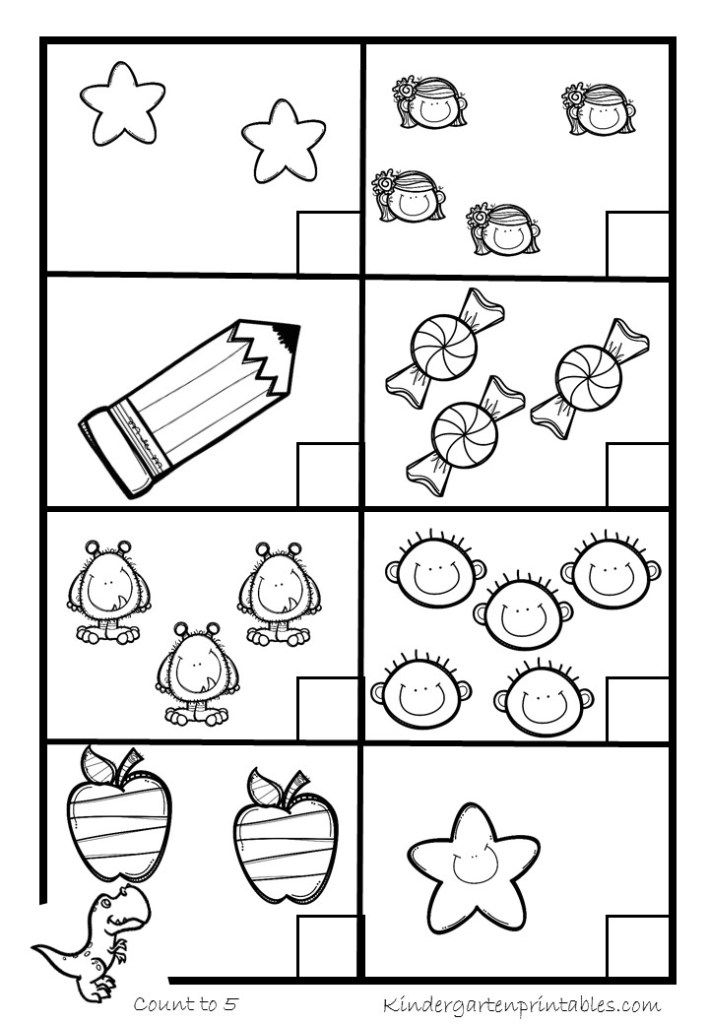

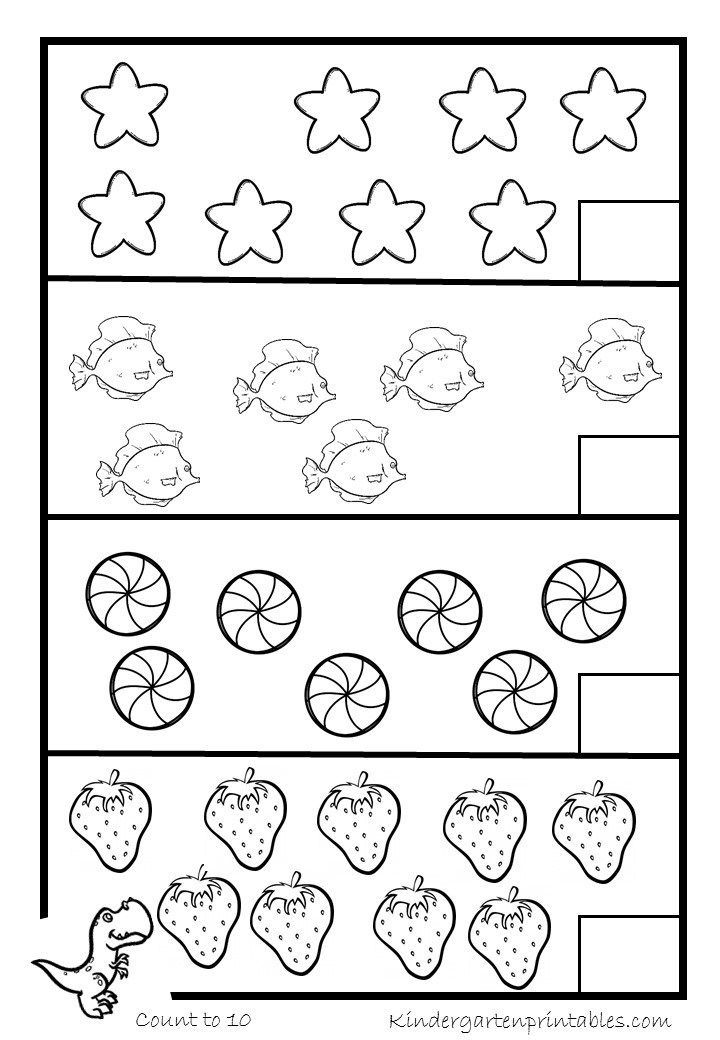

Counting for child

What Children Know and Need to Learn about Counting

Print resource

Print resource or save as PDF

Print feature not currently compatible with Firefox.

DREME TE

Print resource

Print resource or save as PDF

Print feature not currently compatible with Firefox.

Children Develop an Everyday Math

Context and overview

Young children, even infants, develop essentially non-verbal basic concepts of quantity: more/less, order, same, and adding/subtracting. Children learn most of these things on their own, without much adult help. Children often use these concepts in everyday life, for example, to determine who has more or less ice cream.

Children’s concepts and procedures are useful under certain conditions but need to be enriched. (Perhaps that’s why number was invented: the shepherd needs to know not only that he has a lot of sheep, but exactly how many.) This is what children know and what they need to learn at roughly ages three, four and five.

More/less

Children need to be able to see that there are more objects here than there. They often solve this problem not by counting but by physical appearance. "This flock of geese in the sky must be larger because it covers a greater area than does the other flock." This approach is often adequate but can lead to wrong answers and confusion.

Order

Judgments of more or less are sufficient for many purposes, but sometimes a comparison between more than two things needs to be made. Thus the idea of order, which includes subtle ideas:

- In a group of three objects, the second item is larger than the one preceding it but smaller than the one following it.

- Also, the item that was first can become last under a new order.

Again young children tend to rely too much on appearances to solve the problems.

Same number

The idea of same number evolves, even without adult assistance, through several stages:

- The first step is seeing that two groups identical in shape and arrangement are also the same in number. Thus, if a brown bear and a yellow canary are placed directly below another brown bear and yellow canary, both rows are the same in number (as well as in shape, color, and arrangement).

- The second step is seeing that two groups differing in color or shape can still be the same in number. Thus, if a brown bear and a yellow canary are placed directly under a pink pig and blue heron, both rows are the same in number (and arrangement, although they differ in shape and color).

- The third step is seeing that two groups differing only in arrangement are the same in number.

Thus, if a brown bear and a yellow canary are not placed directly under a pink pig and blue heron but instead lie elsewhere, both groups are the same in number (although they differ in arrangement, shape and color).

Thus, if a brown bear and a yellow canary are not placed directly under a pink pig and blue heron but instead lie elsewhere, both groups are the same in number (although they differ in arrangement, shape and color). - The fourth is seeing that one group, when rearranged, has the same number as it did before it was moved around. Thus, if the child first sees a brown bear and a yellow canary in one arrangement, which is then transformed, the child realizes that the number did not change from what it was before the rearrangement.

- The fifth is first seeing that two amounts are the same number when they look similar, for example five eggs in a row and five egg cups in a row both have the same number. But then if there is a transformation (for example spreading the eggs apart so that the line of eggs is longer than the line of egg cups), the child has to be able to understand that the eggs and egg cups are the same in number even though the two lines look different.

The idea of adding as resulting in more and subtracting in less

Children learn that:

- When you add something to an existing set, the result is that you have more than you had at first.

- If you start with two groups of the same number, and by magic (while the child is not looking), one set is now more numerous than the other, you must have added to one or subtracted from the other

- You don’t have to count to arrive at these judgments concerning more and concerning addition and subtraction: you can solve the problem by reason alone.

Later instruction needs to build on all of these ideas when written numbers are introduced.

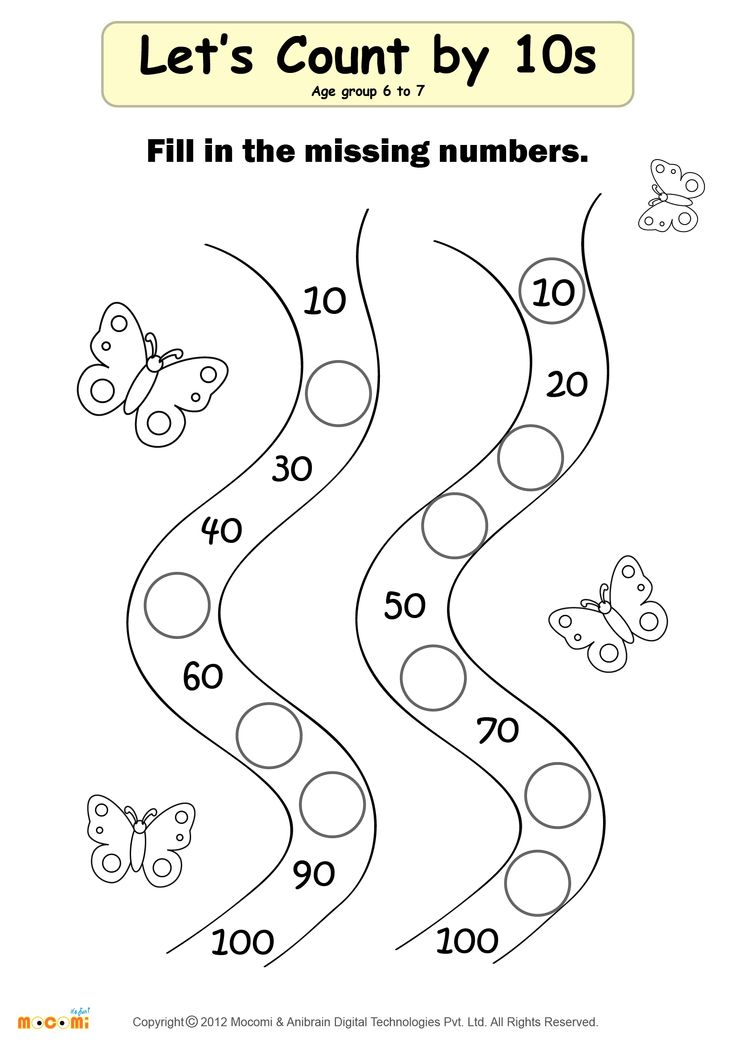

Learning the Counting Words

Context and overview

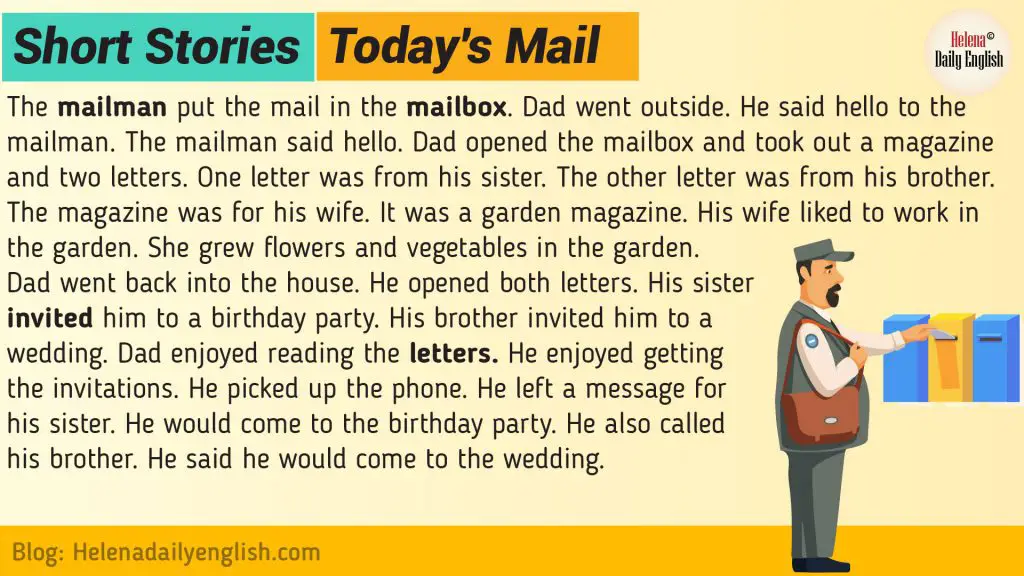

In everyday life, we use counting words all the time, selecting items from the supermarket (“we need two bananas”) or playing “10, nine, eight, … blast off!” Children love counting as high as they can, like grown-ups. They may even be interested in the name of the highest number. Fluency in the counting words aids later computation.

They may even be interested in the name of the highest number. Fluency in the counting words aids later computation.

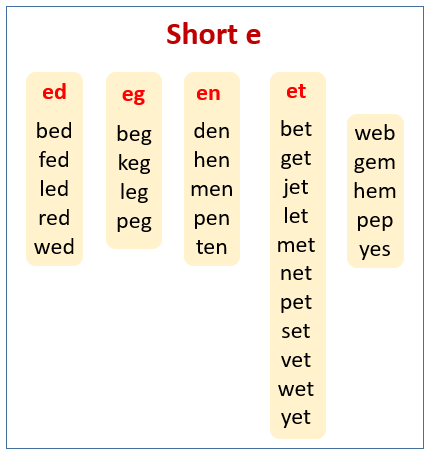

Rote memory plus

At first, children memorize the counting words from about one to 10 or so. But their learning doesn’t involve only memory. Children learn some ideas and rules about number too, namely that proper order is essential; numbers are different from letters; and you are not supposed to skip or repeat numbers when you count.

Structure

Later, children pick up the underlying structure of number: ten is the basic unit (20, 30, etc.) and we tack units onto the tens (

twenty-one etc.). The rules for saying the English counting words from eleven to nineteen are especially hard to learn because they are poorly designed. Eleven should be "ten-one," just like twenty-one. Fifteen should be "ten-five," like twenty-five. The East Asian languages get this right, but English and many other languages do not. By contrast, English is fairly well designed for the number words beginning with twenty. Each of the tens words resembles a unit word. Forty is like four; eighty like eight, and so on. Fifty comes before sixty. (A fairly minor problem is that twenty should sound more like two and ideally should be “two-ten;” thirty should be “three-ten” and so on). After saying a tens word, the child appends the unit words, one through nine. Learning to count to 20 and beyond is a child's first experience with base-ten ideas. In this case, teaching needs to stress the base-ten pattern underlying the counting numbers: the structure. We need to “instructure” (teach the structure) not “instruct.”

By contrast, English is fairly well designed for the number words beginning with twenty. Each of the tens words resembles a unit word. Forty is like four; eighty like eight, and so on. Fifty comes before sixty. (A fairly minor problem is that twenty should sound more like two and ideally should be “two-ten;” thirty should be “three-ten” and so on). After saying a tens word, the child appends the unit words, one through nine. Learning to count to 20 and beyond is a child's first experience with base-ten ideas. In this case, teaching needs to stress the base-ten pattern underlying the counting numbers: the structure. We need to “instructure” (teach the structure) not “instruct.”

