consideration usually does not exceed three reporting years, excluding the year with the conclusion of the inspection. Other circumstances are acceptable in practice. In our review, we will consider such situations in which the IFTS can legally check the payer, even if the three-year period has already expired.

Example

Company "X" received an order from the tax authorities about the upcoming test visit. The decision was made on December 28, 2013. The Organization received it only on January 12, 2014. Are there any limits on the period that will be considered by controllers as part of this event? The Federal Tax Service has the right to check the timely receipt of payments, as well as the accuracy of their calculation, for a period of time starting from 01/01/2009 (clause 4 of article 89 of the Tax Code of the Russian Federation). The following fact deserves special attention: the payer received the decision to organize an inspection by controllers in the next calendar year after it was made. This moment does not affect the circumstances. A three-year period is also subject to control. In the real practice of judicial protection, there are enough indicators that confirm this interesting conclusion. For example, the conclusion of the Federal Arbitration Court of the North-Western District of June 22, 2012 No. A05-14239/2010. In the clarifications of the Plenum of the Supreme Arbitration Court of the Russian Federation (clause 27 of the resolution dated February 28, 2001 No.

The Organization received it only on January 12, 2014. Are there any limits on the period that will be considered by controllers as part of this event? The Federal Tax Service has the right to check the timely receipt of payments, as well as the accuracy of their calculation, for a period of time starting from 01/01/2009 (clause 4 of article 89 of the Tax Code of the Russian Federation). The following fact deserves special attention: the payer received the decision to organize an inspection by controllers in the next calendar year after it was made. This moment does not affect the circumstances. A three-year period is also subject to control. In the real practice of judicial protection, there are enough indicators that confirm this interesting conclusion. For example, the conclusion of the Federal Arbitration Court of the North-Western District of June 22, 2012 No. A05-14239/2010. In the clarifications of the Plenum of the Supreme Arbitration Court of the Russian Federation (clause 27 of the resolution dated February 28, 2001 No. 5), the following concept is fixed: in clause 4 of Art. 89 of the Tax Code of the Russian Federation, there are rules that limit the limitation period when considering the IFTS of the last phase of the enterprise's life. Controllers can check such a period. In this part of the above article, it is not prohibited to conduct inspections in the current calendar year.

5), the following concept is fixed: in clause 4 of Art. 89 of the Tax Code of the Russian Federation, there are rules that limit the limitation period when considering the IFTS of the last phase of the enterprise's life. Controllers can check such a period. In this part of the above article, it is not prohibited to conduct inspections in the current calendar year.

An isolated case here is the submission by the payer of a repeated declaration (updated) within the framework of exit control. Such a derogation exempts the Federal Tax Service from time limits (three years). Control can be carried out without taking into account the statute of limitations, if a declaration was submitted to clarify the information.

The formulated provision “as part of the on-site verification procedure” implies certain manipulations by the payer. The organization may attempt to limit the likelihood of extending the deadline. If we interpret the law directly, it turns out that an exception takes place if the clarification is submitted at the time of the on-site verification event. The Federal Tax Service of the Russian Federation provided clarifications on this issue (letter dated May 29, 2012 No. AS-4-2/8792). The tax authorities suggest that the exact time of submission of the clarification is not so important for the verification event. The applied rules do not depend on this setting. An on-site inspection may be carried out for the period listed in the declaration, which exceeds 3 years from the date of the decision to exercise control, provided that the specified period has not been previously inspected. On this issue, at different times, the courts of different instances took the side of the payer.

The Federal Tax Service of the Russian Federation provided clarifications on this issue (letter dated May 29, 2012 No. AS-4-2/8792). The tax authorities suggest that the exact time of submission of the clarification is not so important for the verification event. The applied rules do not depend on this setting. An on-site inspection may be carried out for the period listed in the declaration, which exceeds 3 years from the date of the decision to exercise control, provided that the specified period has not been previously inspected. On this issue, at different times, the courts of different instances took the side of the payer.

Here is an example:

On August 24, 2009, the head of the IFTS decided to carry out an inspection on the territory of the SME "ROSSBAN". The goal was to determine the correctness of the calculation of payments to the budget and the timeliness of their transfer, retention. It was also planned to check insurance premiums for OPS from 01/01/2008 to 12/31/2008.

For the tax levied on profits (for the first quarter of 2005), the company submitted a repeated declaration on March 12, 2008. This happened 3 months before the departure of controllers to the enterprise in order to check documents for 2005-2007. The above decision of the Federal Tax Service did not mean that the review will affect 2005, including its first quarter.

