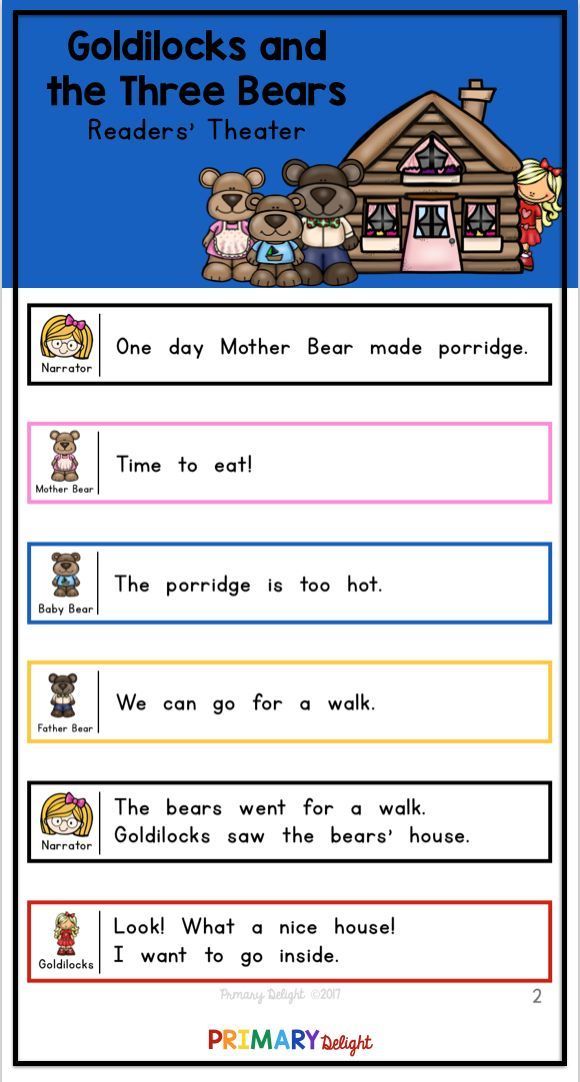

Goldilocks and the three bears script

Goldilocks and the Three Bears – A simple five minute play script for young children

Posted in Aesop's fabes, Animal Stories, Bear Hunt, Drama, Drama for children, drama for kids, Drama games for 3 year olds, Drama games for 4 year olds, English as a second language, English teaching games, Esl, Esl Drama, fables, Fairy Tales, Goldilocks anD the three bears, Hans Christian Andersen, Panchatantra plays, Plays, Plays for Children, Snow White, Storytelling, The Emperor's New Clothes, The Enormous Turnip, The Little Mermaid, The three billy goats gruffPosted on by Drama Start Books

