E 2 8

E-2 Treaty Investors info from top rated immigration firm in NJ

Treaty Investors

E-2 Treaty Investor

The E-2 nonimmigrant classification allows a national of a treaty country (a country with which the United States maintains a treaty of commerce and navigation) to be admitted to the United States when investing a substantial amount of capital in a U.S. business. Certain employees of such a person or of a qualifying organization may also be eligible for this classification. (For dependent family members, see “Family of E-2 Treaty Investors and Employees” below.)

See U.S. Department of State’s Treaty Countries for a current list of countries with which the United States maintains a treaty of commerce and navigation.

Who May File for Change of Status to E-2 Classification

If the treaty investor is currently in the United States in a lawful nonimmigrant status, he or she may file Form I-129 to request a change of status to E-2 classification. If the desired employee is currently in the United States in a lawful nonimmigrant status, the qualifying employer may file Form I-129 on the employee’s behalf.

How to Obtain E-2 Classification if Outside the United States

A request for E-2 classification may not be made on Form I-129 if the person being filed for is physically outside the United States. Interested parties should refer to the U.S. Department of State website for further information about applying for an E-2 nonimmigrant visa abroad. Upon issuance of a visa, the person may then apply to a DHS immigration officer at a U.S. port of entry for admission as an E-2 nonimmigrant.

General Qualifications of a Treaty Investor

To qualify for E-2 classification, the treaty investor must:

- Be a national of a country with which the United States maintains a treaty of commerce and navigation

- Have invested, or be actively in the process of investing, a substantial amount of capital in a bona fide enterprise in the United States

- Be seeking to enter the United States solely to develop and direct the investment enterprise.

This is established by showing at least 50% ownership of the enterprise or possession of operational control through a managerial position or other corporate device.

This is established by showing at least 50% ownership of the enterprise or possession of operational control through a managerial position or other corporate device.

An investment is the treaty investor’s placing of capital, including funds and/or other assets, at risk in the commercial sense with the objective of generating a profit. The capital must be subject to partial or total loss if the investment fails. The treaty investor must show that the funds have not been obtained, directly or indirectly, from criminal activity. See 8 CFR 214.2(e)(12) for more information.

A substantial amount of capital is:

- Substantial in relationship to the total cost of either purchasing an established enterprise or establishing a new one

- Sufficient to ensure the treaty investor’s financial commitment to the successful operation of the enterprise

- Of a magnitude to support the likelihood that the treaty investor will successfully develop and direct the enterprise.

The lower the cost of the enterprise, the higher, proportionately, the investment must be to be considered substantial.

The lower the cost of the enterprise, the higher, proportionately, the investment must be to be considered substantial.

A bona fide enterprise refers to a real, active and operating commercial or entrepreneurial undertaking which produces services or goods for profit. It must meet applicable legal requirements for doing business within its jurisdiction.

Top

Marginal Enterprises

The investment enterprise may not be marginal. A marginal enterprise is one that does not have the present or future capacity to generate more than enough income to provide a minimal living for the treaty investor and his or her family. Depending on the facts, a new enterprise might not be considered marginal even if it lacks the current capacity to generate such income. In such cases, however, the enterprise should have the capacity to generate such income within five years from the date that the treaty investor’s E-2 classification begins. See 8 CFR 214.2(e)(15).

General Qualifications of the Employee of a Treaty Investor

To qualify for E-2 classification, the employee of a treaty investor must:

- Be the same nationality of the principal alien employer (who must have the nationality of the treaty country)

- Meet the definition of “employee” under relevant law

- Either be engaging in duties of an executive or supervisory character, or if employed in a lesser capacity, have special qualifications.

If the principal alien employer is not an individual, it must be an enterprise or organization at least 50% owned by persons in the United States who have the nationality of the treaty country. These owners must be maintaining nonimmigrant treaty investor status. If the owners are not in the United States, they must be, if they were to seek admission to this country, classifiable as nonimmigrant treaty investors. See 8 CFR 214.2(e)(3)(ii).

Duties which are of an executive or supervisory character are those which primarily provide the employee ultimate control and responsibility for the organization’s overall operation, or a major component of it. See 8 CFR 214.2(e)(17) for a more complete definition.

See 8 CFR 214.2(e)(17) for a more complete definition.

Special qualifications are skills which make the employee’s services essential to the efficient operation of the business. There are several qualities or circumstances which could, depending on the facts, meet this requirement. These include, but are not limited to:

- The degree of proven expertise in the employee’s area of operations

- Whether others possess the employee’s specific skills

- The salary that the special qualifications can command

- Whether the skills and qualifications are readily available in the United States.