During the trial, they took into account the current situation and concluded that the revised declaration had already been examined during a desk audit of documents or during an on-site audit in 2005. Therefore, the tax authority had no reason to consider data for the first quarter of 2005 during the audit from 01/01/2008 to 12/31/2008. The judge made a reasonable conclusion: the disputed amended declaration was subject to research and evaluation during a cameral event in the tax office or during an on-site audit of the period to which it relates (2005). As a result, the tax authority had no legal grounds to audit the 1st quarter of 2005 as part of the audit in 2008 (01 January to 31 December). (Resolution of the Thirteenth AAS dated May 30, 2011 No. А21-8116/2010).

(Resolution of the Thirteenth AAS dated May 30, 2011 No. А21-8116/2010).

Another exceptional situation implied by Art. 89 of the Tax Code of the Russian Federation - a smaller tax payment is prescribed in the repeated declaration. In this option, controllers have the right to re-check the taxpayer. In the process, they can cover the period indicated in the declaration, which exceeds the limitation of 3 years.

Residents (organizations) not included in the unified register of participants in the Special Economic Zone (Kaliningrad Region) are also excluded from the general procedure. Exit control in relation to such subjects is carried out, guided by the rules prescribed in 288.1 and 385.1 of the Tax Code of the Russian Federation.

Consider an example:

At the beginning of March 2021, FTS employees checked the counterparty and demanded documents from the company for 2017. How legitimate are the actions of the inspectors?

It is believed that after a three-year period, the inspectorate has the right to request documents. There is another position. If papers are requested under Art. 93 and paragraph 2 of Art. 93.1. (regarding a specific transaction), then the inspectorate officer has the right to demand the necessary information from the actors who have information about the transaction. There is a conflict or legal uncertainty here. In practice, it is impossible to figure out what specifically the specialist is interested in as part of the audit. These articles contradict each other. Therefore, it is recommended to ask the tax officer to clarify the situation: what event is accompanied by the receipt of the document. Until further clarification, information may not be provided.

There is another position. If papers are requested under Art. 93 and paragraph 2 of Art. 93.1. (regarding a specific transaction), then the inspectorate officer has the right to demand the necessary information from the actors who have information about the transaction. There is a conflict or legal uncertainty here. In practice, it is impossible to figure out what specifically the specialist is interested in as part of the audit. These articles contradict each other. Therefore, it is recommended to ask the tax officer to clarify the situation: what event is accompanied by the receipt of the document. Until further clarification, information may not be provided.

At the same time, it is worth remembering that refusal to present documents contains certain risks. In any case, the tax authority has the right to request documents even beyond the 3-year period.

Taxpayers often have a question: how does the tax service request documents from counterparties? What papers during the on-site inspection may the inspector request? Should an organization provide documents if three years have passed?

The answer is obvious: the company is obliged to provide the requested documents for the entire period under review. During the verification process, inspectors can request information about the company being checked from other persons, for example, from counterparties, if they have this information. This is possible on the basis of paragraph 1 of Article 93.1 NK. The list of documents is contained in the order (its sample is approved by the order of the Federal Tax Service of November 7, 2018 No. ММВ-7-2/628). An on-site tax audit for 3 years does not count down the statute of limitations for documents, in this case it does not apply. If the period of storage of papers has expired or they have been destroyed, then you can refuse. For failure to submit important documents under Art. 126 of the Tax Code, it is impossible to attract an organization in such a situation. As arbitration practice has shown, there are judicial acts that support the correctness of this conclusion.

During the verification process, inspectors can request information about the company being checked from other persons, for example, from counterparties, if they have this information. This is possible on the basis of paragraph 1 of Article 93.1 NK. The list of documents is contained in the order (its sample is approved by the order of the Federal Tax Service of November 7, 2018 No. ММВ-7-2/628). An on-site tax audit for 3 years does not count down the statute of limitations for documents, in this case it does not apply. If the period of storage of papers has expired or they have been destroyed, then you can refuse. For failure to submit important documents under Art. 126 of the Tax Code, it is impossible to attract an organization in such a situation. As arbitration practice has shown, there are judicial acts that support the correctness of this conclusion.

The Federal Tax Service is not entitled to request various documents that are not related to the field of activity of the enterprise. The enterprise is not obliged to provide information to the inspection about the work of another company, which is its counterparty, but is not the object of control. It is also possible not to inform the tax authorities about the suppliers of products sold by the enterprise to the counterparty if it is under verification.

The enterprise is not obliged to provide information to the inspection about the work of another company, which is its counterparty, but is not the object of control. It is also possible not to inform the tax authorities about the suppliers of products sold by the enterprise to the counterparty if it is under verification.