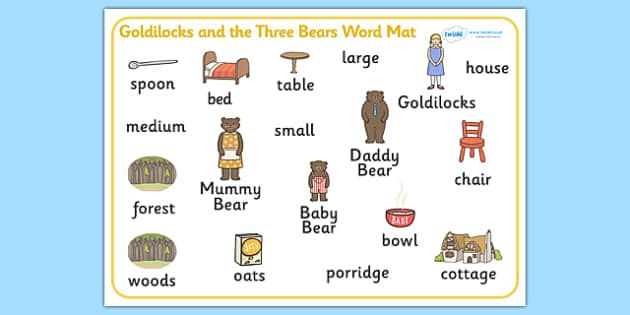

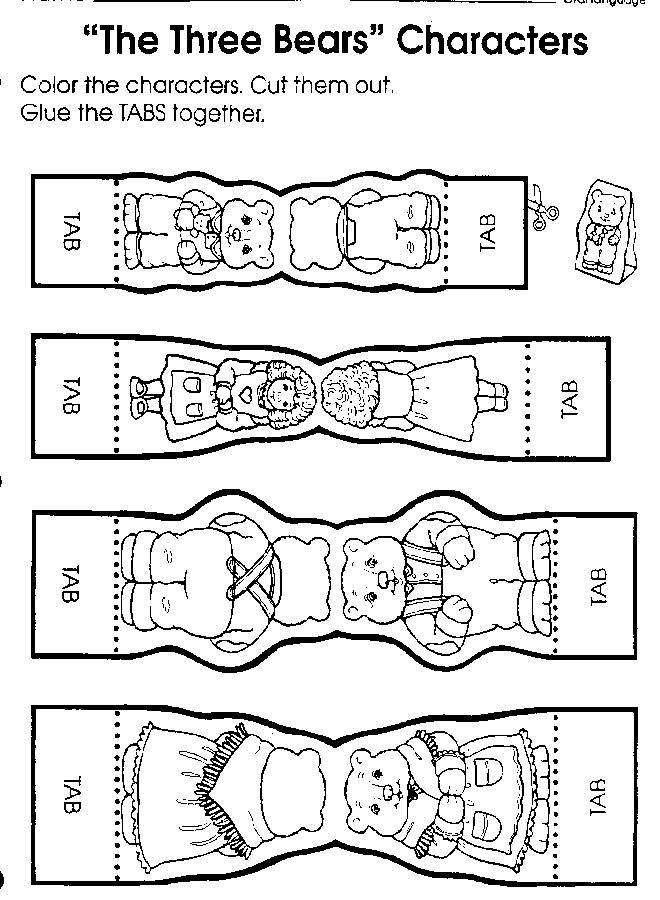

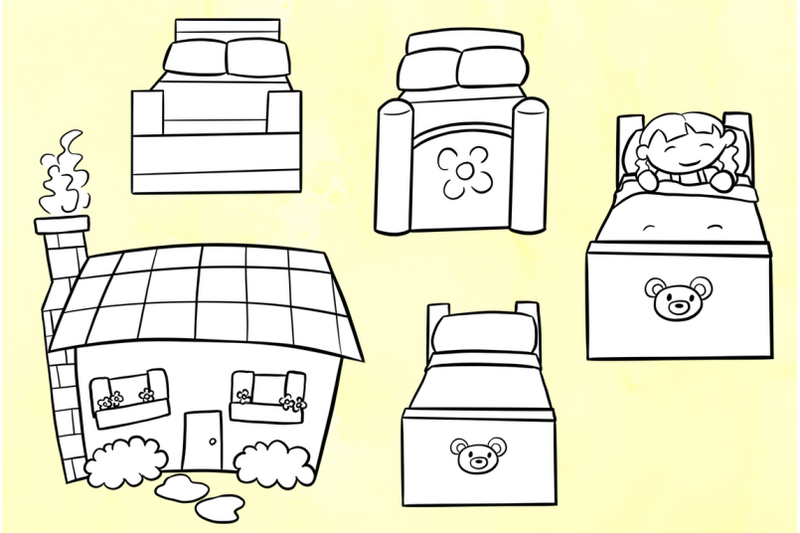

Characters: Three storytellers, Goldilocks, three bears, three bowls, three chairs, three beds.

Storyteller 1: Once upon a time, there were three bears who lived in a little house in the woods.

Storyteller 2: There was Daddy Bear, there was Mummy Bear and there was Baby Bear.

Storyteller 3: One fine day, they decided to go for a walk.

Daddy Bear: What a lovely sunny day it is today. Let’s all go to the woods.

Baby Bear: I’m hungry. I want to eat my porridge.

Mummy Bear: The porridge is still hot; it will be cool enough by the time we come back from our walk.

Storyteller 1: So, off they went on their walk.

Storyteller 2: Just then, a little girl called Goldilocks was walking in the woods.

Storyteller 3: She was picking flowers for her grandma.

Storyteller 1: She stopped suddenly and saw a pretty little house.

Goldilocks: Oh, what a pretty little house. I am feeling a little tired and hungry. I wonder if whoever lives here will let me rest for a few moments and give me something to eat (She knocks on the door.) There is no answer…. (She opens the door slowly and goes inside. )

)

Goldilocks: Oh look, three bowls of porridge.

Bowl 1: Eat me! I have lots of salt on me. (Goldilocks eats some but spits it out.)

Goldilocks: Yuck! You are too salty.

Bowl 2: I have lots of sugar on me. (Goldilocks eats some but spits it out.)

Goldilocks: Yuck! You are too sugary.

Bowl 3: Eat me! I’m just right. (Goldilocks eats some and likes it and continues eating it until all the porridge is gone.)

Goldilocks: Mmmmmm, that was just right. Oh look, three chairs. I think I’ll sit down for a moment.