Knowledge of a foreign language and culture does not, by itself, meet this requirement. Note that in some cases a skill that is essential at one point in time may become commonplace, and therefore no longer qualifying, at a later date. See 8 CFR 214.2(e)(18) for a more complete definition.

Period of Stay

Qualified treaty investors and employees will be allowed a maximum initial stay of two years. Requests for extension of stay may be granted in increments of up to two years each. There is no maximum limit to the number of extensions an E-2 nonimmigrant may be granted. All E-2 nonimmigrants, however, must maintain an intention to depart the United States when their status expires or is terminated.

Requests for extension of stay may be granted in increments of up to two years each. There is no maximum limit to the number of extensions an E-2 nonimmigrant may be granted. All E-2 nonimmigrants, however, must maintain an intention to depart the United States when their status expires or is terminated.

An E-2 nonimmigrant who travels abroad may generally be granted an automatic two-year period of readmission when returning to the United States. It is generally not necessary to file a new Form I-129 with USCIS in this situation.

Terms and Conditions of E-2 Status

A treaty investor or employee may only work in the activity for which he or she was approved at the time the classification was granted. An E-2 employee, however, may also work for the treaty organization’s parent company or one of its subsidiaries as long as the:

- Relationship between the organizations is established

- Subsidiary employment requires executive, supervisory, or essential skills

- Terms and conditions of employment have not otherwise changed.

See 8 CFR 214.2(e)(8)(ii) for details.

USCIS must approve any substantive change in the terms or conditions of E-2 status. A “substantive change” is defined as a fundamental change in the employer’s basic characteristics, such as, but not limited to, a merger, acquisition, or major event which affects the treaty investor or employee’s previously approved relationship with the organization. The treaty investor or enterprise must notify USCIS by filing a new Form I-129 with fee, and may simultaneously request an extension of stay for the treaty investor or affected employee. The Form I-129 must include evidence to show that the treaty investor or affected employee continues to qualify for E-2 classification.

It is not required to file a new Form I-129 to notify USCIS about non-substantive changes. A treaty investor or organization may seek advice from USCIS, however, to determine whether a change is considered substantive. To request advice, the treaty investor or organization must file Form I-129 with fee and a complete description of the change.

See 8 CFR 214.2(e)(8) for more information on terms and conditions of E-2 treaty investor status.

A strike or other labor dispute involving a work stoppage at the intended place of employment may affect a Canadian or Mexican treaty investor or employee’s ability to obtain E-2 status. See 8 CFR 214.2(e)(22) for details.

Family of E-2 Treaty Investors and Employees

Treaty investors and employees may be accompanied or followed by spouses and unmarried children who are under 21 years of age. Their nationalities need not be the same as the treaty investor or employee. These family members may seek E-2 nonimmigrant classification as dependents and, if approved, generally will be granted the same period of stay as the employee. If the family members are already in the United States and are seeking change of status to or extension of stay in an E-2 dependent classification, they may apply by filing a single Form I-539 with fee. Spouses of E-2 workers may apply for work authorization by filing Form I-765 with fee. If approved, there is no specific restriction as to where the E-2 spouse may work.

If approved, there is no specific restriction as to where the E-2 spouse may work.

As discussed above, the E-2 treaty investor or employee may travel abroad and will generally be granted an automatic two-year period of readmission when returning to the United States. Unless the family members are accompanying the E-2 treaty investor or employee at the time the latter seeks readmission to the United States, the new readmission period will not apply to the family members. To remain lawfully in the United States, family members must carefully note the period of stay they have been granted in E-2 status, and apply for an extension of stay before their own validity expires.

Forms

- Employment Based Forms

- Form I-129, Petition for Nonimmigrant Worker

Other USCIS Links

- Work Authorization

Department of State Links

- Treaty Countries

- Electronic Visa Application Forms

Top

Investor or treaty Trader E-1 / E-2 visa proceedings at Mupllclaw.

com

comE-1 Treaty Trader Visa

The E-1 nonimmigrant classification allows a national of a treaty country (a country with which the United States maintains a treaty of commerce and navigation) to be admitted to the United States solely to engage in international trade on his or her own behalf. Certain employees of such a person or of a qualifying organization may also be eligible for this classification. The Treaty Investor may has some differeces with the Treaty trader but it’s almost the same requirements.