The three-year restriction for on-site inspections does not apply to taxpayers who are subject to the special regime established by Ch. 26.4 of the Tax Code of the Russian Federation. They are subject to the rules under production sharing agreements. This norm is fixed by the Tax Code of the Russian Federation (Article 346.42). In this article, there is a postulate: controllers during a field event have the right to cover any period of time during the total period of validity of the production sharing agreement, starting from the year it enters into force.

Situations in which the IFTS can check the activities of the organization, even if the period has exceeded three years:

| Exceptions | Bases | |

|---|---|---|

| 1 | The payer submitted a repeated declaration (updated) during an on-site inspection by the Federal Tax Service of his documents | clause 4 article 89 of the Tax Code of the Russian Federation |

| 2 | The taxpayer filed a clarification and indicated the amount, which is less than previously declared. On this occasion, a second visit of the tax authorities to object 9 was organized0085 On this occasion, a second visit of the tax authorities to object 9 was organized0085 | paragraph 10 of Art. 89 of the Tax Code of the Russian Federation |

| 3 | Organizing a visit by tax officials to a resident who was excluded from the list of the Special Economic Zone (Kaliningrad Region) in order to review the correctness of the calculation of corporate property tax and income tax. There is a caveat here: the decision to hold such an event was made no later than 3 months from the date of payment by the subject of the specified tax | paragraph 16.1 of Art. 89 of the Tax Code of the Russian Federation |

| 4 | An on-site audit is carried out in relation to a taxpayer operating under a special tax regime (there is a production sharing agreement). | paragraph 1 of Art. 346 of the Tax Code of the Russian Federation |

IFTS can carry out field control, covering not only 3 years preceding the start of the event, but also the current year. Such checks are not prohibited and are carried out in accordance with the procedure established in the Tax Code of the Russian Federation. The courts also approve of this. For example, there is a ruling of the Supreme Court of the Russian Federation dated 09.09.2014 No. 304-KG14-737.

Such checks are not prohibited and are carried out in accordance with the procedure established in the Tax Code of the Russian Federation. The courts also approve of this. For example, there is a ruling of the Supreme Court of the Russian Federation dated 09.09.2014 No. 304-KG14-737.

The periods under consideration can be legally extended, following the norms of paragraph 2 of article 89.2 of the Tax Code of the Russian Federation.

The procedure established in this article prescribes: verification of organizations participating in the RIP (regional investment project) may cover a period of time up to five years, which precedes the year the FTS decision on exit control is made. RIP is a term that combines various investment initiatives (their goal is the release of goods based on the requirements of Article 25.8 of the Tax Code of the Russian Federation).

Materials more than three years prior to the tax audit may be requested by controllers from enterprises that adhere to agreements on the division of manufactured goods (Chapter 26. 4 of the Tax Code of the Russian Federation). Such taxpayers are subject to other requirements. Controllers during the visit have the right to consider any period when the specified agreement was in force (from the first year of its adoption). If an enterprise does not participate in RIP, has not concluded any production sharing agreements, this does not mean that the Federal Tax Service will limit the inspection period to three years. The inspectors have reason to extend the period under consideration. The taxpayer himself can provoke an increased interest of controllers by performing certain manipulations. A suspicious action would be to contact the Federal Tax Service with clarification on any tax. Controllers can arrange a second visit to check the timing of the clarification, even if it has gone beyond three years.

4 of the Tax Code of the Russian Federation). Such taxpayers are subject to other requirements. Controllers during the visit have the right to consider any period when the specified agreement was in force (from the first year of its adoption). If an enterprise does not participate in RIP, has not concluded any production sharing agreements, this does not mean that the Federal Tax Service will limit the inspection period to three years. The inspectors have reason to extend the period under consideration. The taxpayer himself can provoke an increased interest of controllers by performing certain manipulations. A suspicious action would be to contact the Federal Tax Service with clarification on any tax. Controllers can arrange a second visit to check the timing of the clarification, even if it has gone beyond three years.

How are sole proprietors who have ceased operations checked? Many believe that after issuing certificates of termination of work, deregistration with the Tax Inspectorate, and receipt of an extract from IGRIP, controllers will no longer check them for the completeness and correctness of paying taxes for the period of work of the IP.

In fact, everything is completely different. An individual remains a taxpayer, despite the loss of his IP status. Accordingly, he is liable to pay fees and taxes even in the event of liquidation of the enterprise.

In fact, everything is completely different. An individual remains a taxpayer, despite the loss of his IP status. Accordingly, he is liable to pay fees and taxes even in the event of liquidation of the enterprise. Article 44 of the Tax Code of the Russian Federation contains explanations of when obligations to pay fees and taxes arise, change and terminate. In paragraph 3 of this article, the obligation to pay tax terminates in the following cases:

- The taxpayer has paid the tax.