Chair 1: Sit on me. I’m very hard. (Goldilocks goes to sit down and jumps up straight away.)

Goldilocks: This chair is too hard.

Chair 2: Sit on me. I’m very soft. (Goldilocks goes to sit down and jumps up straight away.)

Goldilocks: This chair is too soft.

Chair 3: Sit on me. I’m just right. (Goldilocks goes to sit down and makes herself comfortable.)

I’m just right. (Goldilocks goes to sit down and makes herself comfortable.)

Goldilocks: This chair is just right. Oh dear, I’ve broken the chair.

Storyteller 2: Goldilocks decided to walk upstairs.

Storyteller 3: She saw three beds.

Bed 1: Lie on me. I’m very hard. (Goldilocks lies down on the bed and suddenly jumps up.)

Goldilocks: This bed is too hard.

Bed 2: Lie on me. I’m very soft. (Goldilocks lies down on the bed and suddenly jumps up.)

Goldilocks: This bed is too soft.

Bed 3: Lie on me. I’m just right. (Goldilocks lies down on the bed and stays there.)

Goldilocks: This bed is just right.

Storyteller 1: Goldilocks fell fast asleep.

Storyteller 2: After a while, the three bears came back from their walk.

Storyteller 3: They walked in to the house and Daddy Bear said…

Daddy Bear: Who has been eating my porridge?

Storyteller 1: Mummy Bear said…

Mummy Bear: Who has been eating my porridge?

Storyteller 2: Baby Bear said…

Baby Bear: Who has been eating my porridge? Look, it is all gone!

Storyteller 3: They saw the chairs and Daddy Bear said…

Daddy Bear: Who has been sitting on my chair?

Storyteller 2: Mummy Bear said…

Mummy Bear: Who has been sitting on my chair?

Storyteller 2: Baby Bear said…

Baby Bear: Who has been sitting on my chair? Look, it’s broken!

Storyteller 3: They walked upstairs and Daddy Bear said…

Daddy Bear: Who has been sleeping in my bed?

Storyteller 1: Mummy Bear said…

Mummy Bear: Who has been sleeping in my bed?

Storyteller 2: Baby Bear said…

Baby Bear: Who has been sleeping in my bed? And look, she is still there!

Storyteller 3: Goldilocks woke and screamed.

Storyteller 1: She jumped out of bed and ran down the stairs and out of the house.

Storyteller 2: The three bears never saw her again

Storytellers: The end.

For more play scripts based on Fairytales, click on the link below.

Like this:

Like Loading...

Goldilocks and the three bears

A short play for children

Read the full script on-line for ‘Goldilocks and the three bears’ below

A short play for children based on the Fairy Tale. Goldilocks is a selfish little girl who seems not to respect other people’s property. After entering the house of the three bears, they decide to lay a trap to teach her to ask before taking things that aren’t hers.

Cast: 5 actors with 1M, 2F and 2 either. Run-time : approx 13 minutes.

This script is copyright Scripts for Stage and cannot be printed or performed without permission.

Download this script now from £0.

99

99 Search For A Script

Search by type of Script Search by type of ScriptComedies (37)Dramas (38)Monologues (16)Murder Mysteries (10)One-Act Plays (30)Pantomimes (10)Plays for Kids (21)Scripts for Schools (20)Short Plays (55)Sketches (39)

Search by Script Run-time Search by Script Run-time>90 minutes (16)<10 minutes (30)10 - 30 minutes (58)30 - 45 minutes (26)45 - 60 minutes (18)60 - 90 minutes (26)

To be performed to Adults (130)All age groups (96)Children (33)

To be performed by Adults (156)Children (28)Mixed Age (73)