To qualify for E-1 classification, the treaty trader must:

- Be a national of a country with which the United States maintains a treaty of commerce and navigation

- Carry on substantial trade

- Carry on principal trade between the United States and the treaty country which qualified the treaty trader for E-1 classification.

Trade is the existing international exchange of items of trade for consideration between the United States and the treaty country. Items of trade include but are not limited to:

Items of trade include but are not limited to:

- Goods

- Services

- International banking

- Insurance

- Transportation

- Tourism

- Technology and its transfer

- Some news-gathering activities.

See 8 CFR 214.2(e)(9) for additional examples and discussion.

Substantial trade generally refers to the continuous flow of sizable international trade items, involving numerous transactions over time. There is no minimum requirement regarding the monetary value or volume of each transaction. While monetary value of transactions is an important factor in considering substantiality, greater weight is given to more numerous exchanges of greater value. See 8 CFR 214.2(e)(10) for further details.

Principal trade between the United States and the treaty country exists when over 50% of the total volume of international trade is between the U.S. and the trader’s treaty country. See 8 CFR 214.2(e)(11).

****************************************

General Qualifications of the Employee of a Treaty Trader. To qualify for E-1 classification, the employee of a treaty trader must:

To qualify for E-1 classification, the employee of a treaty trader must:

- Be the same nationality of the principal alien employer (who must have the nationality of the treaty country)

- Meet the definition of “employee” under the relevant law

- Either be engaging in duties of an executive or supervisory character, or if employed in a lesser capacity, have special qualifications.

If the principal alien employer is not an individual, it must be an enterprise or organization at least 50% owned by persons in the United States who have the nationality of the treaty country. These owners must be maintaining nonimmigrant treaty trader status. If the owners are not in the United States, they must be, if they were to seek admission to this country, classifiable as nonimmigrant treaty traders. See 8 CFR 214.2(e)(3)(ii).

Duties which are of an executive or supervisory character are those which primarily provide the employee ultimate control and responsibility for the organization’s overall operation, or a major component of it. See 8 CFR 214.2(e)(17) for a more complete definition.

See 8 CFR 214.2(e)(17) for a more complete definition.

Special qualifications are skills which make the employee’s services essential to the efficient operation of the business. There are several qualities or circumstances which could, depending on the facts, meet this requirement. These include, but are not limited to:

- The degree of proven expertise in the employee’s area of operations

- Whether others possess the employee’s specific skills

- The salary that the special qualifications can command

- Whether the skills and qualifications are readily available in the United States

Knowledge of a foreign language and culture does not, by itself, meet this requirement. Note that in some cases a skill that is essential at one point in time may become commonplace, and therefore no longer qualifying, at a later date. See 8 CFR 214.2(e)(18) for a more complete definition.

**************************************

If the treaty trader is currently in the United States in a lawful nonimmigrant status, he or she may file Form I-129 to request a change of status to E-1 classification. If the desired employee is currently in the United States in a lawful nonimmigrant status, the qualifying employer may file Form I-129 on the employee’s behalf.

If the desired employee is currently in the United States in a lawful nonimmigrant status, the qualifying employer may file Form I-129 on the employee’s behalf.

A request for E-1 classification may not be made on Form I-129 if the person being filed for is physically outside the United States. Interested parties should refer to the U.S. Department of State website for further information about applying for an E-1 nonimmigrant visa abroad. Upon issuance of a visa, the person may then apply to a DHS immigration officer at a U.S. port of entry for admission as an E-1 nonimmigrant.

E-2 Treaty Investor Visa

To qualify for E-2 classification, the treaty investor must:

- Be a national of a country with which the United States maintains a treaty of commerce and navigation

- Have invested, or be actively in the process of investing, a substantial amount of capital in a bona fide enterprise in the United States

- Be seeking to enter the United States solely to develop and direct the investment enterprise.

This is established by showing at least 50% ownership of the enterprise or possession of operational control through a managerial position or other corporate device.

This is established by showing at least 50% ownership of the enterprise or possession of operational control through a managerial position or other corporate device.

An investment is the treaty investor’s placing of capital, including funds and/or other assets, at risk in the commercial sense with the objective of generating a profit. The capital must be subject to partial or total loss if the investment fails. The treaty investor must show that the funds have not been obtained, directly or indirectly, from criminal activity. See 8 CFR 214.2(e)(12) for more information.