- Death of the payer or declaration of his death (in accordance with the legislative procedural norms of the Russian Federation).

- The taxpaying enterprise was liquidated after the necessary settlements and payments to the Russian budget were made (according to Art. 49Tax Code of the Russian Federation).

- Other circumstances have arisen in connection with which the obligation to pay fees and taxes has been terminated.

Based on the cases considered, according to the law, the liquidation of an individual entrepreneur does not mean that the obligation to pay tax has been terminated. The Tax Code of the Russian Federation provides: the taxpayer is obliged to store accounting data and other important documents of the organization for 4 years (paragraph 1 of article 23). If entrepreneurial activity is terminated, the natural person is not released from such obligation.

The Tax Code of the Russian Federation provides: the taxpayer is obliged to store accounting data and other important documents of the organization for 4 years (paragraph 1 of article 23). If entrepreneurial activity is terminated, the natural person is not released from such obligation.

Many mistakenly think that after deregistration of an organization or individual entrepreneur, the Federal Tax Service cannot have questions for them. In reality, everything is different. In accordance with Art. 23 of the Tax Code of the Russian Federation, after the completion of the activity by the entrepreneur, the controllers conduct an audit. Having closed the IP, the citizen is obliged to keep important documents for 4 years from the date of deregistration of the company. This time period is necessary to detect possible non-payment to the budget, additional charges (fines, taxes, penalties). After a 4-year period, the inspection is no longer entitled to check the papers of the former IP.

An on-site inspection may be ordered by the Federal Tax Service at the place of legal registration of the enterprise or at the place of residence of an individual. If the inspectors have no questions, the procedure is completed, then no acts are drawn up. If during the audit errors were found when calculating payments and filling out declarations, then draw up an act. Then the entrepreneur is charged with arrears and fines. All this must be paid, even when the IP has already been deregistered. If the audit revealed an overpayment, then the entrepreneur draws up an application for a refund. Within 3 years from the date of payment of the tax payment, such an application can be submitted.

What restrictions does the IFTS have?

Separately, it should be noted that the IFTS has the right to request information from counterparties of the surveyed company only in certain situations (paragraphs 1, 2 of article 93. 1 of the Tax Code of the Russian Federation). Let's list them:

1 of the Tax Code of the Russian Federation). Let's list them:

- Directly during the verification event.

- In the process of implementing additional measures.

This defines the fact that inspectors may require information, but only within established periods and activities. If the controllers have already completed the audit of the organization, but the counterparty received a request for the provision of papers on its activities, he is obliged to fulfill this requirement. Outside of the audit, the inspectorate has the right to consider materials only on specific transactions.

The Inspectorate may request any number of transaction documents. There are no restrictions here. In practice, inspectors make requests in case of a real need for them. Failure to provide data and documents threatens with a fine, but it does not depend on the number of documents.

If an organization is required to provide documents by an inspection at the location of its counterparty, then the requirement may not be fulfilled. "Alien" IFTS must send a letter to the inspection at the place of registration of the organization. From there, a demand will come containing a copy of the order. Employees should not make a direct request from a company that is registered with another IFTS. In this option, you can send a written refusal to the IFTS, which made the request.

"Alien" IFTS must send a letter to the inspection at the place of registration of the organization. From there, a demand will come containing a copy of the order. Employees should not make a direct request from a company that is registered with another IFTS. In this option, you can send a written refusal to the IFTS, which made the request.

The reason for refusing to check in the office may be: the area of the occupied office is too small, the company is carrying out repairs on the territory, etc. These facts must be documented.

If the audit is organized at the location of the tax office, controllers have the right to enter the company's territory. Inspectors can carry out individual manipulations within the framework of control (inventory, inspection, seizure). Restriction of access of officials to the territory of a controlled person is fixed by a special act. In the future, he will prove the fact of an administrative offense.

Important conclusions:

- The taxpayer and the Federal Tax Service can reconcile calculations for a period exceeding three years.

- The liquidation of an individual entrepreneur does not mean that the tax authorities are no longer entitled to conduct audits for the period of operation of the former entrepreneur.

There is a position:

An on-site inspection can be carried out by the Federal Tax Service Inspectorate for a period not previously considered, for which the “clarification” was provided, even after a three-year period. When submitting an updated declaration, it is important to calculate the required timeframes. Field inspections in practice are carried out in different ways. There are enterprises that are inspected every year, others are checked much less frequently. Usually, the employees of the Federal Tax Service try to avoid rare inspections, "dead zones" - cases when the enterprise has not been inspected for more than 3 years and therefore it is no longer subject to inspection. If your organization has not been checked for a long time, expect the arrival of controllers.