Number of Male/Female Roles Number of Male/Female Roles10F (2)10M (2)1F (16)1M (16)1M 1F (15)1M 2F (10)1M 3F (5)1M 4F (9)1M 5F (5)1M 6F (8)1M 7F (4)1M 9F (2)2F (12)2M (15)2M 10F (1)2M 1F (13)2M 2F (7)2M 3F (12)2M 4F (6)2M 5F (10)2M 6F (6)2M 7F (2)2M 8F (3)2M 9F (1)3F (10)3M (8)3M 1F (5)3M 2F (13)3M 3F (4)3M 4F (10)3M 5F (8)3M 6F (6)3M 7F (4)3M 8F (1)3M 9F (2)4F (4)4M (2)4M 1F (8)4M 2F (5)4M 3F (9)4M 4F (8)4M 5F (7)4M 6F (5)4M 7F (1)4M 8F (2)5F (1)5M (1)5M 1F (2)5M 2F (9)5M 3F (4)5M 4F (6)5M 5F (6)5M 6F (3)5M 7F (3)6F (1)6M (1)6M 1F (6)6M 2F (4)6M 3F (4)6M 4F (4)6M 5F (1)6M 6F (3)7F (2)7M (4)7M 1F (4)7M 2F (3)7M 3F (5)7M 5F (6)8F (3)8M (3)8M 1F (1)8M 2F (3)8M 4F (5)9M 1F (3)9M 3F (3)

Min Actors needed (with doubling) Min Actors needed (with doubling)1 (16)2 (17)3 (19)4 (10)5 (19)6 (10)7 (10)8 (11)9 (10)10 (8)11 (4)12 or more (30)

Maximum Roles Maximum Roles1 (16)2 or less (28)3 or less (46)4 or less (54)5 or less (67)6 or less (73)7 or less (82)8 or less (90)9 or less (97)10 or less (106)11 or less (111)12 or less (120)13 or more (39)

Number of Characters Number of Characters1 (16)2 (19)3 (21)4 (11)5 (21)6 (11)7 (12)8 (14)9 (12)10 (9)11 (6)12 or more (38)

Country set in Country set inChina (1)Fictional Country (22)France (1)Ireland (1)Non-specific (78)Spain (1)United Kingdom (40)USA (17)