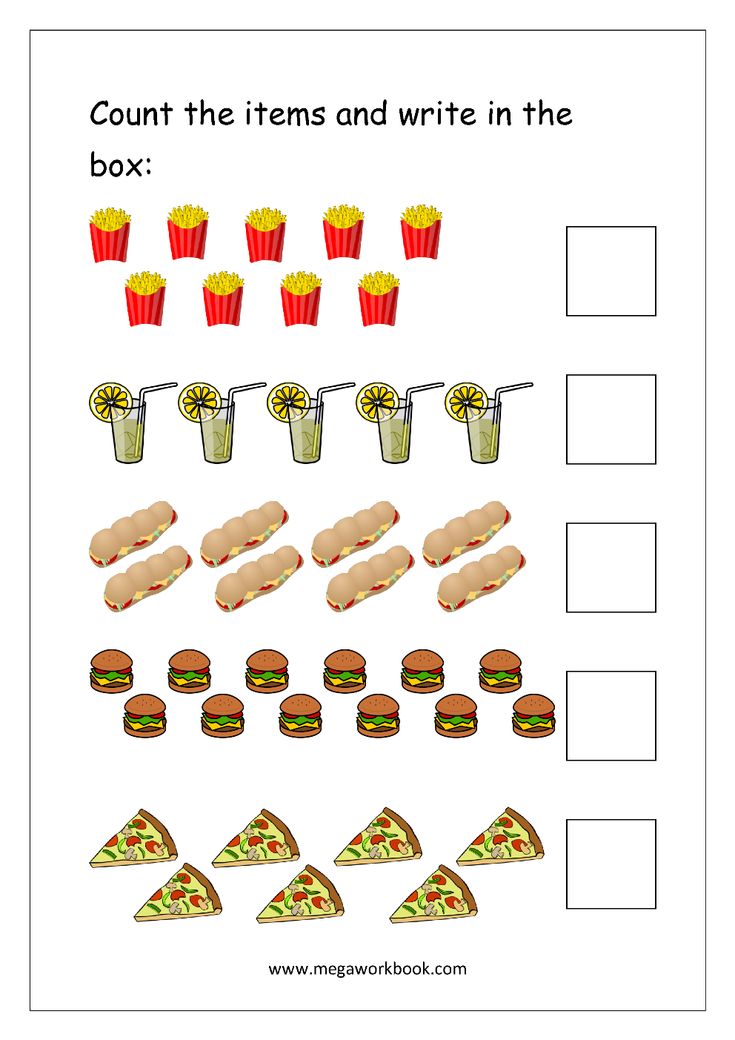

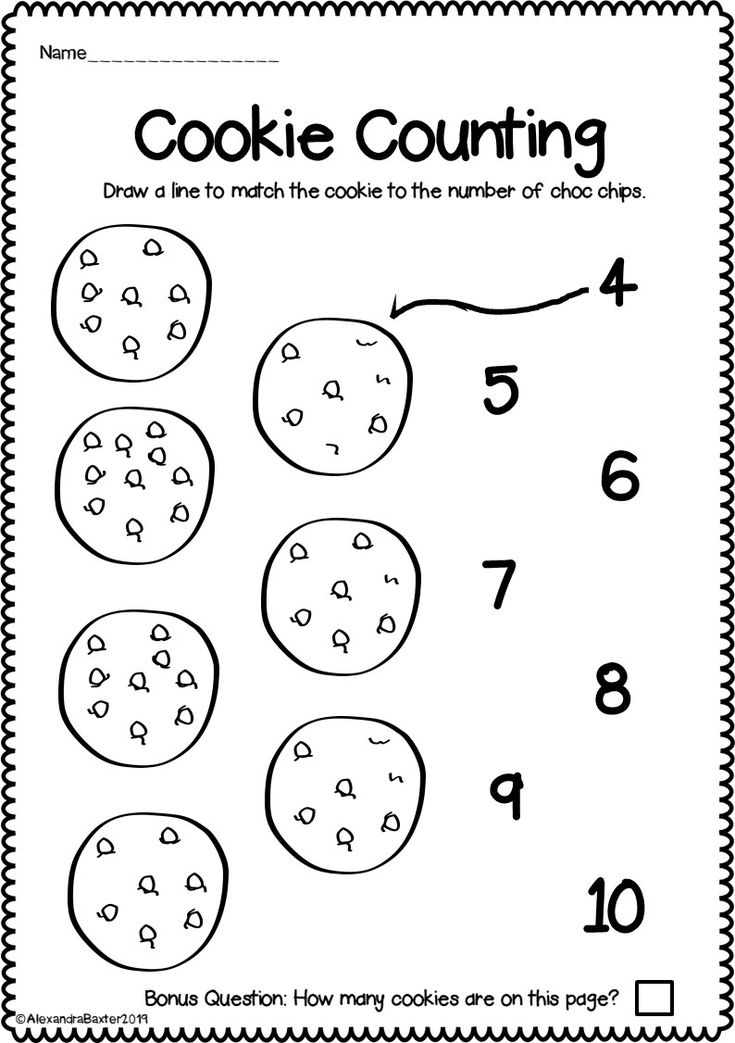

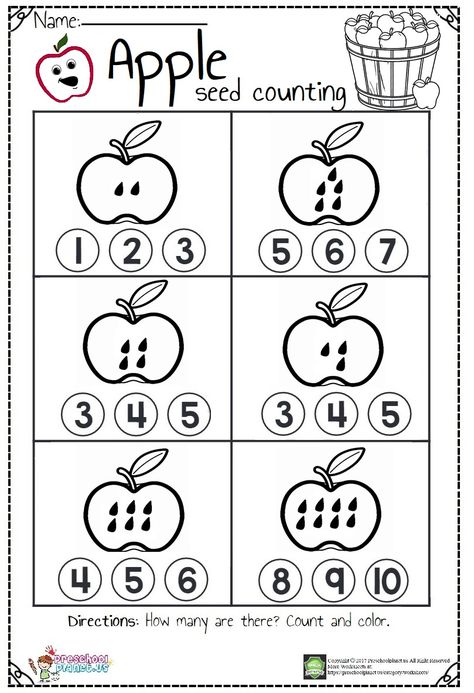

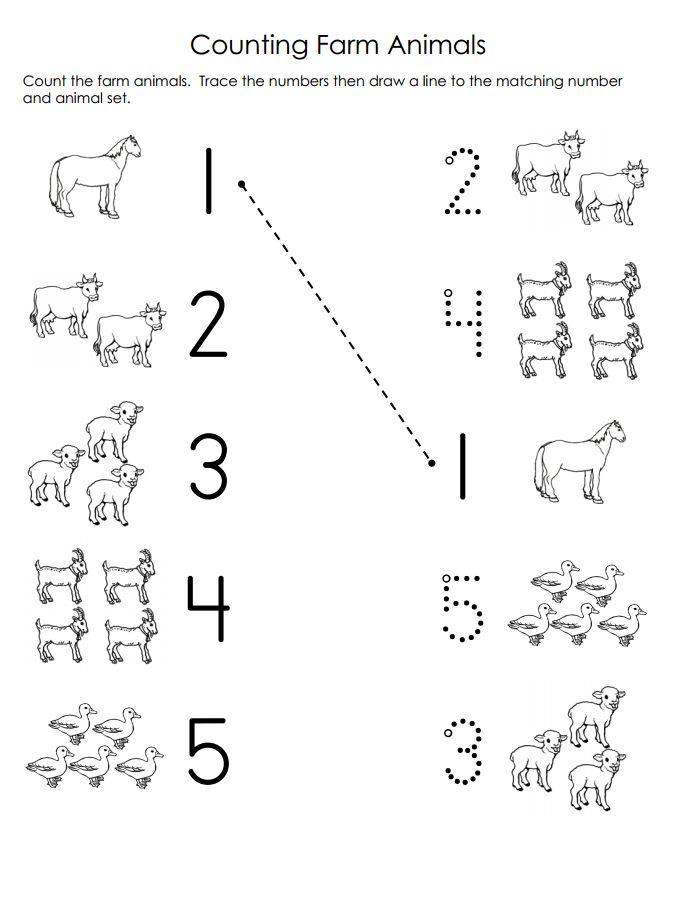

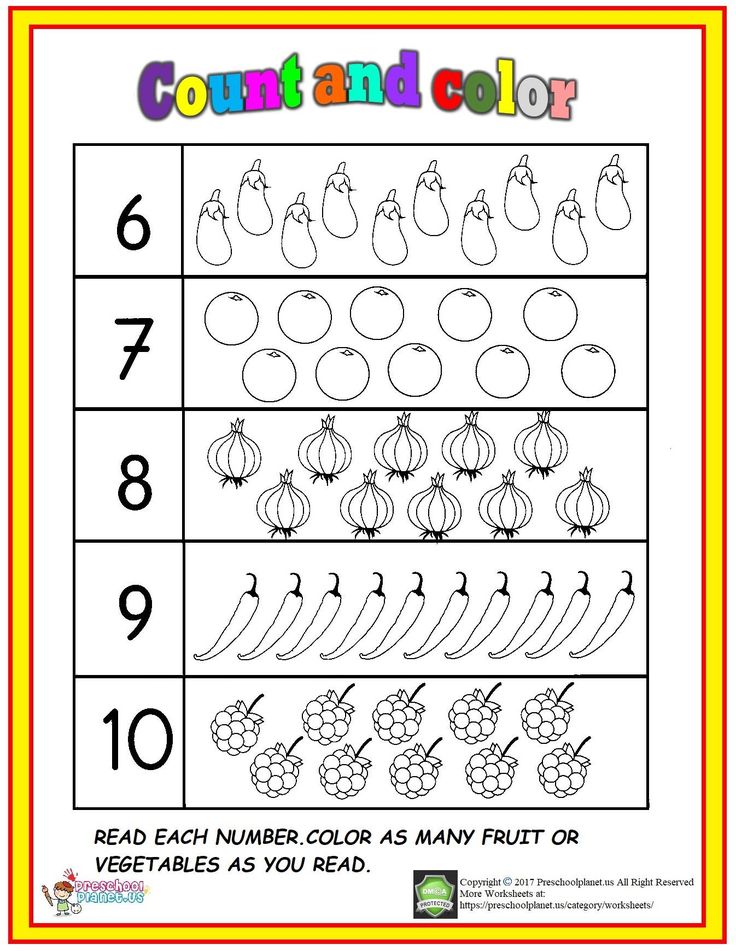

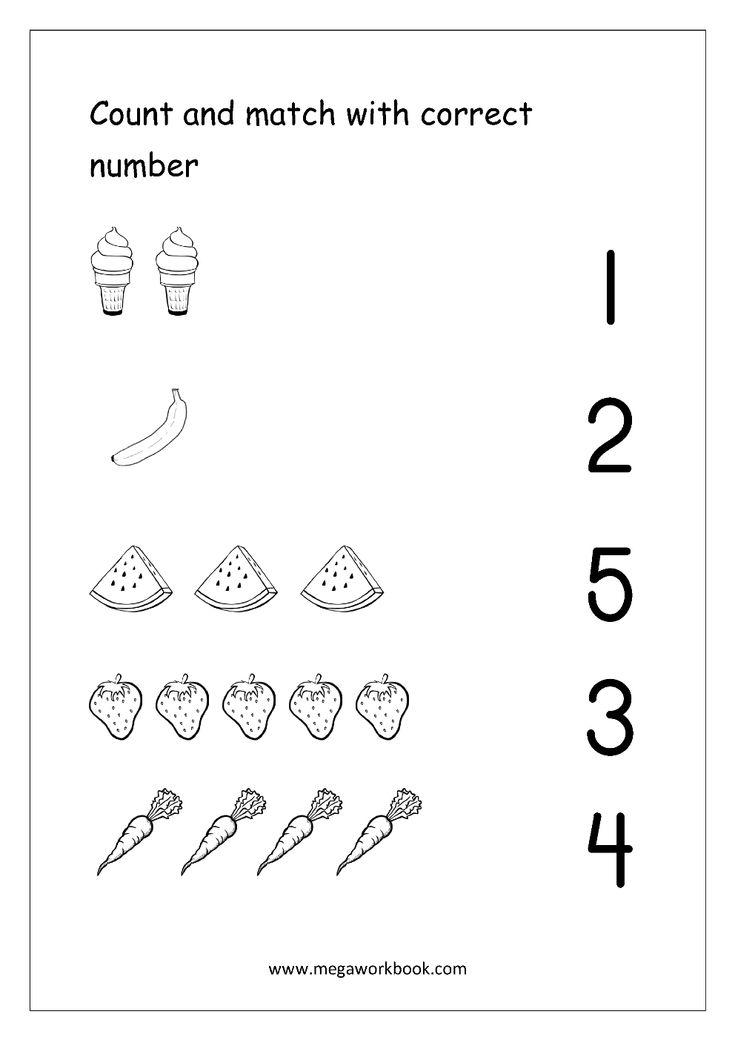

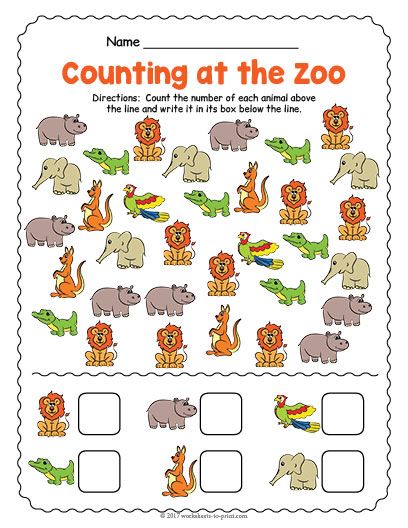

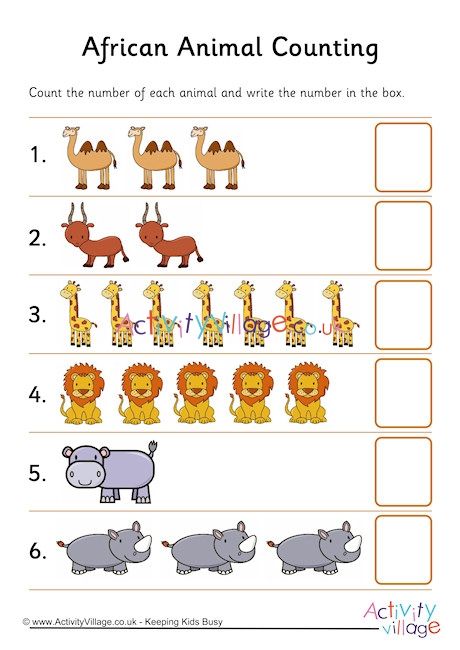

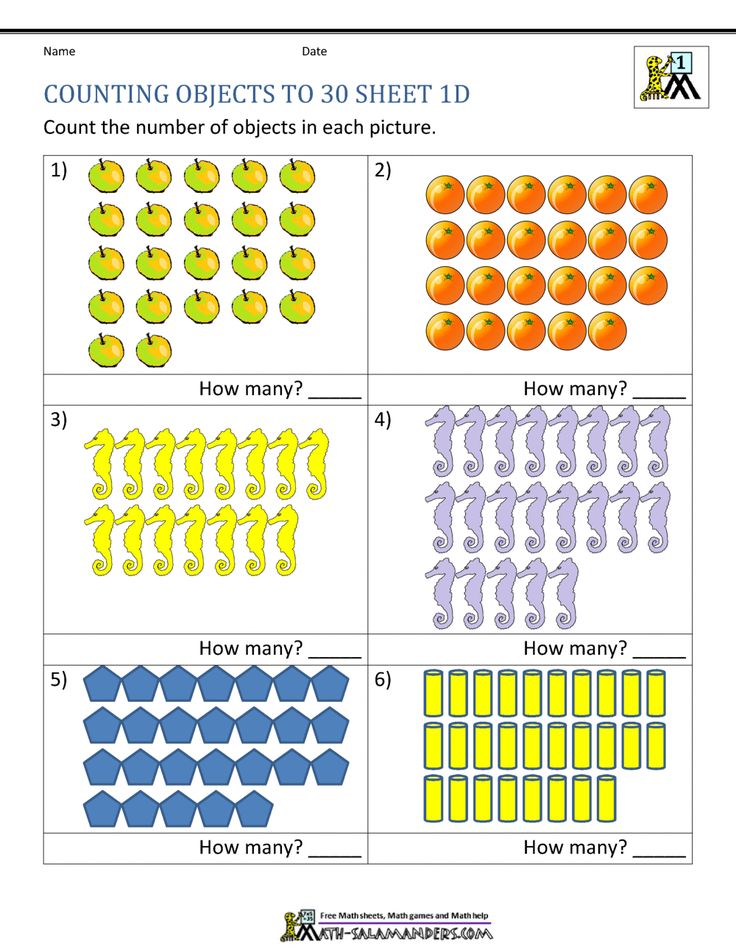

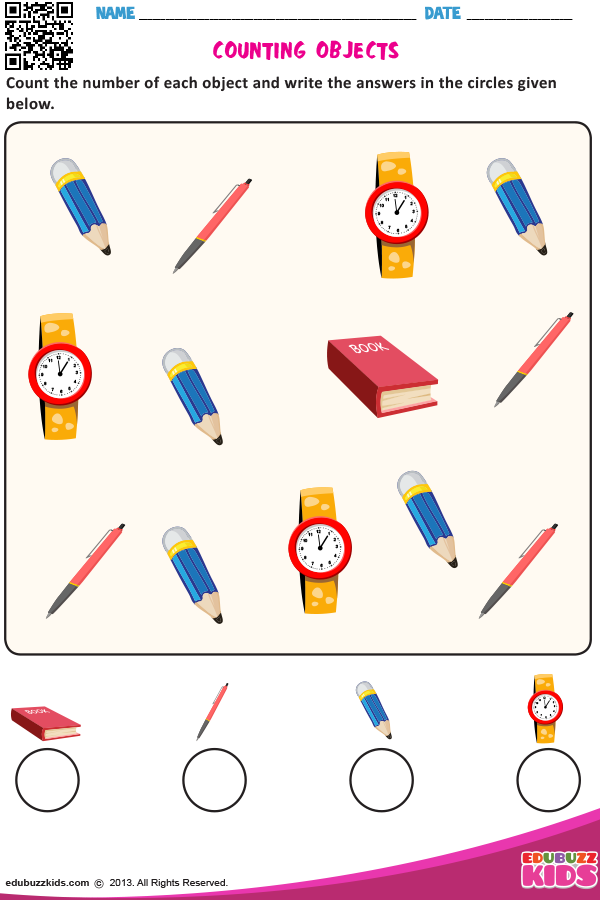

Counting Things: How Many Are There?