A substantial amount of capital is:

- Substantial in relationship to the total cost of either purchasing an established enterprise or establishing a new one

- Sufficient to ensure the treaty investor’s financial commitment to the successful operation of the enterprise

- Of a magnitude to support the likelihood that the treaty investor will successfully develop and direct the enterprise.

The lower the cost of the enterprise, the higher, proportionately, the investment must be to be considered substantial.

The lower the cost of the enterprise, the higher, proportionately, the investment must be to be considered substantial.

A bona fide enterprise refers to a real, active and operating commercial or entrepreneurial undertaking which produces services or goods for profit. It must meet applicable legal requirements for doing business within its jurisdiction.

Marginal Enterprises

- The investment enterprise may not be marginal. A marginal enterprise is one that does not have the present or future capacity to generate more than enough income to provide a minimal living for the treaty investor and his or her family. Depending on the facts, a new enterprise might not be considered marginal even if it lacks the current capacity to generate such income. In such cases, however, the enterprise should have the capacity to generate such income within five years from the date that the treaty investor’s E-2 classification begins. See 8 CFR 214.2(e)(15).

**************************************

General Qualifications of the Employee of a Treaty Investor

To qualify for E-2 classification, the employee of a treaty investor must:

- Be the same nationality of the principal alien employer (who must have the nationality of the treaty country)

- Meet the definition of “employee” under relevant law

- Either be engaging in duties of an executive or supervisory character, or if employed in a lesser capacity, have special qualifications.

If the principal alien employer is not an individual, it must be an enterprise or organization at least 50% owned by persons in the United States who have the nationality of the treaty country. These owners must be maintaining nonimmigrant treaty investor status. If the owners are not in the United States, they must be, if they were to seek admission to this country, classifiable as nonimmigrant treaty investors. See 8 CFR 214.2(e)(3)(ii).

Duties which are of an executive or supervisory character are those which primarily provide the employee ultimate control and responsibility for the organization’s overall operation, or a major component of it. See 8 CFR 214.2(e)(17) for a more complete definition.

Special qualifications are skills which make the employee’s services essential to the efficient operation of the business. There are several qualities or circumstances which could, depending on the facts, meet this requirement. These include, but are not limited to:

- The degree of proven expertise in the employee’s area of operations

- Whether others possess the employee’s specific skills

- The salary that the special qualifications can command

- Whether the skills and qualifications are readily available in the United States.

Knowledge of a foreign language and culture does not, by itself, meet this requirement. Note that in some cases a skill that is essential at one point in time may become commonplace, and therefore no longer qualifying, at a later date. See 8 CFR 214.2(e)(18) for a more complete definition.

**********************************

If the treaty investor is currently in the United States in a lawful nonimmigrant status, he or she may file Form I-129 to request a change of status to E-2 classification. If the desired employee is currently in the United States in a lawful nonimmigrant status, the qualifying employer may file Form I-129 on the employee’s behalf.

A request for E-2 classification may not be made on Form I-129 if the person being filed for is physically outside the United States. Interested parties should refer to the U.S. Department of State website for further information about applying for an E-2 nonimmigrant visa abroad. Upon issuance of a visa, the person may then apply to a DHS immigration officer at a U. S. port of entry for admission as an E-2 nonimmigrant.

S. port of entry for admission as an E-2 nonimmigrant.

If you have any question regarding this visa petition, please call the office to set up a valuable consultation with our Immigration Lawyer.

Mystic - E2.8 - a project of a panel-frame house made of SIP panels from SIPwall (ECOPAN).

Cost of building a turnkey SIP house*:

| House kit | №1 LUX | №2 PREMIUM | No. 3 STANDARD | №4 GUARANTOR | |||

| Cost of house kit (prefabricated house with porch and veranda) | nine0011 1054 732 | – | 832 200 | ||||

| Warranty and production | |||||||

| House kit warranty* | 10 years old | ||||||

The house kit is made of three-layer SIP panels produced using SIPWALL (ECOPAN) technology at our own factory located in Shuya, Ivanovo region. In the manufacture of a prefabricated panel-frame house, only chamber-dried planed lumber is used, treated with the Wood Shield fire and bioprotective composition at the factory. All SIP panels of the house kit are manufactured in accordance with the design documentation developed by SIPWALL's own design department, and are lined with dry planed lumber. At the exit from the SIPWALL factory, the house kit has 99% readiness. In the manufacture of a prefabricated panel-frame house, only chamber-dried planed lumber is used, treated with the Wood Shield fire and bioprotective composition at the factory. All SIP panels of the house kit are manufactured in accordance with the design documentation developed by SIPWALL's own design department, and are lined with dry planed lumber. At the exit from the SIPWALL factory, the house kit has 99% readiness. | |||||||