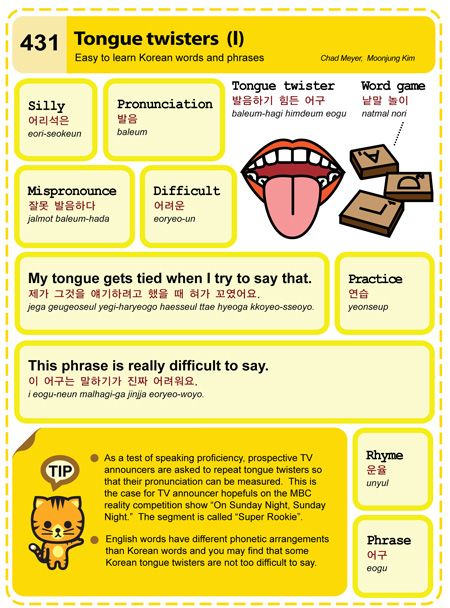

Search by tag Search by tag1800s (3)1990's (1)3 wishes (1)abbey (1)abusive (1)accident (2)actor (1)adventure (1)affair (5)afterlife (1)AGM (1)aladdin (1)alcohol (1)alexa (1)alien (1)aliens (2)all souls day (1)amateur theatre (1)amdram (1)American Civil War (1)angel (1)anger (1)angler (2)antique (1)ants (1)apple (1)appointment (1)armageddon (1)army (1)arson (1)art (1)astronaut (1)auction (1)audience (1)audience participation (8)audition (4)Austen (1)barbie (1)bat (1)bear (1)bears (2)best friend (1)between (2)bff (1)big bad wolf (1)bins (2)bird (2)bird watching (1)birds (1)birdwatching (1)birthday (2)bizarre (1)black cat (1)blackmail (1)blog (1)blogger (1)body (1)book (1)book club (1)boots (1)boss (1)botanist (1)bowls (1)boxer (1)brandy (2)breadcrumbs (2)brexit (1)bridge (1)bully (1)bullying (1)burger (1)burglar (2)burke (1)bus stop (2)business (1)butler (1)buttons (1)cafe (2)cake (2)call centre (1)campsite (1)captain hook (1)cat (3)catwalk (2)CB radio (1)charity (1)charles dickens (1)charm (1)charmless (1)chat (1)chef (1)china (1)chip shop (1)christmas (3)christmas carol (1)christmas eve (1)christmas play (2)church (1)cinderella (2)climbing (1)cliques (1)comedy (7)Communism (1)conflict (1)congress (1)conmen (1)constable (1)cosmonaut (1)costume (1)counselor (1)court (2)covid (3)cowboy (2)crime (4)cult (1)curse (1)customer (1)customs (1)Dame (7)danger (2)date (1)dating (1)daughter (1)dead parrot (1)death (5)debt (1)demon (1)derelict (1)desert (1)detective (10)devil (1)dialogue (1)dick (2)dick whittington (2)dickens (2)diner (1)divine (1)divorce (1)doctor (3)dog (3)doll (1)dragon (1)drama (1)drama-free (1)dramatic (5)dream (1)dysfunctional (1)ears (1)easter (1)edgar allen poe (8)edinburgh (1)egypt (1)election (1)elf (2)elitist (1)elves (1)emperor (1)enchanted (1)end of the world (1)ending (1)enemies (1)engagement (1)entr'acte (1)equal (1)errand (1)experiment (1)factory (1)factory boy (1)fairy (1)fairy godmother (1)fairy tale (2)faked death (1)Falstaff (1)family (7)fantasy (1)farce (5)farm (1)farmer (1)fashion (2)fast food (1)father (1)fire (2)fish (3)fishing (1)folk (1)folk tale (2)food (1)forgotten (1)frances trollope (1)frankenstein (2)free sample (1)fridge (1)friend (1)friends (1)friendship (1)frog (1)fruit (1)full cast (1)full length (1)function (1)funeral (2)funny (4)future (1)Gabriel Oak (1)gallows (2)george bernard shaw (1)ghost (5)ghosts (1)global warming (1)glue (1)goblin (3)goldilocks (1)golf (1)gothic (1)grafitti (1)granny (1)greed (1)greta (1)Gretel (1)grim reaper (1)Grimm (1)guilt (1)gun (1)guru (1)gym (1)halloween (9)ham (1)hangman (1)Hansel (1)hare (1)haunted (1)heart (1)heaven (1)Hedgehog (1)heir (1)help (1)Henry VIII (2)hero (3)heroes (2)homeless (1)horrible boss (1)horror (3)horse (1)hospital (1)hotel (3)house party (1)humiliation (1)huntsman (1)hypnosis (1)I-spy (1)idiom (1)igor (1)illness (1)imaginary friend (1)industrial (1)industrial revolution (1)industry (1)infidelity (1)inhertance (1)inn (3)inspector (1)insurance (3)interview (3)isolation (1)issues (1)jealous (1)jester (1)journalist (1)kidnap (2)kids play (1)king (5)King Arthur (1)knight (1)knights (1)knox (1)lab coat (1)large cast (1)legend (1)legends (1)liar (1)liars (1)library (1)lie (1)lies (3)life (1)life in the mills (1)lift (1)limerick (1)linguistics (1)literal (1)literature (1)lockdown (1)london (3)lord (1)lost (1)love (4)love story (2)lucifer (1)lunch (1)lying (1)macbeth (1)Madding Crowd (1)magic (4)malapropism (1)mall (1)mansion (1)marion (1)marriage (3)mary shelley (1)mayor (2)Medieval (1)meditate (1)meditation (1)meeting (2)melodrama (1)memory (2)mental health (1)Merlin (1)mesmer (1)message (1)meta (1)meta-play (1)mills (1)mine (1)misogyny (1)mole (1)monk (2)monkey paw (1)monologue (1)monster (1)moral (3)morals (1)mother (2)mountain (2)mouse (2)movie (1)moving (1)moving house (1)murder (20)murder mystery (7)music (1)musical (2)mutiny (1)my fair lady (1)mysoginy (1)mystery (10)myths (1)naughty list (1)new york (1)news (1)newspaper (1)night (1)nightingale (1)nightmare (1)non sequitur (1)nonsense (1)North vs South (1)nottingham (1)nurse (1)odd (1)Odyssey (1)office (1)ogre (2)open day (1)orang-utan (1)outdoors (1)outer space (1)Owl (1)painting (1)pandemic (2)panto (8)pantomime (6)pardon (1)parent (1)parenthood (1)paris (1)park (1)parrot (2)party (1)past (1)perfect (1)Performance licence (163)Period drama (1)peterpan (2)phone (1)photographer (1)picnic (1)pigeon (1)plague (1)plant (2)plot (1)plough play (1)poe (8)poison (2)police (8)politician (2)politics (1)porridge (1)pregnancy (1)present (1)prince (5)princess (7)prisoner of war (1)private school (1)problems (1)progressive era (1)promotion (1)prophet (1)protest (1)pseudonym (1)pub (7)pumpkin (1)puppy (1)puss (1)puss in boots (1)pygmalion (1)queen (7)queen elizabeth I (2)queen victoria (1)queen's head (1)rabbit (1)radio (1)recycling (1)red riding hood (2)refrigeration (1)reindeer (2)relationship (4)relationships (2)rememberance (1)renovation (1)rescue (2)restaurant (1)retirement (1)retirement village (1)retro (2)revenge (3)rhyme (1)rhyming (2)riddle (1)river (1)robbery (2)robin hood (3)rose (2)rose red (1)royal (2)royal ball (1)ruin (1)Rumpelstiltskin (1)Russia (1)russian (1)safety (1)Sailor (1)sales (1)salesman (1)santa (2)santa claus (2)sat-nav (1)scary (2)scheming (1)school (2)sea (1)seagull (1)secret (1)secret service (1)seed (1)self-centered (1)selfish (2)selling (1)selling houses (1)shakespeare (2)shakespearean (1)shelter (1)sheriff (1)Sherrif (1)ship (1)shoemaker (1)shoes (1)shop (2)silent movie (1)sketch (5)skype (1)sleeping beauty (2)smuggle (2)smuggler (2)snow (2)snow white (2)snowflake (1)snug (4)social distance (1)social distancing (1)socks (1)son (1)songs (1)sorrow (1)speed dating (1)spider (1)spiderella (1)spinning wheel (1)spooky (6)spy (4)squirrel (1)star (1)stars (1)Statue (1)stealing (1)sticky (1)story (3)story teller (1)stranger (1)strangers (1)sufferage (1)sufferagette (1)suicide (1)super hero (1)super heroes (1)super powers (1)superhero (2)sword fight (1)talking cat (1)tavern (4)tax (1)teams (1)teasing (1)teddy (2)teeth (2)thanksgiving (1)the raven (2)theatre group (3)three wishes (1)thunberg (1)time (3)time travel (3)tinkerbell (1)tongue twister (1)tragic (1)train (2)trick (1)troll (1)truth (1)tupperware (1)TV (2)TV show (1)ugly sisters (1)unemployed (1)united states (1)usa (1)utah (1)utopia (1)valuation (1)vampire (1)victorian (2)villain (3)vintage (2)void (2)Voyage (1)waiter (1)war (1)wash (1)wassailing (1)watch (1)wedding (1)weird (2)Western (1)white feather (1)whittington (2)whodunit (1)widow (2)widow twankee (1)widower (1)wilberforce (1)will (1)winderness (1)wish (1)wishes (1)Witch (6)witchcraft (1)witches (2)wizard (1)wolf (2)woods (2)wool (1)work (1)world war (1)world war 2 (2)World War I (3)writer (1)writing (1)WWI (1)WWII (2)yacht (1)zeppelin (1)zombie (1)zoom (1)