Context and overview

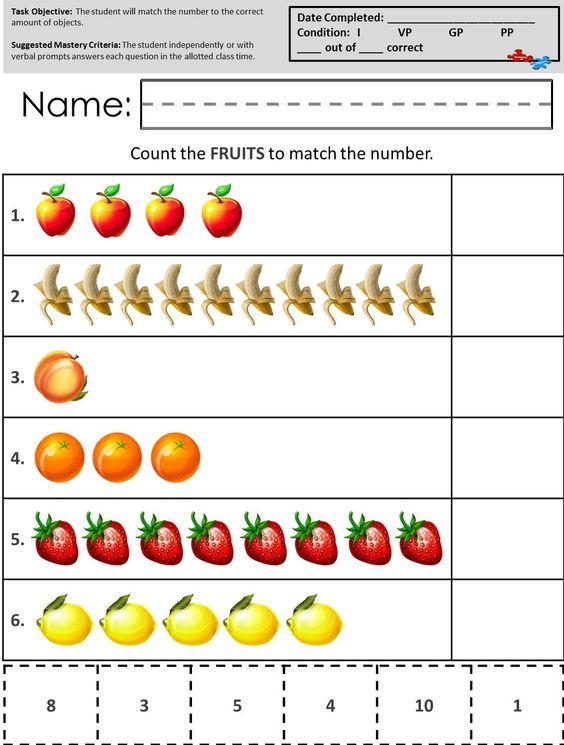

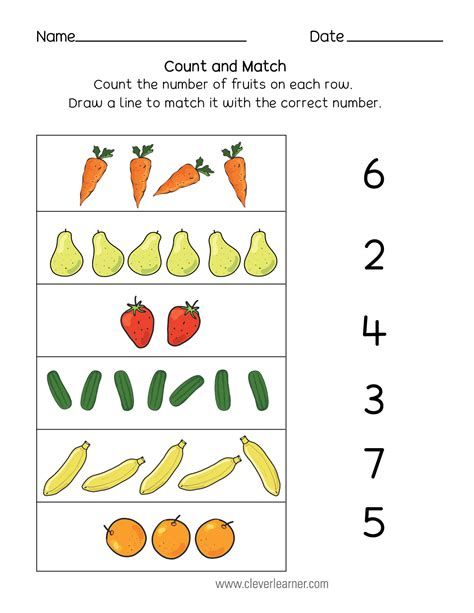

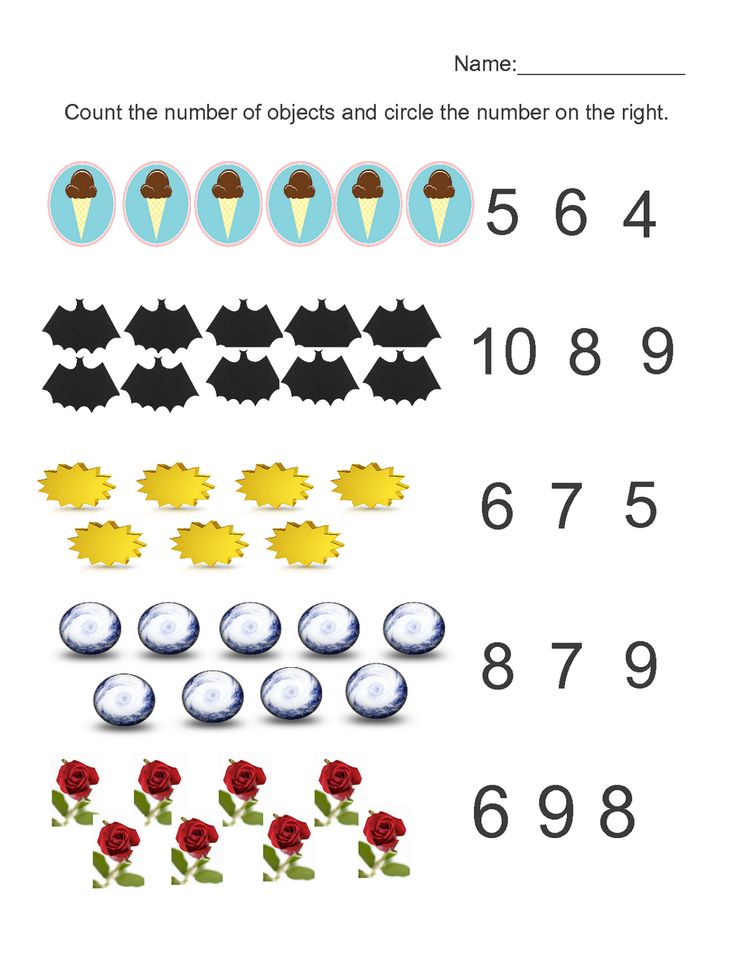

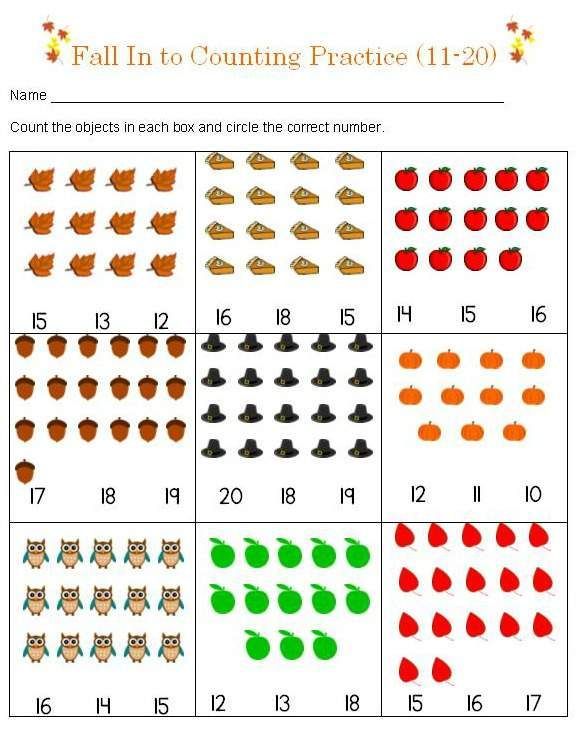

Children’s ideas about same, more, less, and order are heavily influenced by perception and by their own imperfect logic (for example, that what looks like more is more). These are good ideas but lack precision, so children need help in taking the next step. The counting words that children learn early on can be used for enumeration; in determining the exact number of a collection, it is the cardinal number that tells how many. Accurate enumeration and understanding of cardinal number are fundamental for all arithmetic (and measurement) and are not as simple as they seem. Rather they involve key mathematical ideas and strategic thinking.

These are good ideas but lack precision, so children need help in taking the next step. The counting words that children learn early on can be used for enumeration; in determining the exact number of a collection, it is the cardinal number that tells how many. Accurate enumeration and understanding of cardinal number are fundamental for all arithmetic (and measurement) and are not as simple as they seem. Rather they involve key mathematical ideas and strategic thinking.

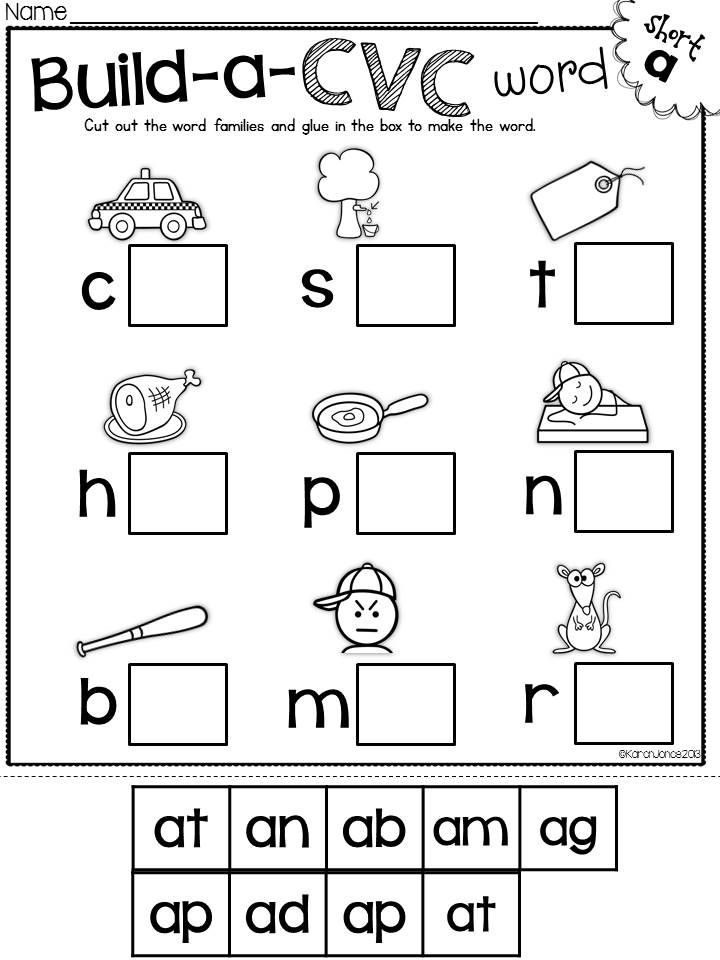

Principles needed to understand enumeration

Enumeration refers to using the counting words to figure out the number of objects. (This includes any object, from imaginary monsters to marbles.) Children must learn to follow several rules and principles to enumerate accurately. This set of rules is fundamental:

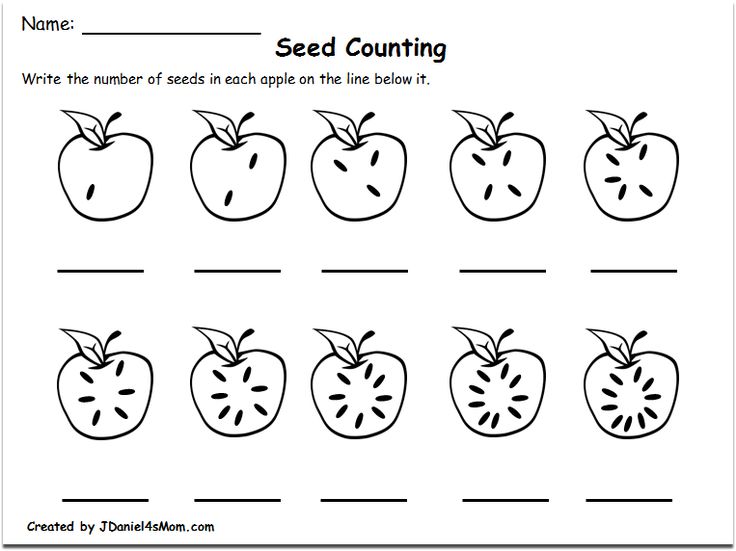

- Say number words in their proper order.

- Match one number word with only one thing (one-to-one correspondence between number word and thing).

- Count each thing once and only once.

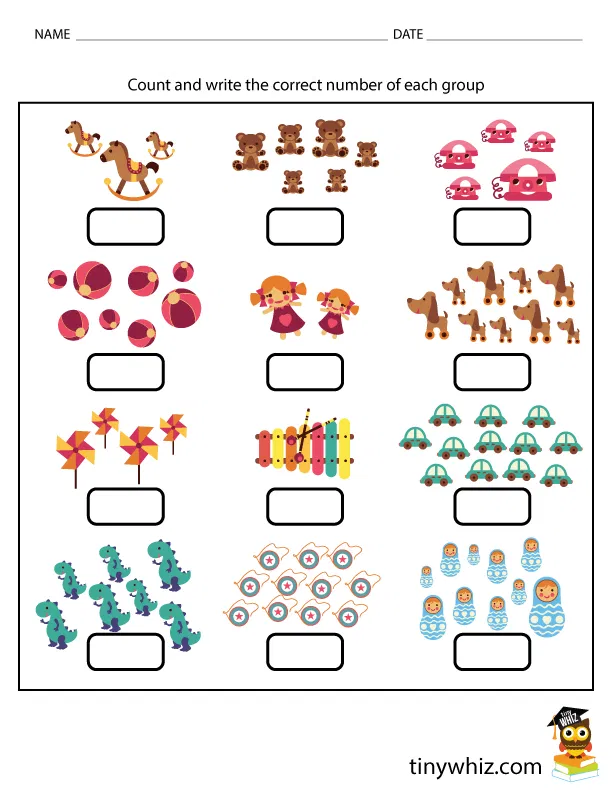

Given these rules and principles, there are several ways to enumerate with accuracy. Children need to be able to:

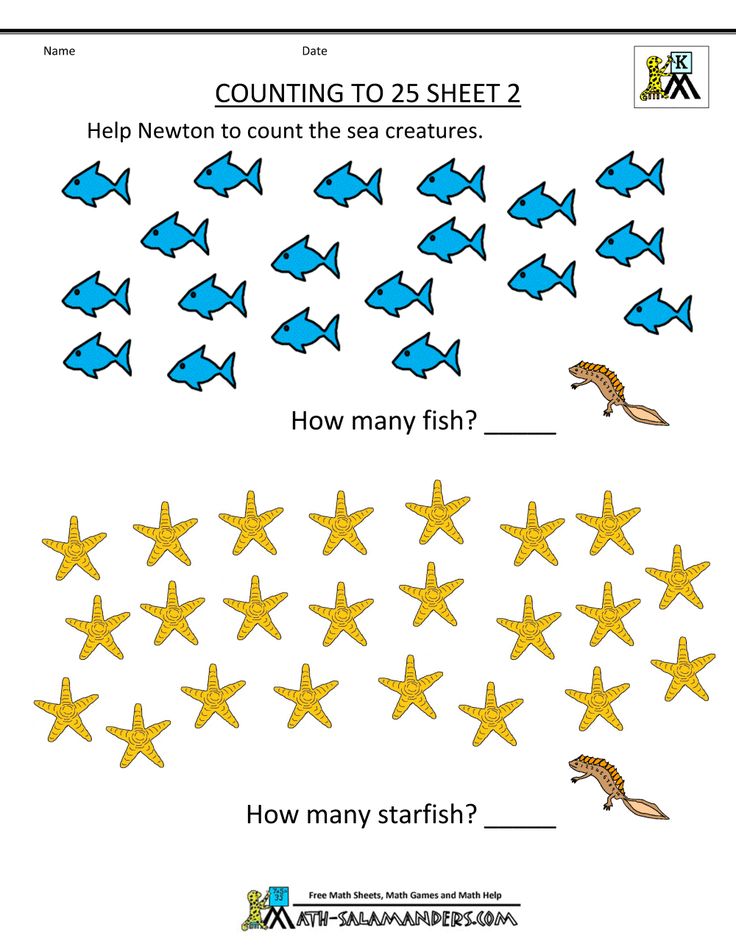

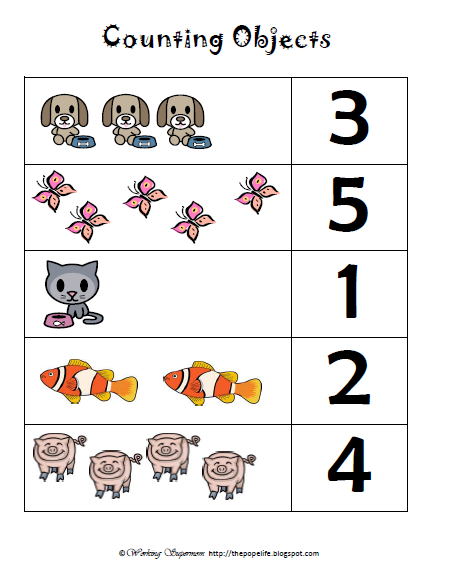

- "See” small numbers (up to four or so) without counting. This is subitizing, which can reduce the drudgery of counting.

- Count one object at a time.

- Point at objects.

- Push objects aside to keep track of which ones have been counted.

- Put objects in a line or other orderly arrangement.

- Count on the fingers.

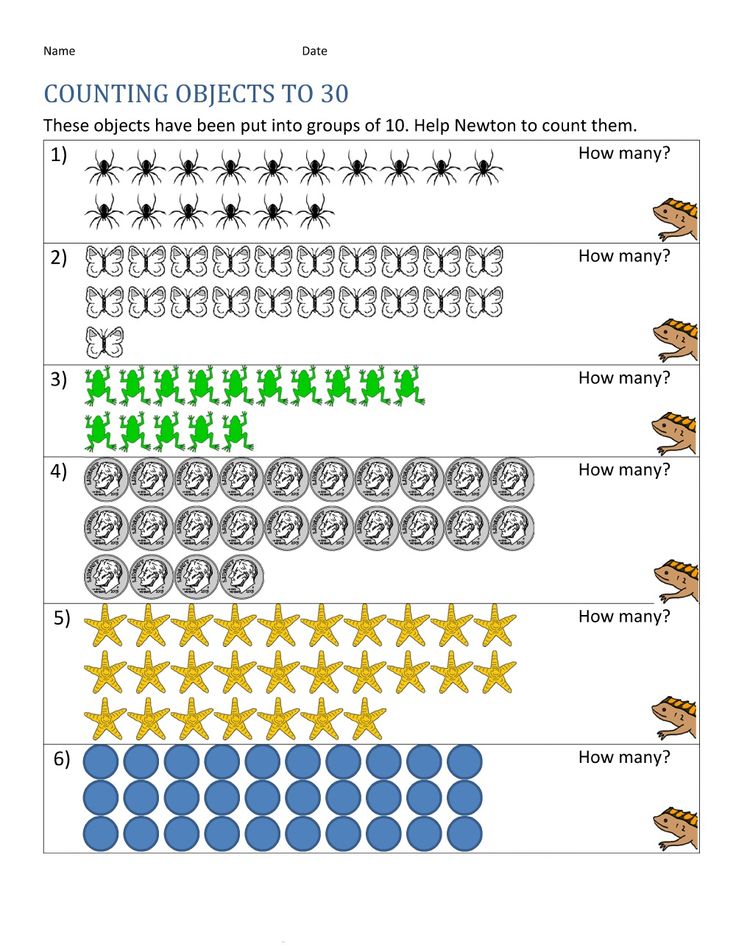

- Group objects into convenient groups that can be subitized or counted.

- Group by 10s.

- Check the answer.

Children need to learn to use these approaches in appropriate situations. For example, if there are only two objects, subitizing may useful, but if there are nine, then pushing objects aside may be indicated.

Understanding cardinality

Children who enumerate accurately also need to understand the result achieved. Suppose a child accurately counts five things. Correct enumeration alone does not necessarily mean that the child understands cardinality. Asked how many there are, the child may simply count the objects another time. For that child, answering the question of how many simply activates the counting routine but does not provide an understanding of the result. Children need to learn several things about cardinal number. The core idea is that correct enumeration yields the cardinal value of set. The last number word does not refer to the last object counted but to the set as a whole. When we count, the number one refers to the first object; two refers not to the second object counted but to the two objects in the new group, and so on. Furthermore, once the child has determined that there are five objects in the set, it does not matter if they are hidden, or if the objects are simply rearranged (say from a straight line to a circle). There are still five objects. This is conservation of number.

Suppose a child accurately counts five things. Correct enumeration alone does not necessarily mean that the child understands cardinality. Asked how many there are, the child may simply count the objects another time. For that child, answering the question of how many simply activates the counting routine but does not provide an understanding of the result. Children need to learn several things about cardinal number. The core idea is that correct enumeration yields the cardinal value of set. The last number word does not refer to the last object counted but to the set as a whole. When we count, the number one refers to the first object; two refers not to the second object counted but to the two objects in the new group, and so on. Furthermore, once the child has determined that there are five objects in the set, it does not matter if they are hidden, or if the objects are simply rearranged (say from a straight line to a circle). There are still five objects. This is conservation of number.

Common mistakes or misconceptions

When counting, children often rely too heavily on physical appearance, just as they did in determining more or less. One goal of teaching should be to help children learn that reason must trump appearance. Children need to think abstractly about tangible things. Eventually, they need to embed understanding of cardinal number (for example, the abstract idea that there are five objects here) within the larger system of number, for example, that five comes after four and is half of 10.

Everyday Numerical Addition and Subtraction

Context and overview

Next we need to understand how concepts of more/less, order, same, adding and subtracting without exact number (knowing that adding means making a set larger even if you don't know of the exact number), and enumeration get elaborated to create numerical addition and subtraction. Children learn some of this on their own, but adults can and should help.

Children learn some of this on their own, but adults can and should help.

Understanding addition

These concepts need to be learned to understand addition (subtraction is similar):

- Addition can be thought of in several ways, including combining two sets, increasing the size of one set, and jumping forward on a number line.

- Simple counting is also adding, one at a time.

- The order of addition makes no difference (the commutative property).

- Adding zero changes nothing.

- Different combinations of numbers can yield the same sum.

- Addition is the inverse of subtraction.

Strategies used to add (or subtract)

Children often begin by using concrete objects and fingers to add but gradually learn mental calculation and remember some of the sums.

- Using concrete objects, children may do the following to solve a simple problem like 3 + 2: They may count all ("I have three here and two there and now I push them together and count all to get five") or they may count on from the larger ("I can start with three and then say, four, five.

")

") - Approaching the problem mentally, children may solve the problem by derived facts, building on what is known ("I know that two and two is four, so I just add one to get five") and by memory ("I just know it!").

More features of numerical addition and subtraction

- It’s always useful to have backup strategies in case one doesn’t work. For example, if unsure about memory, the child can always count to get the answer.

- It’s important for the child to be able to check the answer.

- It’s important for the child to explain why 3 + 2 gives five as the answer, since proof is a social act requiring language.

- The child needs to learn different strategies for different set sizes. (Counting one by one is good for adding small sets but tedious and inefficient for larger sets.)

- The child should also be able to describe how he got the answer. (Self-awareness is one aspect of metacognition. Of course, remembering what you just did is essential for describing it in words.

)

) - Language is vital for describing one’s work and thinking, and to convince others; children need to learn mathematical vocabulary.

- The child should be able to apply the math in real situations or stories about real situations (such as word problems).

Number Sense

Context and overview

Children need to develop number sense, a concept that is notoriously difficult to define in a simple and exclusive way. I like to think of it as mathematical street smarts, which can be used in just about any area of number, including those discussed above. Number sense, which helps the child to make sense of the world, has several components, each of which undergoes a process of development.

Thinking instead of calculating

Number sense involves using basic ideas to avoid computational drudgery, as when the child knows that if you add two and three and get five, then you don’t have to calculate to get the answer to three-and-two.

Use what is convenient

Number sense involves breaking numbers into convenient parts that make calculation easier, as when we mentally add 5 + 5 + 1 instead of 5 + 6.

Knowing what’s plausible or impossible

Number sense may involve a “feel” for numbers in the sense of knowing whether certain numbers are plausible answers to certain problems (if you are adding two and three you know that the answer must be higher than three; anything lower is not only implausible but impossible).

Understanding relationships

Number sense involves intuitions about relationships among numbers. (For example, "this is 'way bigger' than that.")

Fluency

Number sense involves fluency with numbers, as when the child knows immediately that eight is bigger than four, or sees that there are three animals without having to count.

Estimation

This involves figuring out the approximate number of a group of objects and is related to the notion of plausible answers.

The Transition to Written, Symbolic Math

Context and overview

Formal, symbolic mathematics can provide children with more powerful tools and ideas than those provided through their informal everyday math. Formal math (and its use of symbols) developed in several cultures and is now virtually universal. Children need to learn it.

Everyday origins and formal math

Children encounter math symbols in everyday life: elevator numbers, bus numbers, television channels and street signs are among the many. Often parents, television, and software activities introduce some simple symbolic math, such as reading the written numbers on the television or on playing cards.

Schools certainly have to teach formal math. But doing so is not easy. Even if they are competent in everyday math, children may have trouble making sense of and connecting their informal knowledge to what is taught in school. Teachers often do not teach symbolism effectively. If children get off on the wrong symbolic foot, the result may be a nasty fall down the educational stairs. So the goal for teachers is to help children, even beginning in preschool, to understand why symbols are used, and to use them in a meaningful way to connect already-known informal mathematics to formal symbolic mathematics. The teacher needs to “mathematize” children’s everyday, personal math; that is, help children connect their informal system with the formal mathematics taught in school. It’s not ill-advised or developmentally inappropriate to introduce symbols to young children, if the activity is motivating and meaningful. On the contrary, it is crucial for the teaching of symbols to begin early on, but again, if and only if it is done in a meaningful way.

If children get off on the wrong symbolic foot, the result may be a nasty fall down the educational stairs. So the goal for teachers is to help children, even beginning in preschool, to understand why symbols are used, and to use them in a meaningful way to connect already-known informal mathematics to formal symbolic mathematics. The teacher needs to “mathematize” children’s everyday, personal math; that is, help children connect their informal system with the formal mathematics taught in school. It’s not ill-advised or developmentally inappropriate to introduce symbols to young children, if the activity is motivating and meaningful. On the contrary, it is crucial for the teaching of symbols to begin early on, but again, if and only if it is done in a meaningful way.

Here are key issues surrounding the introduction of formal math to young children:

Young children have a hard time connecting numerals and the symbols of arithmetic (+ and -) to their own everyday math

They may add well but be confounded by the expression 3 + 2. It is as if the child is living in alternate realities: the everyday world and the “academic” (in the pejorative sense) world. The everyday world makes sense and the world of school does not. You think for yourself in the former and do what you are told in the latter.

It is as if the child is living in alternate realities: the everyday world and the “academic” (in the pejorative sense) world. The everyday world makes sense and the world of school does not. You think for yourself in the former and do what you are told in the latter.

The equals sign (=) is a daunting challenge

The teacher intends to teach the equals sign as "equivalent," and thinks she has, but the child learns it as “makes” (e.g., 3 + 2 makes 5). This is a tale of how child egocentrism meets teacher egocentrism but neither talks with the other.

The solution

We should not avoid teaching symbols but need to introduce them in a meaningful way. This means taking account of what children already know and relating the introduction of symbols to that prior knowledge. It also means motivating the use of symbols. Thus if you want to tell a friend how many dolls you have at home, you need to have counted them with number words (symbols) and then use spoken words (“I have five dolls”), written words (“I have five dolls” written on a piece of paper or a computer screen), or written symbols (5) to communicate the result.

Manipulatives can help

Use of manipulatives can be effective in teaching symbolism and formal math, but they are often utilized badly. The goal is not to have the child play with concrete objects but to use these objects to help the child learn abstract ideas. The goal of manipulatives is to get rid of them by putting them in the child’s head to use as needed in thought. For example, suppose the child learns to represent tens and ones with base-ten blocks. Given the mental addition problem 13 plus 25, the child may understand that each number is composed of 10s (the 10 by 10 squares) and some units (the individual blocks), and that solving the problem involves adding one 10 and two more, which is easy, and then figuring out the number of units. The mental images of the 10s and ones provide the basis for her calculation, part of which may be done by memory (one plus two is three) and part of which may be done by counting on her fingers (five fingers and three more give eight).

Conclusion

The basics of number are interesting and deep. Although young children develop a surprisingly competent everyday mathematics, they have a lot to learn and teachers can help.

Resource Type

Handout

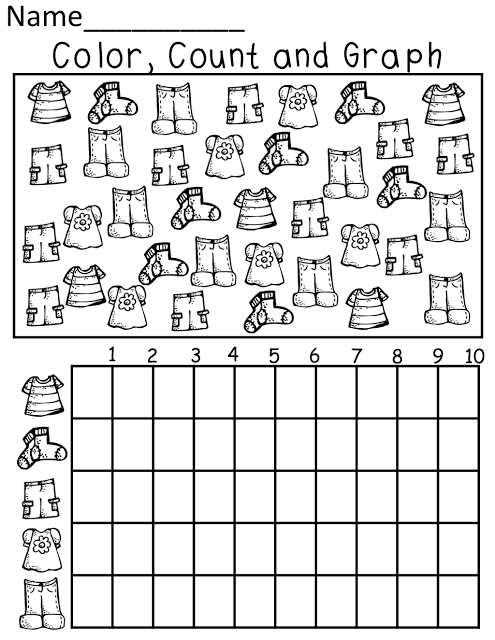

How Children Learn to Count

- Education

- Maths Tips

- 5 and under

Counting is easily taken for granted but there's a lot of fascinating research into how we learn to count - and there's more to it than you may think.

The mathematical brain

It’s first worth considering where our capacity to do mathematics comes from.

Neuropsychologist Brian Butterworth in his book “The Mathematical Brain” suggests we’re born with an innate sense of number hard-wired into our brain and he attributes this to a small region of the brain behind the left ear he calls "the number module". He compares this idea to colour – in the same way we perceive the “greenness” of a leaf we can also perceive the “twoness” or “threeness” of a group of objects.

He compares this idea to colour – in the same way we perceive the “greenness” of a leaf we can also perceive the “twoness” or “threeness” of a group of objects.

Take counting. Like times tables and algebra, we tend to think it's something kids have to be taught. Wrong, says Butterworth - it's an instinct. Sure, we have to learn the names and symbols of numbers to develop that instinct, but, because the number module is hardwired into the brain, basic counting comes naturally.

Remote tribes can count even when they have no words for numbers. In maths as in language he believes, "kids start off with little starter kits" And their maths starter kit is the number module.

There are other theories too - such as maths being an extension of our spatial awareness – but there’s something nice in the idea of a “little maths starter kit”.

A Word of warning - All this doesn't mean a child is predestined to be either good at maths or not. Far from it, we’re all born ready to learn maths – and it’s what happens in the first 10 years or so that sets us up.