Search by Playwright Search by PlaywrightAlan Kilpatrick (1)Andy Bennison (4)Arthur Charles (1)Bonnie Milne Gardner (1)Caroline McMullan - O'Donnell (1)Christian Darkin (1)Conner Case (1)Corinne Walker (2)Daniel McEwen (1)Dan Noonan (1)David Thrasher (1)DeLaney Hardy Ray (2)Derek Olson (5)Eleanor Mallinson (2)Elizabeth Shannon (1)Emma Selle (1)Gary Diamond (5)Gary Diamond & Ray Lawrence (3)H. E. Hubler (1)Jane Spamer (1)Janet Smith (37)Jennie MacDonald (1)John Cuthbert (1)Jude Emmet (4)Kate Pennell (2)Kenneth P. Langer (23)Kevin Broughton (1)Kevin Scully (1)Larry J Collins (1)Laurie Scoggins (1)Lawrence C. Connolly (1)Mariam Esseghaier (1)Mark Davenport (1)Michael Morton (1)Michael Noonan (1)Michael Slack (2)Mo Speller (2)Nicky Denovan (1)P. Fraser Reader (1)Peter Robbie (3)Philip Jamieson (4)Phil Johnson (2)Rita Trotman (1)Robert Black (6)Sam Taylor (1)Tom Mallender (1)Vicky Connor (1)

E. Hubler (1)Jane Spamer (1)Janet Smith (37)Jennie MacDonald (1)John Cuthbert (1)Jude Emmet (4)Kate Pennell (2)Kenneth P. Langer (23)Kevin Broughton (1)Kevin Scully (1)Larry J Collins (1)Laurie Scoggins (1)Lawrence C. Connolly (1)Mariam Esseghaier (1)Mark Davenport (1)Michael Morton (1)Michael Noonan (1)Michael Slack (2)Mo Speller (2)Nicky Denovan (1)P. Fraser Reader (1)Peter Robbie (3)Philip Jamieson (4)Phil Johnson (2)Rita Trotman (1)Robert Black (6)Sam Taylor (1)Tom Mallender (1)Vicky Connor (1)

Audio Version Available Audio Version AvailableYes (4)

GRAPH-Five in focus: Goldilocks and the Three Bears

01/30/2023 09:19

43

(Reuters) Not too hot and not too cold. This is what investors hope for in terms of economic forecasts as China's economy recovers after the coronavirus pandemic, and companies are struggling with stagnant inflation and increasingly constrained consumers.

But the rhetoric of the world's three largest central banks, which are going to hold their first meetings in 2023, not reminiscent of the "Goldilocks scenario" - mild growth retardation and gradual decline in inflation. nine0003

1) WILL THE FED SLOW DOWN?

Will the Federal Reserve soften its hawkish rhetoric in the face of slowing inflation or will stay on course? Investors generally expect rate hikes by 25 basis points following meeting 1 February and the fact that rates will not exceed 5%.

The leaders of the US Federal Reserve, however, predicted the growth of the key interest rate above the range of 5.00-5.25% this year.

Whatever signals the Fed sends, they can play an important role in determining the duration of this year's rally. Dollar bears, in turn, will track dove moods that could further accelerate the fall dollar. The US currency has fallen almost 11% since reaching a multi-year high in September last year. nine0003

2) BACK TO WORK

Chinese markets are back to work after a week Lunar New Year celebrations and will try to continue with where we left off - at a five-month peak blue-chip mainland China.

After reports from officials that deaths from coronavirus has declined by about 80% since its peak in beginning of the year, market sentiment should remain optimistic. Statements by the authorities contradict fears that New Year's travel will provoke a new wave of morbidity. nine0003

The opening of the Chinese economy could be reflected in the data business activity index, which will be published in Tuesday, services sector return to growth. Industrial the sector is probably still shrinking, but this is largely due to happy new year holidays, and next month should happen strong rebound.

3) YOUR MOVE ECB

The European Central Bank will meet on Thursday and, is expected to raise the rate by 50 basis points to 2.5%. Markets are most concerned about uncertainty about the following controller steps. nine0003

Yastrebino-minded officials insist that this will happen in March. After all, inflation is well above the target level of 2%, as is likely to will show preliminary data for January, coming out on Wednesday.

Markets have priced in further monetary tightening policies by 100 bp up to July.

But the pigeons sound more and more confident: yes, inflation is high, but it off record highs, they say. Therefore, it is necessary exercise caution before committing to rate hikes after February. nine0003

Markets, agitated by discordant opinions, will expect that the ECB will present a united front. At least it can hope.

4/ TEAM "A"

Three "A" - Apple, Amazon and Alphabet - three of the four largest by market value American companies - report profits on Thursday.

More than 100 S&P 500 companies join reporting season.

Microsoft, the fourth American mega-company, has already published financial results. Her cloud business met Wall Street expectations, but the giant's disappointing forecast received little encouragement from the broader tech sector. nine0003

Technology companies in general are under pressure the need for growth while reducing costs in ahead of a possible recession. The total earnings of companies from the S&P 500 index fell by 2.9% compared to the same period a year earlier, according to Refinitive IBES.

The total earnings of companies from the S&P 500 index fell by 2.9% compared to the same period a year earlier, according to Refinitive IBES.