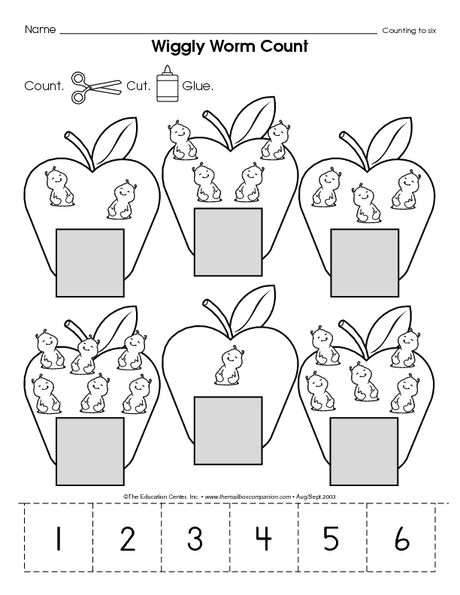

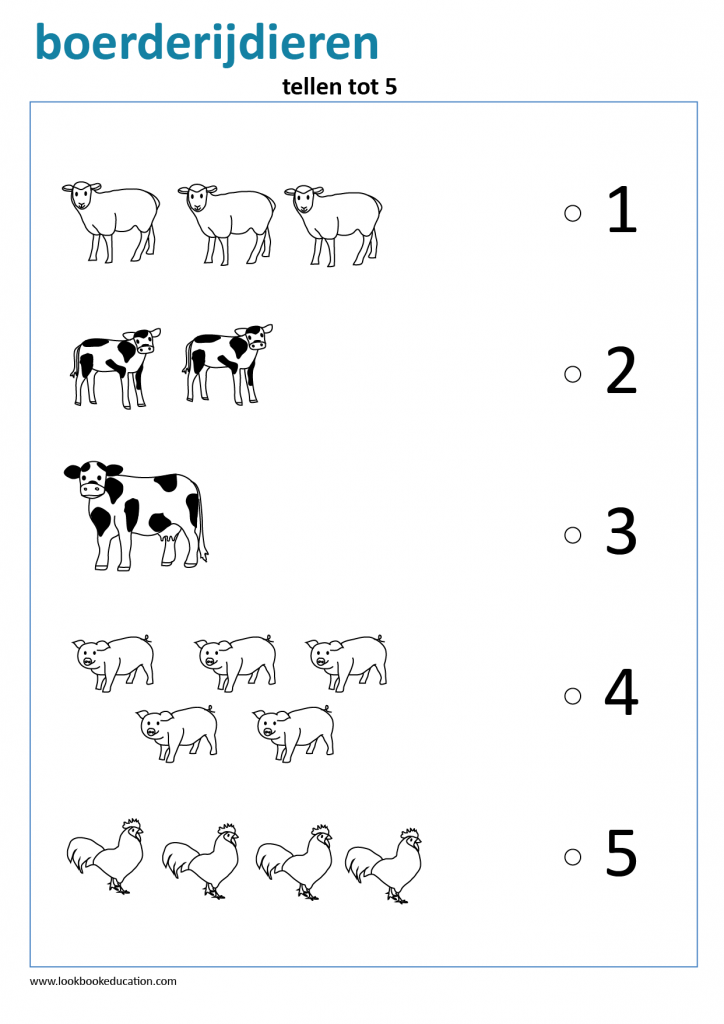

Counting with toddlers

Research suggest that toddlers - even as young as 12 months - have a sense of how many there are in a set - up to around three objects. This comes from their innate sense of number.

Counting is learned when the toddler starts making the connection between this innate sense of "how many there are" and the language we use to count "one, two, buckle my shoe". This is the first stage in learning maths and it's the building block for many early concepts.

Should parents count with their toddlers? Absolutely, using a variety of real objects. And since counting and language are interlinked reading to your toddlers is equally, if not more, important.

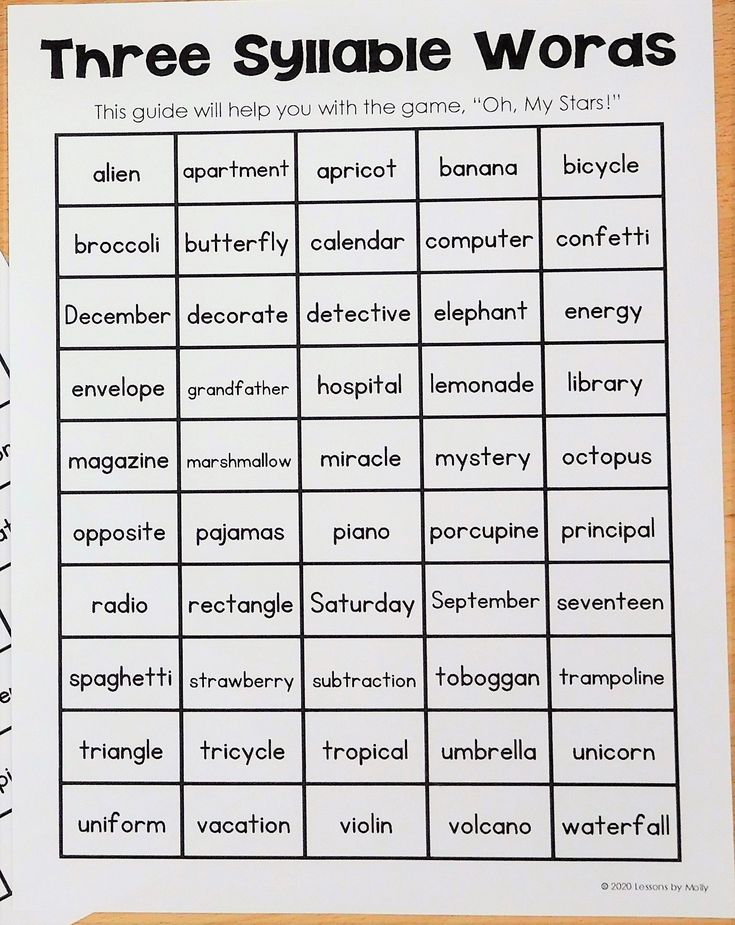

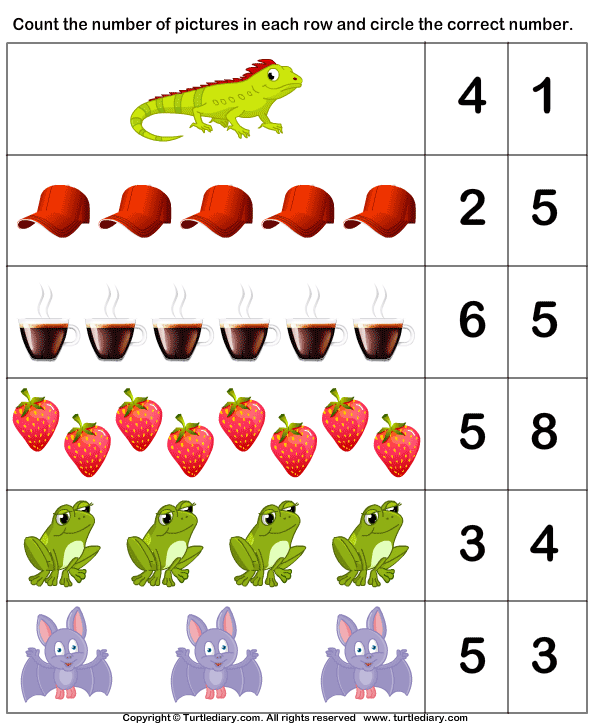

Counting - early learning milestones

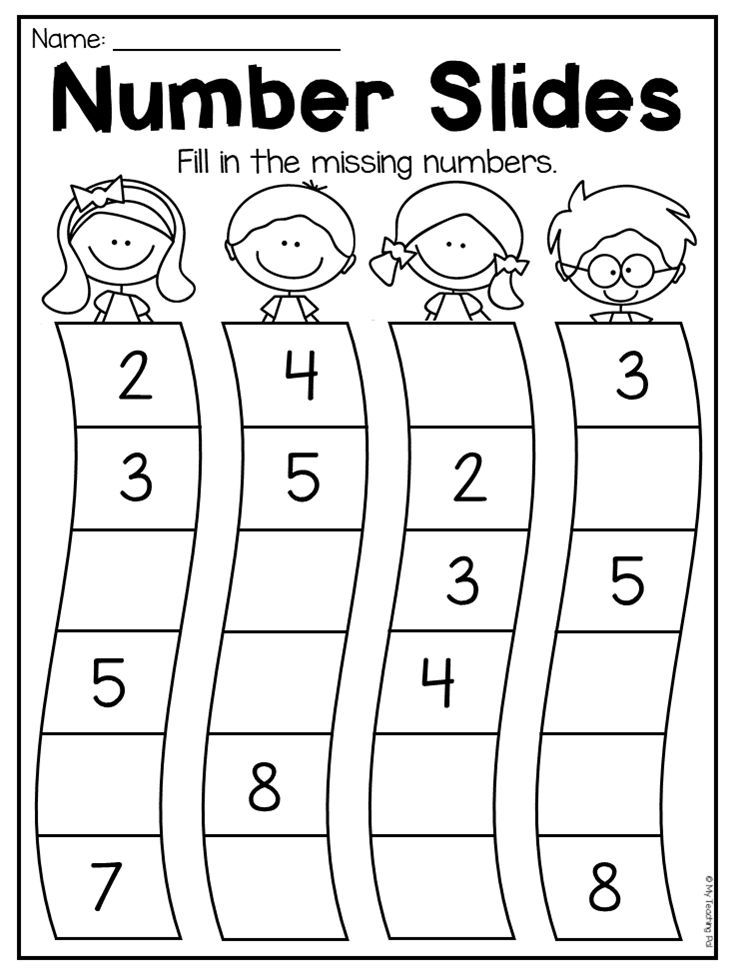

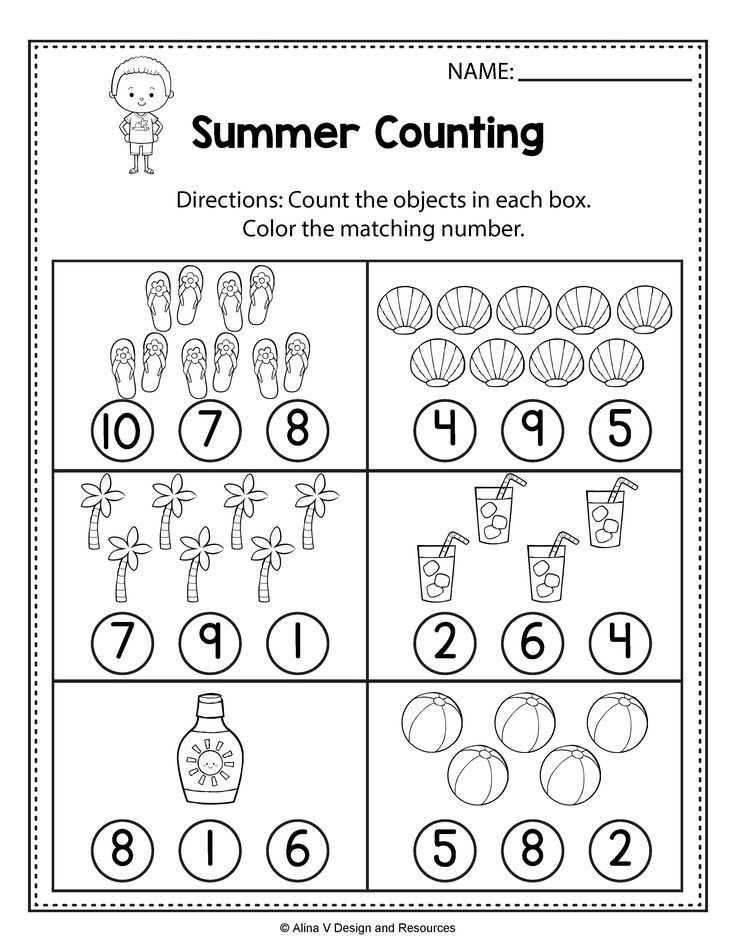

Here are some stages of learning to count that you may notice your child going through at ages 3 to 5:

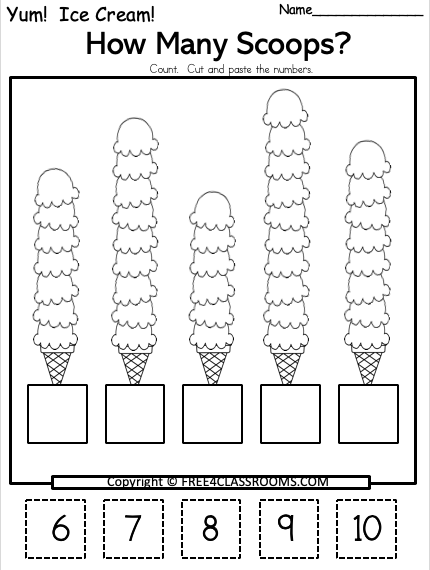

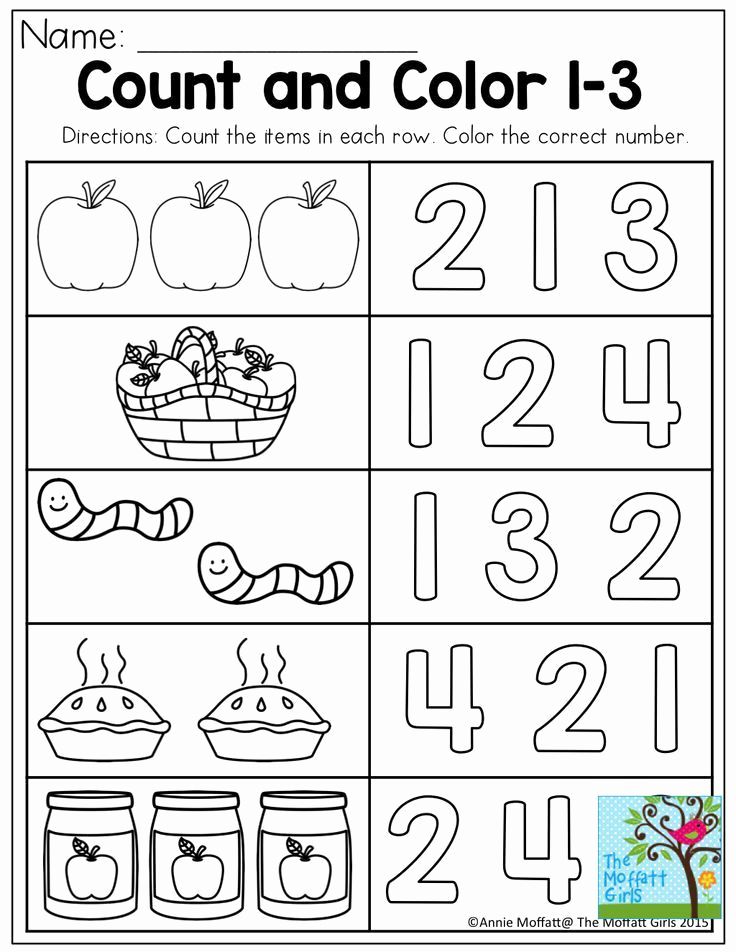

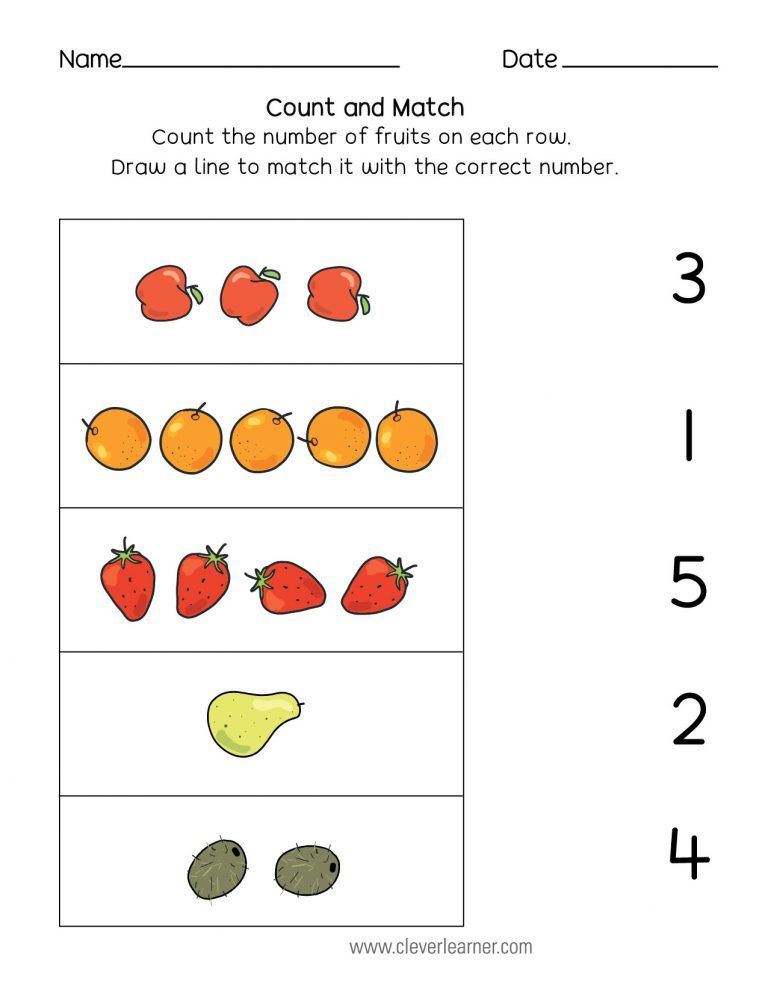

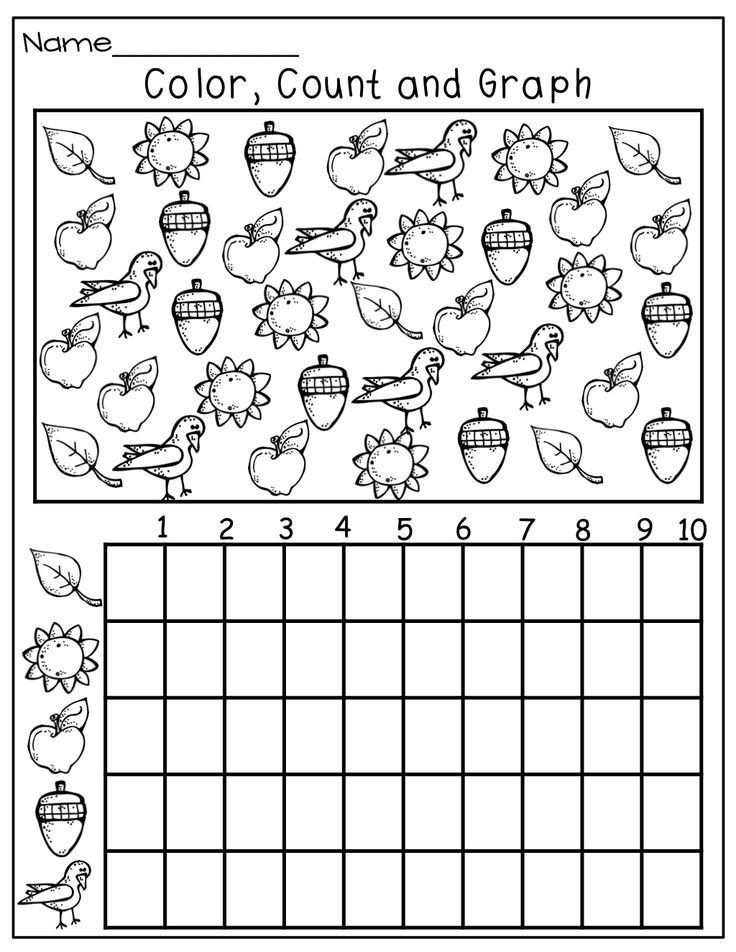

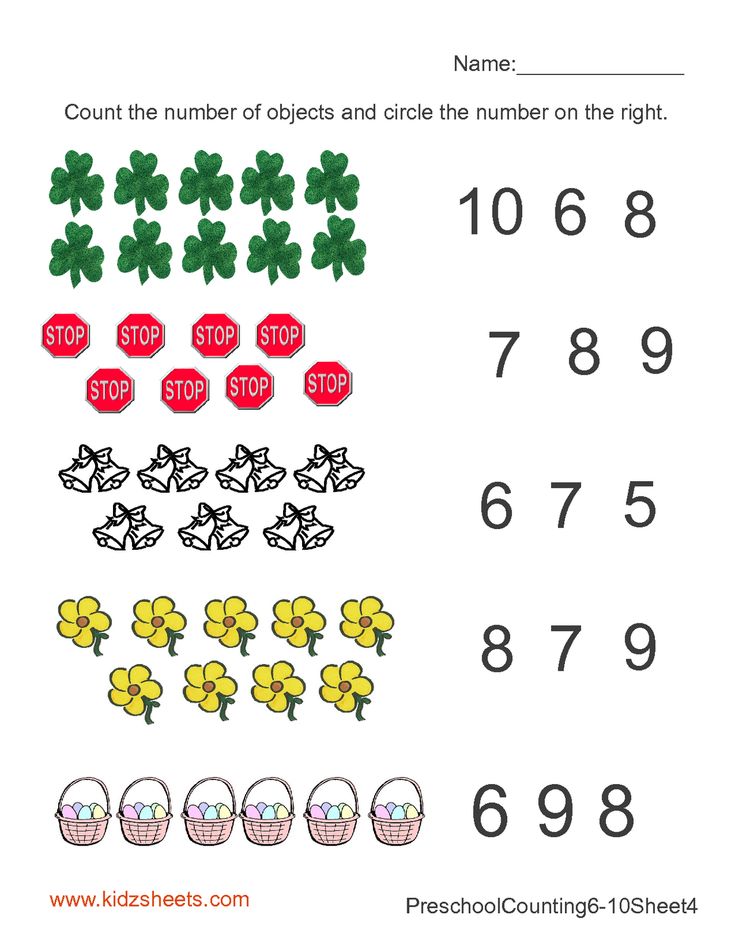

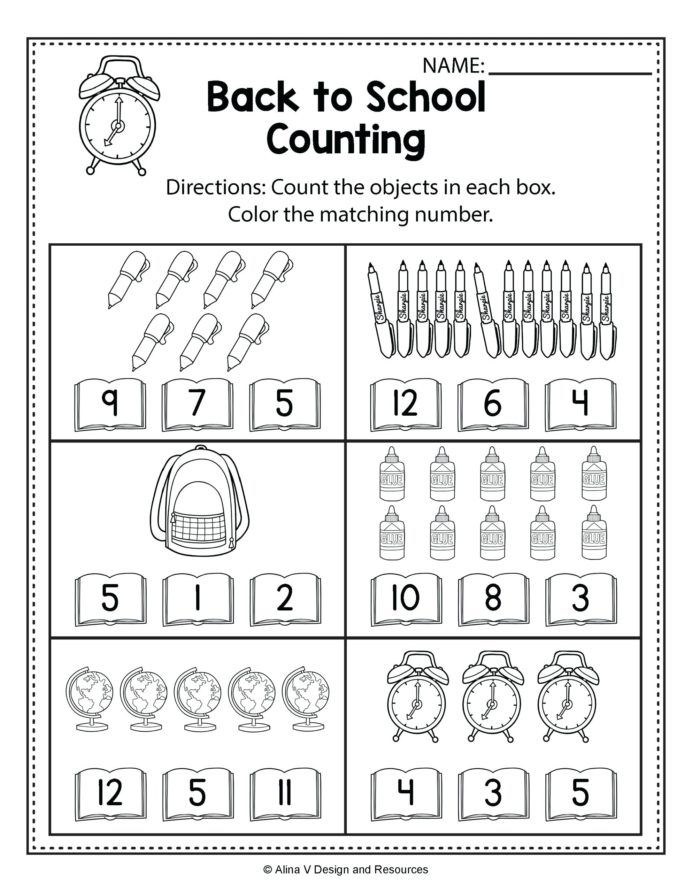

- Recognising how many objects are in a small set without counting. So if you show your child four apples they won't have to count them to tell you there's four.

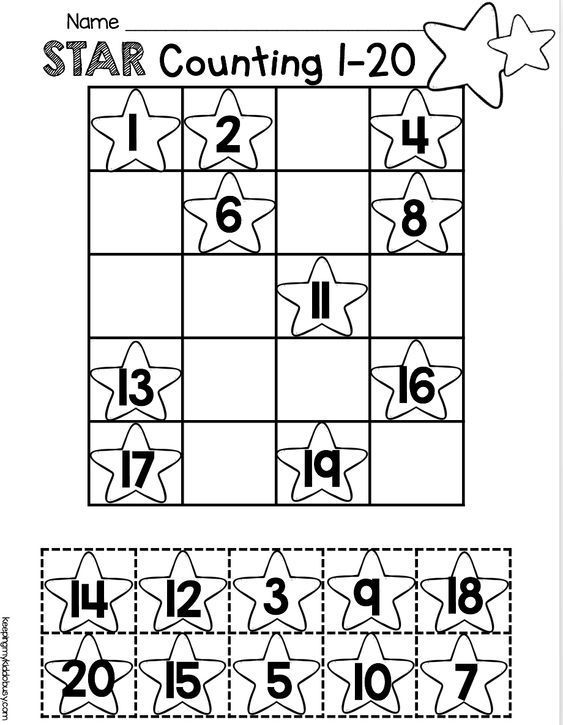

- Knowing the "number words" from one to ten and their order.

- Know the sequence regardless of which number they start on. So if you say "start counting at four" they will count "four, five . ." as opposed to always counting from one.

- Conservation of quantity - This is where children realise that the number of objects in a set stays the same unless any are added or removed. So if they count six cans of beans in a straight line, then you rearrange the beans ( in front of their eyes ) into say two stacks of three - they will realise there's still six without recounting.

- Counting non-visible objects - your child will realise they can count things they can't touch or even see - such as sounds, members of someone else's family, or even ideas.

- Cardinality, not to be confused with carnality - This is knowing that the last number counted is equal to the quantity of the set. If your child counts six oranges 1,2,3,4,5,6 and then you ask "how many oranges are there"? and they count them again then they haven't grasped "cardinality".

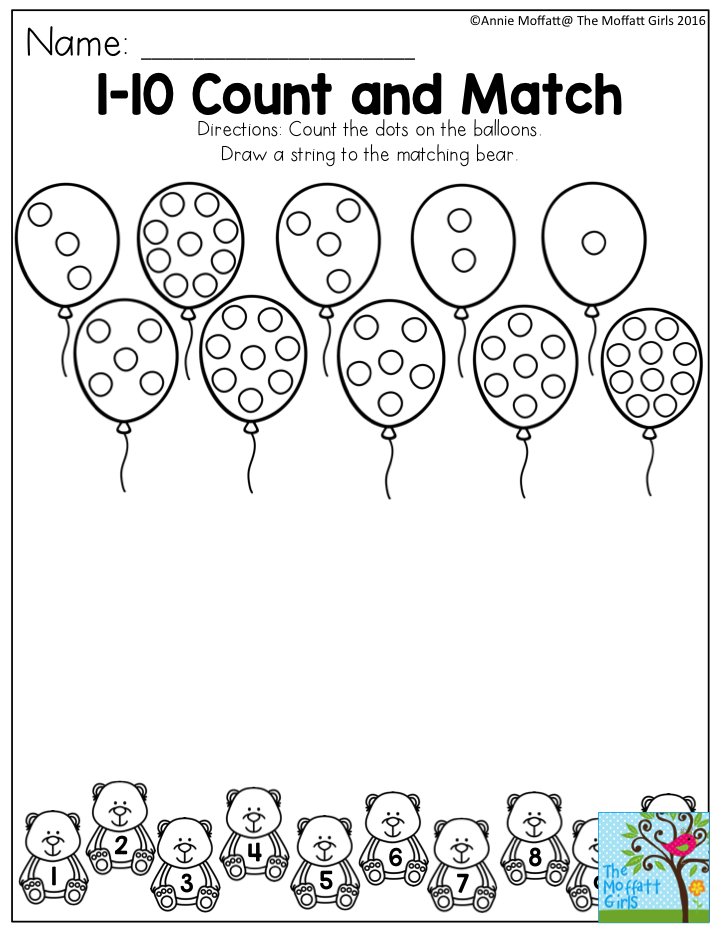

Counting on - as a step towards adding

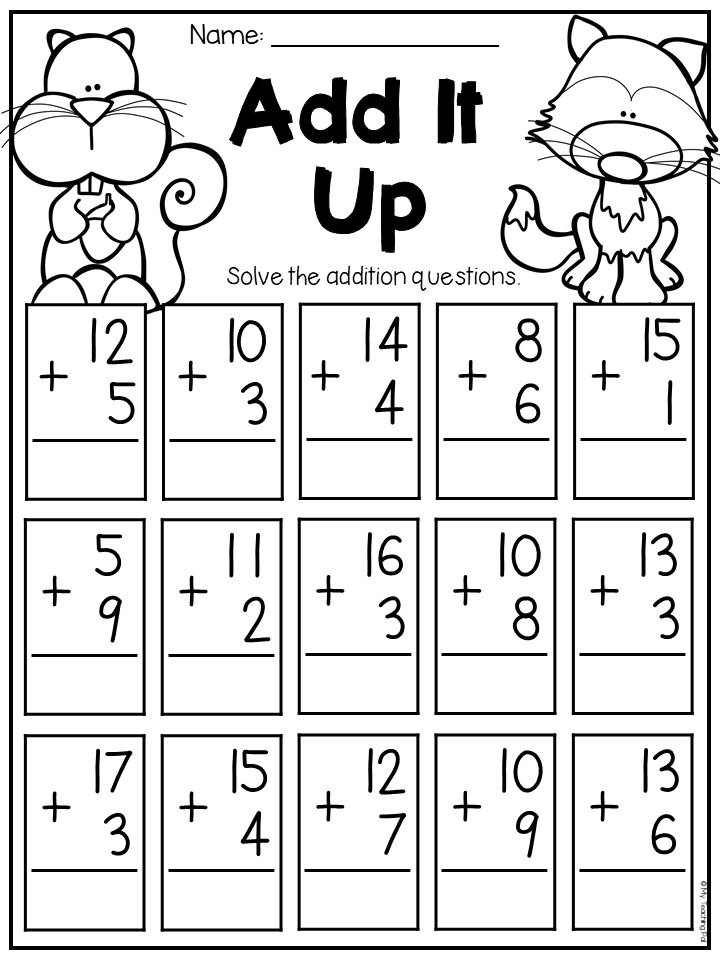

Learning to add comes as an extension of counting. Here are some stages a child goes through to make this connection:

- Counting all - For 3 + 5, children will count "one, two, three" and then "one, two, three, four, five" to establish the quantity of the sets to be added – for example, three fingers on one hand and five fingers on the other. The child will then count all the objects "one, two, three, four, five, six, seven, eight"

- Counting on from the first number - Some children come to realise that it is not necessary to count the first number to add. They can start with three, and then count on another five to get the solution. Using finger counting, the child will no longer count out the first set, but start with the word ‘Three’, and then use a hand to count on the second added: ‘Four, five, six, seven, eight’.

- Counting on from the larger number - It's more efficient when the smaller of the two numbers is counted.

The child now selects the biggest number to start with which is "five", and then counts on "six, seven, eight".

The child now selects the biggest number to start with which is "five", and then counts on "six, seven, eight". - The final stage isn't really counting - it's where learners know their number facts and skip the time-consuming counting altogether.

Number lines are great visual tools for making this connection between "counting on" and addition or subtraction - we use them in Komodo a lot. Here's an earlier blog article all about number lines.