5/END MAY BE NEAR

The Bank of England is expected to be the first major central banks, which switched to a "hawkish" monetary policy in December 2021, will hold the tenth increase in this cycle rates. nine0003

Money markets predict that the British central bank will will raise rates by 0.5 percentage points to 4%. December core inflation has fallen to 10.5%, but it is still five times exceeds the official target of the regulator.

Deutsche Bank analysts believe that this will be the last significant rate hike by the Bank of England. Fresh Data showed a sharp decline in business activity in the UK and inconclusive retail sales during the Christmas period. nine0003

Economists polled by Reuters now expect the Central Bank to Britain will stop at 4.25%. But many do not agree with this opinion, referring to the volatile core inflation that eliminates food and energy costs. The original message in English is available at code

The original message in English is available at code

(Amanda Cooper, Kevin Buckland in Tokyo, Dara Ranasinghe and Naomi Rovnik in London, Ira Iosebashvili and Lewis Krauskopf in New York)

Five in focus: Goldilocks and the Three Bears

Jan 30 (Reuters) - Not too hot and not too cold. This is what investors hope for in terms of economic forecasts as China's economy recovers after the coronavirus pandemic, and companies are struggling with stagnant inflation and increasingly constrained consumers.

But the rhetoric of the world's three largest central banks, which are going to hold their first meetings in 2023, not reminiscent of the "Goldilocks scenario" - mild growth retardation and gradual decline in inflation. nine0003

1) WILL THE FED SLOW DOWN?

Will the Federal Reserve soften its hawkish rhetoric in the face of slowing inflation or will stay on course? Investors generally expect rate hikes by 25 basis points following meeting 1 February and the fact that rates will not exceed 5%.

The leaders of the US Federal Reserve, however, predicted the growth of the key interest rate above the range of 5.00-5.25% this year.

Whatever signals the Fed sends, they can play an important role in determining the duration of this year's rally. Dollar bears, in turn, will track dove moods that could further accelerate the fall dollar. The US currency has fallen almost 11% since reaching a multi-year high in September last year. nine0003

2) BACK TO WORK

Chinese markets are back to work after a week Lunar New Year celebrations and will try to continue with where we left off - at a five-month peak blue-chip mainland China.

After reports from officials that deaths from coronavirus has declined by about 80% since its peak in beginning of the year, market sentiment should remain optimistic. Statements by the authorities contradict fears that New Year's travel will provoke a new wave of morbidity. nine0003

The opening of the Chinese economy could be reflected in the data business activity index, which will be published in Tuesday, services sector return to growth. Industrial the sector is probably still shrinking, but this is largely due to happy new year holidays, and next month should happen strong rebound.

Industrial the sector is probably still shrinking, but this is largely due to happy new year holidays, and next month should happen strong rebound.

3) YOUR MOVE ECB

The European Central Bank will meet on Thursday and, is expected to raise the rate by 50 basis points to 2.5%. Markets are most concerned about uncertainty about the following controller steps. nine0003

Yastrebino-minded officials insist that this will happen in March. After all, inflation is well above the target level of 2%, as is likely to will show preliminary data for January, coming out on Wednesday.

Markets have priced in further monetary tightening policies by 100 bp up to July.

But the pigeons sound more and more confident: yes, inflation is high, but it off record highs, they say. Therefore, it is necessary exercise caution before committing to rate hikes after February. nine0003

Markets, agitated by discordant opinions, will expect that the ECB will present a united front. At least it can hope.

At least it can hope.

4/ TEAM "A"

Three "A" - Apple, Amazon and Alphabet - three of the four largest by market value American companies - report profits on Thursday.

More than 100 S&P 500 companies join reporting season.

Microsoft, the fourth American mega-company, has already published financial results. Her cloud business met Wall Street expectations, but the giant's disappointing forecast received little encouragement from the broader tech sector. nine0003

Technology companies in general are under pressure the need for growth while reducing costs in ahead of a possible recession. The total earnings of companies from the S&P 500 index fell by 2.9% compared to the same period a year earlier, according to Refinitive IBES.

5/END MAY BE NEAR

The Bank of England is expected to be the first major central banks, which switched to a "hawkish" monetary policy in December 2021, will hold the tenth increase in this cycle rates. nine0003

Money markets predict that the British central bank will will raise rates by 0.