Beyond basic counting

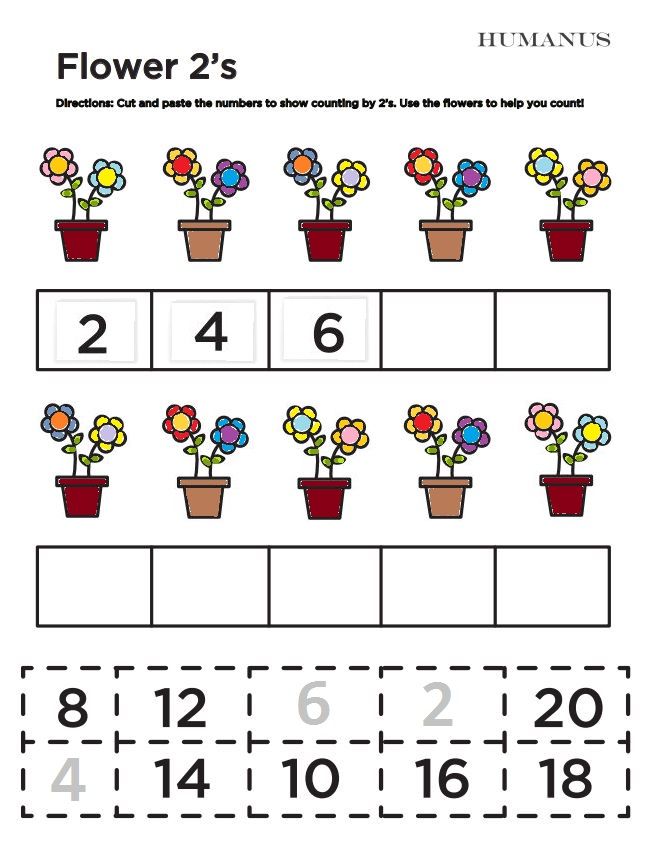

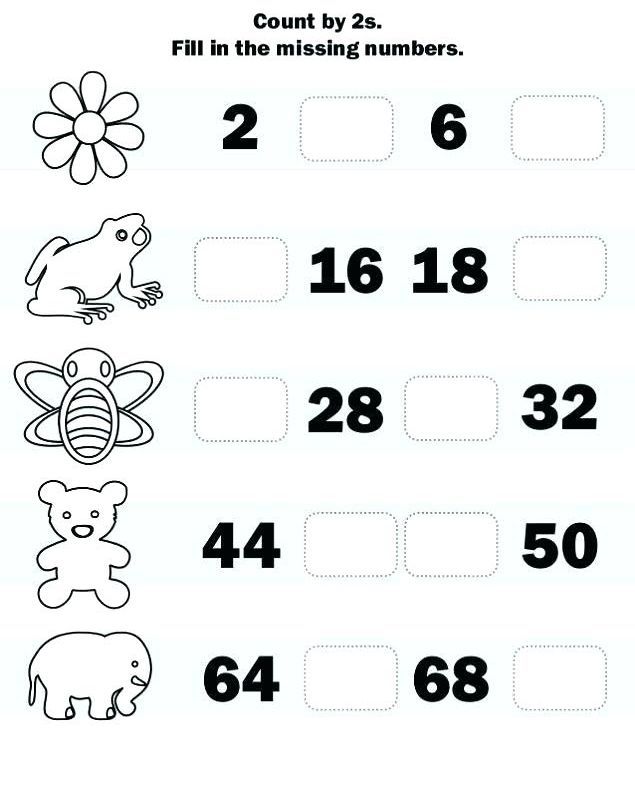

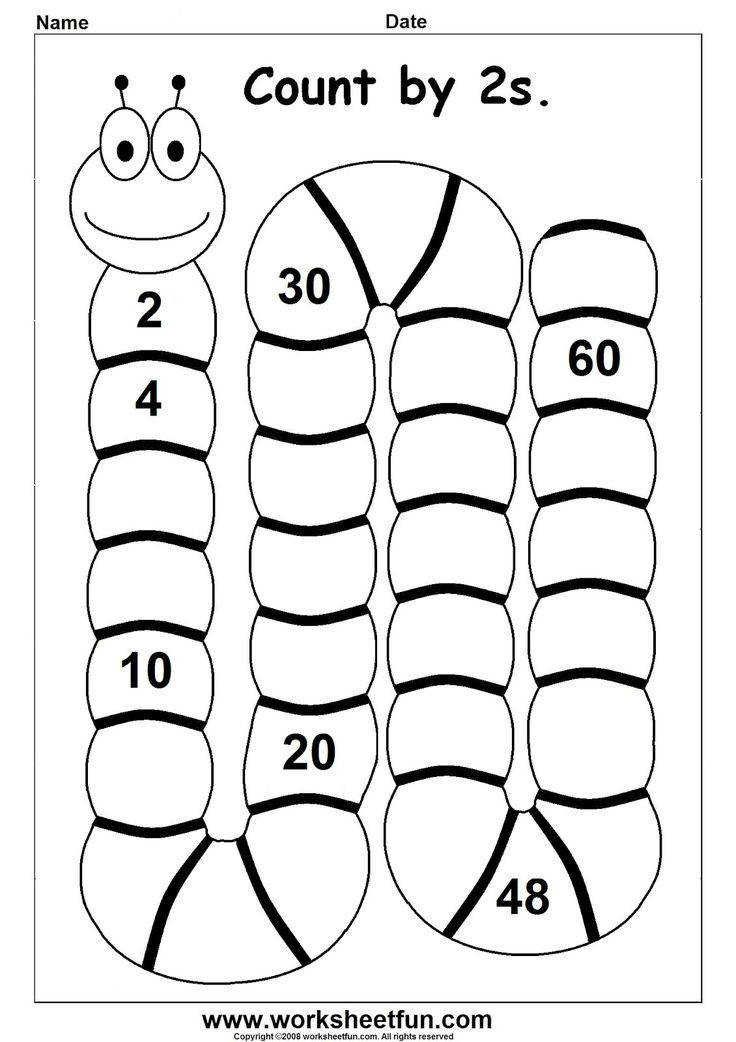

Counting is the first mathematical pattern learners encounter. From here they soon begin to count backwards which is a step towards subtraction and they'll also count in twos, fives and tens which are a foundation for multiplication.

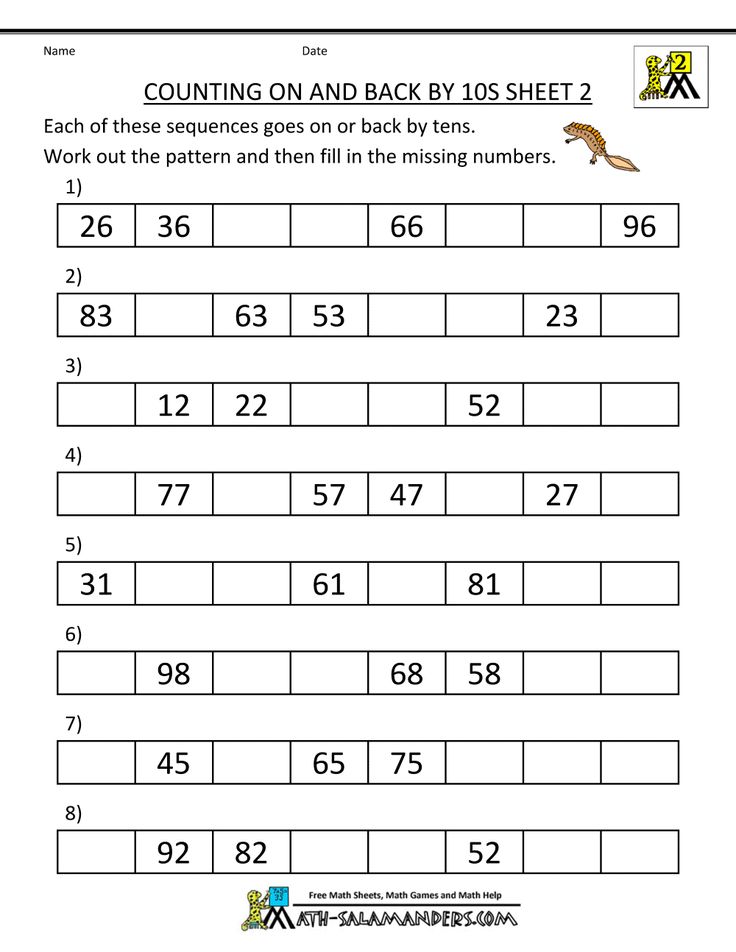

The next big step is the idea of place value and counting to base 10. Learners often make this leap simply because it's an obvious and efficient way to count large numbers. In Komodo, we use practice examples like this to help learners make the connection to counting in tens and ones.

It's easy to forget that counting is a key concept in maths with many stages before it's mastered. There's certainly a lot more to it than one, two, three!

I'm Ged, Co-founder of Komodo, ex-maths teacher and dad. If you have any questions please get in touch.

About Komodo - Komodo is a fun and effective way to boost primary maths skills. Designed for 5 to 11 year olds to use in the home, Komodo uses a little and often approach to learning maths (15 minutes, three to five times per week) that fits into the busy routine. Komodo users develop fluency and confidence in maths - without keeping them at the screen for long.

Find out more about Komodo and how it helps thousands of children each year do better at maths - you can even try Komodo for free.

Related Posts

Mindset - the path to mastery

People who have a growth mindset believe that they always have the potential to learn and improve. They are more motivated to persevere with difficult tasks, to take risks and to learn from failure.

They are more motivated to persevere with difficult tasks, to take risks and to learn from failure.

Top tips to de-stress homework time

Homework can be a trigger for some of the worst fights and arguments that we have with our children. Here are some solutions that can help reduce tensions and get homework done without arguments.

At what age can a bank deposit be opened: deposits for minors

For life

Small business

Parents, caring about the future of their children, start saving money in advance for education, buying real estate, a car. For such cases, banks offer to open special children's accounts and deposits.

Become a client

Can a child open a bank deposit

Art. 26, 28 of the Civil Code of the Russian Federation provide for 3 categories of minors and assign to them a different scope of actions in terms of financial relations:

- Minors under 6 years of age. Deprived of legal capacity, transactions on their behalf are carried out by legal representatives - parents, adoptive parents, guardians.

- Minor citizens from 6 to 14 years old. Independently perform simple operations to pay for goods and services. But contracts in their interests are concluded only by legal representatives.

- Minor citizens from 14 to 18 years old. The right to open accounts, deposits and partially dispose of funds on them.

Thus, only representatives can open a deposit for a child under 14 years old, from 14 to 18 years old - they, or the child does it on his own.

Account for children under 14 years old

Bank deposits and accounts for citizens under 14 years old have their own characteristics in terms of processing and using money. In some cases, to open and use an account, you may need permission from the guardianship and guardianship authorities.

Raiffeisen Bank does not currently open accounts for persons under 14 years of age.

Decoration.

- Savings accounts or deposits are opened for children of this age.

- The parent provides the bank with his passport, TIN, birth certificate of the child. If the representative is a foreigner or stateless person, a migration card will be required. Adoptive parents bring an agreement on the adoption of a child. The trustee attaches an act of the guardianship body confirming his status.

- A deposit is opened in a bank office, as a rule, online registration is not provided. The deposit is subject to insurance in the DIA separately from the accounts of the parents, in case of revocation of the license from the bank, compensation is paid on it.

Can a child under 14 manage a deposit

A minor is listed as the owner of a deposit, which can be replenished without restrictions by any person: parents, grandparents, acquaintances. A child, having reached the age of 14, has the right to independently deposit money and withdraw interest. When he turns 18, he can fully cash out the account. Statements on the movement of funds are issued by the bank to legal representatives.

Since such deposits are intended for children, debit transactions, even for representatives, are limited. To withdraw funds, you will need the written permission of the guardianship and guardianship authority.

Early closing of the deposit

If the parents want to withdraw all the money from the bank deposit ahead of schedule, the approval of the guardianship authority will also be required. In this case, accrued interest will be recalculated at the demand rate. If interest has not been withdrawn, the body of the deposit will not change. If the income was previously withdrawn, then the deposit will be reduced by the amount spent.

To close an account, you must provide the bank with the parent's passport, depositor's passbook, and written permission from the guardianship authority. If the child has reached the age of 14, money can be withdrawn only in his presence.

Account for children aged 14-18

A savings account or deposit for persons aged 14-18 has more permitted activities.

Registration

The set of documents is similar to the above, but instead of a birth certificate, a minor's passport is presented. In general, the procedure does not differ from the standard one.

Can a child over the age of 14 manage a deposit

A minor has the right to replenish and withdraw money from the deposit. If the account holder issues an order to a third party at a financial institution or a notary, that person will also be able to withdraw funds. However, parental and guardian consent is required.

If a minor plans to withdraw a salary, scholarship, financial assistance, unemployment benefit, bonus for participating in competitions, accrued interest or money deposited by him into the account, permission from the parents and guardianship authority is not required.

When it comes to issuing pensions, alimony, inheritance, insurance payments or funds contributed by others, the bank needs the written approval of the guardianship authority and one of the parents.

Account statements are issued to both parents and the depositor. When the child reaches the age of 18, the restrictions on withdrawing money from the deposit are removed.

Early closing of the deposit

The owner or his legal representatives can close the deposit ahead of schedule. It is necessary to present a passport, a deposit agreement, a passbook, the consent of the guardianship authority and one of the parents. Accrued interest will be recalculated by the bank at a nominal rate and issued minus previous withdrawals.

Basic terms and conditions for child accounts and deposits

As of March 2021, credit institutions offer the following terms and conditions for savings accounts for minors:

rates — up to 6%;

minimum amount — 1 ₽;

terms - from 1 to 2160 days, prolongation is acceptable;

monthly capitalization;

can be replenished and partially withdrawn.

Open accounts mainly in rubles.

The following options are provided for popular deposits:

rates — up to 6.5%;

minimum amount — 10,000 ₽;

terms - from 90 to 1095 days, prolongation is rarely used;

monthly capitalization;

replenishment, withdrawal depending on the conditions.

Children's deposit is issued in rubles and dollars.

Raiffeisen Bank offers unique savings programs that include financial protection. You can open a child deposit for 25 years and enjoy the following privileges:

index investments to protect against inflation; diversify risks by opening accounts in different currencies; at the end of the term, receive the sum insured in the 100% volume and additional investment income.

If your goal is to receive a regular income from the deposit to increase the child's capital, you can consider the conditions for deposits for citizens over 18 years old. According to them, you have the right to transfer interest to another account or add it to the body of the deposit. The rates of many deposits are fixed for the entire term of the contract.

Is this page helpful?

99% of customers find the page useful

+7 495 777-17-17

For calls within Moscow

8 800 700-91-00

For calls from other regions of Russia

Follow us on social networks blog

© 2003 – 2023 JSC Raiffeisenbank

General license of the Bank of Russia No. 3292 dated February 17, 2015

3292 dated February 17, 2015

Information on interest rates under bank deposit agreements with individuals

RBI Group Code of Corporate Conduct

Corporate Information Disclosure Center

Information disclosure in accordance with Bank of Russia Ordinance No. 3921-U dated December 28, 2015

By continuing to use the site, I agree to the processing of my personal data

Follow us in social networks and blog

+7 495 777-17-17

For calls within Moscow

8 800 700-91-00

For calls from other regions of Russia

© 2003 – 2023 JSC Raiffeisenbank.

General license of the Bank of Russia No. 3292 dated February 17, 2015.

Information on interest rates under bank deposit agreements with individuals.

RBI Group Code of Conduct.

Corporate Information Disclosure Center.

Disclosure of information in accordance with Bank of Russia Directive No. 3921-U dated December 28, 2015.

By continuing to use the site, I agree to the processing of my personal data.

how to get permission to withdraw funds from a minor

Tamara Skokova

worked in the guardianship department

Author profile

By law, parents cannot dispose of their children's property. This also applies to the money on the child’s account: in order to withdraw it, you will need permission from the guardian. Since there are many nuances in this procedure and not everything is regulated by law, disputes and omissions arise.

I worked in the guardianship authorities for 17 years, including considering applications for the disposal of minors' money. I’ll tell you what restrictions there are if you want to withdraw money from a child’s account, how to get permission and what problems there may be.

What you will learn

- How money can end up in a child’s account

- Restrictions on using money in a child’s account

- How money can be spent from a child’s account

- Which guardianship authority should I apply for permission

- What to do with the child’s registration

- Documents for guardianship

- Risks for the parties if the account of a minor is used

- What to do if the child wants to withdraw money himself

- How to report on spending money from the child’s account

The best articles on how to buy, sell, rent and equip a home are in your mail on Tuesdays. Free of charge

Free of charge

How money can end up in a child's account

A bank account for a child can be opened by parents or, for example, by a grandmother who wants to regularly deposit money in order to save a certain amount by the time her grandson comes of age. The child’s account can also receive social benefits or insurance compensation if the child was insured, for example, in case of injury. But most often, money ends up in children's accounts as a result of real estate transactions.

By law, in order to sell a home where the owners have children, you need to get a guardianship permit. It will be given if the living conditions of the children do not worsen as a result of the deal: the new housing will be no less than the previous one, with repairs no worse, and the necessary infrastructure will be nearby.

/dolg-za-doli/

Tax on children's shares: how not to turn a child into a debtor

But it happens that housing is sold, but new ones are not bought. There are two such cases:

There are two such cases:

- The family has several apartments, and the family sells one of them, while the child has a share in another apartment.

- The family moves to another region and will buy a new apartment when they sell the old one. But the date of the new deal is unknown.

In such cases, guardianship allows the sale of the child's share, but asks to deposit money into the child's bank account. This is a kind of monetary guarantee that the rights of the child are respected and he is indirectly provided with housing: he can buy a share for himself with money from the account.

For example, a family with one child has two apartments, in each of which the child has 1/3. When selling one apartment, parents can put money for the child's share into his bank account. This is normal, because there are other accommodations.

To calculate the value of a share, the sale price is simply divided by the size of the share. That is, if the apartment was sold for R3,000,000, then the cost of the third part is R1,000,000. 0003

0003

Restrictions on the use of money in a child's account

In order to respect the rights of the child, the state has introduced a preliminary approval procedure: until the child is under 18 years old, parents can manage his money only with the permission of the guardianship and guardianship authorities. Guardianship has the right to give instructions on how to spend children's money.

For example, a family sold an apartment and the money for the children's share was credited to the account. The family does not have another apartment, so guardianship will allow you to withdraw money only for the purchase of new housing. And if there is another apartment, then the money will be allowed to be spent, for example, on the treatment or education of a child.

Guardianship issues a written permission, you need to come to the bank with it to withdraw money. Guardianship also has the right to refuse in writing - with an explanation of the reasons.

Art. 21 of the law on guardianship and guardianship

What can you spend money from the child's account on

There is no approved list of purposes - such as, for example, for mother capital. Guardianship will proceed from the interests of the child. Here are the cases when they will definitely not refuse:

Guardianship will proceed from the interests of the child. Here are the cases when they will definitely not refuse:

- The child needs expensive treatment, and this is confirmed by medical documents.

- The purchase of a house is planned, and the child will be allocated a share in it.

- The money is needed for a ticket for the child to recover.

- You need to pay for your child's education.

The main thing guardianship looks at is whether the money will really go to the needs of the child. He should not be the parent's sponsor.

Is it possible to use children's money to pay off a mortgage. Sometimes parents want to withdraw their children's money to pay off a loan, including a mortgage. This will not work, because the loan is issued to the parents, and the child is not yet solvent and does not have to pay the debts. Guardianship will not allow the use of money for these purposes.

Community 10/20/22

Received a deduction, and then repaid the mortgage with maternity capital. Do I need to return tax money?

Do I need to return tax money?

The refusal can be challenged in court, but the judges will also proceed from the interests of the child - parents rarely win such cases.

Using a more complex example, I will show how the work with debts is built.

In Khabarovsk, a grandmother took custody of her orphaned granddaughter, who inherited from her mother a debt on a loan of 336,936 R and 704 R in a bank account. Another girl received 432,843 R as insurance compensation in connection with the death of her mother. The insurance was credited to the child's bank account.

Decision of the Khabarovsk District Court No. 2-1305 / 2020DOCX, 13 KB

Grandmother and granddaughter filed an application with the guardianship department: they asked to withdraw 336,936 R from insurance money in order to close the loan debt. They indicated that the debt is growing, as the bank charges interest and penalties. Guardianship refused, and the court recognized this decision as legal: the amount in the account is the only thing the girl has, and this money cannot be spent on debts, this is contrary to the interests of the child.

The bank tried to recover the debt from the guardian grandmother and set her the amount already 474,217 R. But the court indicated that the heirs are liable for debts only within the limits of the inherited property. Since the money on the children's account was not part of the inheritance, the court recovered in favor of the bank 704 R - everything that was on the accounts of the deceased.

Decision of the Khabarovsk District Court No. 2-1760/2020DOCX, 14 KB

Is it possible to spend children's money on repairing an apartment. This is possible if the child is registered and lives in an apartment. Parents also need to confirm that the renovation will improve the living conditions of the child. Most likely, they will not refuse if you plan to repair a children's room or kitchen.

They may refuse if the repair will be only in the parent's bedroom, and the child's will not be affected. The guardian may ask for photographs of the apartment to determine who uses which rooms. In addition, after the repair, it will be necessary to report: show the contract with the contractor, which will indicate in which rooms the work was carried out. You can do repairs on your own, but then you will need to present checks for building materials.

In addition, after the repair, it will be necessary to report: show the contract with the contractor, which will indicate in which rooms the work was carried out. You can do repairs on your own, but then you will need to present checks for building materials.

It is permissible to spend money from a child's account for several different purposes, but all of them must be agreed with the guardian.

/guide/smeta/

How to make an estimate

We had a case when a family with four children sold an apartment and moved to a village in another region. Parents were obliged to put money from the sale of children's shares into the account. When they entered into a deal to buy a house in another region, they were allowed to withdraw money. But not all the children's money was spent on buying a house. The parents applied to the guardianship again and asked to remove the leftovers in order to buy furniture, a computer and other things for the children. We gave such permission because the purchases improved the life of children.

We gave such permission because the purchases improved the life of children.

In my practice, most of the refusals are related to the fact that parents asked to withdraw money “for the daily needs of the child”: clothes, food, personal belongings. By law, parents are already obliged to provide for all these children - guardianship cannot agree on such expenses.

It happens that guardianship authorities are faced with misappropriation of funds - mainly when it comes to guardians. Children in care receive many different payments: allowances, pensions, alimony, rent subsidies, and so on. This money goes to the so-called nominal account. The guardian can use them without the knowledge of the guardian, but still must spend the money in the interests of the child. Sometimes there are guardians who break the law and spend money on their own needs.

In 2020, in the Lipetsk region, it was found out that the guardian had withdrawn money from a nominal account for two years and spent it for no clear reason. The court ordered the woman to return 301,667 R to the children's account.

The court ordered the woman to return 301,667 R to the children's account.

Which guardianship authority should be contacted for permission

For permission to withdraw money from a child's account, apply to the department of guardianship and guardianship at the place of residence of the child. According to the law, the place of residence for minors under 14 years of age is the place of residence of their parents.

p. 2 art. 20 of the Civil Code of the Russian Federation

Guardianship will be based on the fact that the place of residence of the child coincides with the registration.

That is, if the family has already left for another region, but the registration has remained at the same address, most likely you will have to return to get permission to withdraw money. Because the guardianship of another area will refuse to consider the application, even if the family has already issued a temporary registration.

But there may be exceptions. Regulations for the work of guardianship authorities in the regions vary. In addition, the law explicitly states that "the protection of the rights of minors is carried out at the place of residence", and there is nothing about registration.

Regulations for the work of guardianship authorities in the regions vary. In addition, the law explicitly states that "the protection of the rights of minors is carried out at the place of residence", and there is nothing about registration.

Community 06/30/22

They want to expel their son from school because there is no registration. It is legal?

How to deal with the registration of a child

When housing is sold, children cannot be registered anywhere. If a child is discharged from one apartment, then he must immediately be registered at another place of residence. This is difficult, because in order to sell real estate, children need to be discharged. And in order to register them in new housing, you must first buy it.

Guardianship gives six days from the date of registration of the right to real estate: it is assumed that the parents immediately after the transaction will submit an application and register the children in the new housing.

Clause 9 and Clause 28 of the Rules for Registration and Deregistration of Citizens of the Russian Federation

If the parents did not register their children, this is considered a violation of the terms of the transaction, but this does not mean that guardianship will require its cancellation. If the housing is really bought, custody through the court will require parents to register children and allocate shares to them.

There are situations when it is impossible to meet within six days, then the child has to be temporarily registered with relatives.

We had a case when parents sold an apartment in the region and took out a mortgage in Moscow. They deposited the money from the sale of their daughter's share to the account, in the application for disposal of this money they indicated that the child would be temporarily registered with relatives. They also brought a notarized obligation to allocate a share after buying an apartment. We have allowed the use of money from the account.

Another period of six days can be increased if you bring a preliminary contract of sale, from which the date of the transaction will be clear.

/guide/childfree/

How to move a child out of an apartment

What documents are needed to obtain guardianship permission to withdraw money

To apply for the disposal of money in a child's account, the following documents are required:

- Parents' application for withdrawal funds.

- Application of a minor if he is over 14 years of age.

- Passports of parents.

- Bank statement indicating the amount on the account.

Depending on the purpose of spending money, the following documents are also attached to the main documents:

- contract for the provision of educational services;

- doctor's report confirming the need for expensive treatment or rehabilitation;

- sales receipts for medicines or medical devices already purchased for a child;

- a preliminary contract for the sale of housing - it must be certified by a notary, it must specify the terms of the transaction, the amount and procedure for allocating a share to the child.

The guardian has 15 days to make a decision. Sometimes they refuse immediately due to the lack of documents or incorrect data provided. For example, once a mother approached us with a request to withdraw money from the account of a child who was registered at the father's place of residence - in another region. The child lived there. I had to refuse and send to receive permission in guardianship at the place of residence.

Community 07/20/22

Years later, utilities billed a debt for registered children. It is legal?

Consent to manage money from a child's account must be given by both parents, even if they are divorced. There are only a few situations when the consent of the second parent is not required:

- He is declared missing or declared dead - there must be a court decision about this.

- Held in custody. You will need a court verdict or a certificate of being in a pre-trial detention center.

- On the run. We need a document from the Ministry of Internal Affairs on the wanted list.

- Avoids parental duties for more than six months, that is, does not see the child, does not call him and does not provide financial support. Any documents that support this will do. The most obvious is a court order on the appointment of alimony and any document that confirms that the parent does not pay them.

Sometimes the second parent, especially when the couple is divorced, deliberately and without any clear reason does not give consent to the disposal of children's money. In this case, the second parent will have to prove that the first parent evades signing the consent. Guardianship employees are unlikely to understand the relationship of the spouses, so you will have to go to court. The court may order the guardianship to allow the release of money with the consent of one parent. But such cases are rare.

It often happens that one of the parents simply does not have time to go to foster care or is in another city. Then you can use a power of attorney. The authority that is entered in the power of attorney is as follows: "the right to consent to the withdrawal of money from the account of a minor for the purchase of housing." The power of attorney must be notarized.

Then you can use a power of attorney. The authority that is entered in the power of attorney is as follows: "the right to consent to the withdrawal of money from the account of a minor for the purchase of housing." The power of attorney must be notarized.

/guide/attorney-outside/

How to issue a power of attorney abroad

If information about the father is included in the birth certificate according to the mother, you need to bring a certificate from the registry office in form No. 2.

This is how the permission to withdraw funds from the child's account looks like. The bank can issue money in cash or transfer it to the parent's accountRisks of the seller and buyer of real estate when using the account of a minor

If there is a guardianship permission to withdraw money from the account, there will be no additional risks for the parties to the transaction. Money in children's accounts is ordinary money in a bank account, the only question is whether there are sanctions for their use. But there are atypical situations. Here are some of them.

But there are atypical situations. Here are some of them.

Deal failed. Parents received permission to use funds, withdrew children's money for a specific transaction, but could not use it.

In this case, guardianship can extend the permit (formally, issue a new one) and agree on a new transaction. But the period must be reasonable: usually we are talking about an extension for a maximum of six months. You will also have to explain why the transaction failed.

Parents spent money for other purposes. They promised to buy one house, but bought another or spent the money on other purposes. In this case, guardianship files a lawsuit in court. As a rule, the court obliges to return the money to the child's account. The same thing happens if the parents did not file a report on the use of money or fraud is visible in the report.

/prava/obyazannosti-matkapital/

Responsibilities when using matkapital

The developer did not deliver the new building on time. By law, guardianship can give permission to use children's money for the purchase of an apartment under construction, if its readiness is more than 70%. In this case, the ownership of the child is formalized when the house is put into operation, and then an extract from the USRN is brought into custody.

By law, guardianship can give permission to use children's money for the purchase of an apartment under construction, if its readiness is more than 70%. In this case, the ownership of the child is formalized when the house is put into operation, and then an extract from the USRN is brought into custody.

If the house cannot be completed in any way, it does not depend on the will of the parents. They have as much time as they want to wait for the completion of construction and issue shares after the handover of the house.

What to do if the child wants to withdraw money on his own

If the child has reached the age of 14, parents are required to obtain permission to withdraw money not only from guardianship, but also from the child. And he himself may want to withdraw money, but this will also require the consent of guardianship and both parents.

We were approached by a 14-year-old girl who wanted to withdraw 250,000 RUR from her account. Her grandmother deposited this money in the bank. The girl's mother didn't mind, legally she didn't have a father. The grandmother found out about her granddaughter's intentions, came to custody and explained that because of the lifestyle of the girl's mother, there were doubts whether the money would go to the child. The grandmother wanted her granddaughter to use the funds for education when she turned 18. The teenager was denied money.

The girl's mother didn't mind, legally she didn't have a father. The grandmother found out about her granddaughter's intentions, came to custody and explained that because of the lifestyle of the girl's mother, there were doubts whether the money would go to the child. The grandmother wanted her granddaughter to use the funds for education when she turned 18. The teenager was denied money.

What the courts say about withdrawing money from children's accounts

Irina Polovodova

lawyer

Author's profile

Guardianship quite often refuses to withdraw money from children's accounts. And parents and guardians no less often challenge these refusals in court. Here are a few examples when the court took the side of guardianship or, conversely, the side of the parents.

The mother of a minor girl from Chelyabinsk wanted to withdraw 67,000 R from her account for the repair and purchase of furniture for the apartment. In social security, the woman explained that she plans to spend 650,000 R on repairs and a little more than 45,000 R on furniture.

In social security, the woman explained that she plans to spend 650,000 R on repairs and a little more than 45,000 R on furniture.

Decision of the Kalininsky District Court of Chelyabinsk No. 2a-4236/2021DOCX, 12 KB

The use of children's money was refused because the parents did not attach an estimate or other documents that would confirm the cost of repairs. In custody, it was decided that 67,000 R was not enough for repairs, and the child would lose money. The court upheld the refusal.

A mother of three children from Podolsk entered into an agreement on participation in shared construction on her own behalf and on behalf of three minor children. But the developer went bankrupt, and the fund for protecting the rights of construction participants returned the money to the family, and the maternity capital to the Pension Fund. Mom received her part of the money, but the cost of children's shares was sent to their savings accounts.

Decision of the Podolsky City Court of the Moscow Region No. 2а-3394/22DOCX, 13 KB

2а-3394/22DOCX, 13 KB

A woman tried to get permission from guardianship to withdraw money without explaining the reasons. But guardianship refused, and the court confirmed her rightness. Although the money that the shareholder invested in the transaction did not originally belong to the children, but now they are in children's accounts. And according to the law, they can be spent only on children: for example, to buy another apartment to replace the one that was not built.

A resident of Surgut wanted to withdraw almost 775,000 R from her daughter's account, which had previously been received from the sale of an apartment. Now the money is needed to buy back a share in the amount of 33/92 in the apartment where the family lives. The share belonged to the child's aunt.

Decision of the Surgut City Court of the Khanty-Mansiysk Autonomous Okrug-Yugra No. 2a-5205/2020DOCX, 14 KB apartment. The court sided with the mother and canceled the guardianship order. Her employees tried to appeal the decision, but in vain.

Her employees tried to appeal the decision, but in vain.

A woman from Vologda sold an apartment owned by her and her daughter and placed almost 845,000 R on a child account. And then she asked for permission to withdraw money to build a house. In return, she undertook to give the child an apartment worth 1,800,000 rubles.

Decision of the Vologda City Court of the Vologda Region No. 2а-6596/2021DOCX, 14 KB

Guardianship was refused, and the woman went to court.

The court recognized the scheme as reasonable. The daughter’s financial situation will only improve: she will immediately become the owner of the apartment, and the family will also build a house. The court ruled to cancel the custody decision and ordered her to allow the money to be withdrawn.

How to report on spending money from a child's account

When the money from the account is spent, you need to bring an expense report to the guardianship as proof that it was spent correctly. A month is given for this from the moment the money is withdrawn. This condition is spelled out in the withdrawal application submitted by the parents.

A month is given for this from the moment the money is withdrawn. This condition is spelled out in the withdrawal application submitted by the parents.

In the case of buying a home, they usually bring an extract from the USRN, which lists the new owners, including the child.

Contracts with contractors, acts of acceptance of work performed and checks are suitable for spending on repairs. Therefore, for repairs with children's money, you will have to hire an officially registered team.

Sometimes guardianship allows you to buy building materials with children's money on the condition that the parents make the repairs themselves. Then checks are required. But there are more chances for approval if there is an estimate from the construction company or individual entrepreneur and a draft contract with the contractor.

/prava/matcapital/

Rights of parents with maternity capital

If parents cannot report or delay in providing documents, guardianship can go to court and he will oblige to return the money.