| Working documentation | |||||||

| Draft design (EP) of the house (Standard/Individual) | X | X | X | X | |||

| Structural documentation (CD) for the assembly of a house kit, developed taking into account the calculation of load-bearing structures for strength. | X | X | X | X | |||

| Foundation piping | |||||||

| Wooden grillage 200 x 150 | X | X | X | X | |||

Overlap at mark +0. 000 000 | |||||||

| Three-layer reinforced SIP panel SIPwall 224U / 174U mm (OSB-3 12 mm "Kalevala" Russia / EGGER *, facade self-extinguishing polystyrene foam PPS 14 200/150 mm, Russia), sewn-in chamber-drying structural lumber, planed, treated with a fire-retardant compound "Wood Shield" in the factory. nine0010 | X | X | X | X | |||

| Exterior walls | |||||||

| Three-layer SIP panel SIPwall 174 mm (OSB-3 12 mm "Kalevala" Russia / EGGER *, facade self-extinguishing polystyrene foam PPS 14 150 mm, Russia), sewn-in chamber-drying structural lumber, planed, treated with the fire-retardant composition "Wood Shield" in factory conditions. | X | X | nine0011 XX | ||||

| Interior walls - interior, bearing | |||||||

Three-layer SIP panel SIPwall 174 mm (OSB-3 12 mm "Kalevala" Russia / EGGER *, facade self-extinguishing polystyrene foam PPS 14 150 mm, Russia), sewn-in chamber-drying structural lumber, planed, treated with the fire-retardant composition "Wood Shield" in factory conditions. | X | ||||||

| Wooden frame with cross-section of posts 37x147 (kiln-dried lumber, planed, treated with the Wood Shield bioprotective composition at the factory). | X | X | X | ||||

| Interior walls - interior, non-bearing | |||||||

| Three-layer SIP panel SIPwall 124 mm (OSB-3 12 mm "Kalevala" Russia / EGGER *, facade self-extinguishing polystyrene foam PPS 14 100 mm, Russia), sewn-in structural kiln-dried lumber, planed, treated with the fire-retardant composition "Wood Shield" in factory conditions. nine0010 | X | ||||||

| Wooden frame with cross-section of posts 37x97 (kiln-dried lumber, planed, treated with the Wood Shield fire-retardant composition at the factory). | X | X | X | ||||

| Interfloor ceiling | |||||||

Three-layer reinforced SIP panel SIPwall 224U / 174U mm (OSB-3 12 mm "Kalevala" Russia / EGGER *, facade self-extinguishing polystyrene foam PPS 14 200/150 mm, Russia), sewn-in chamber-drying structural lumber, planed, treated with a fire-retardant compound "Wood Shield" in the factory. nine0010 nine0010 | X | X | |||||

| Wooden beams with OSB-3 subfloor coating 22 mm thick (kiln-dried lumber, planed, factory-treated with Wood Shield flame retardant). | X | X | |||||

| Second floor ceilings and/or attic roof | |||||||

| Three-layer reinforced SIP panel SIPwall 224U / 174U mm (OSB-3 12 mm "Kalevala" Russia / EGGER *, facade self-extinguishing polystyrene foam PPS 14 200/150 mm, Russia), sewn-in chamber-drying structural lumber, planed, treated with a fire-retardant compound "Wood Shield" in the factory. nine0010 | X | X | X | ||||

| Wooden beams/rafter system for insulation. | X | ||||||

| Beams - supporting structures | |||||||

Set of beams, posts (sewn/glued). (kiln-dried lumber, planed, treated with the fire-retardant composition "Wood Shield" in the factory). | nine0011 X X | X | X | ||||

| Porch, terrace, canopy, balcony | |||||||

| Lumber required for the construction of the structure. | X | X | X | X | |||

Additional services:

Complete set of house kit No. 4

- Basement ceilings - reinforced SIP panels 224/174 mm thick. nine0286

- External walls - SIP panels 174 mm thick.

- Interfloor ceiling - wooden beams with OSB-3 subfloor coating 22 mm thick.

- Second floor ceilings and/or attic roof - wooden beams/truss system

- Interroom walls - a wooden framework with a section of racks of 147 and 97 mm.

- Set of beams, posts (sewn/glued).

- Lumber needed for the manufacture of porches, terraces. nine0285 KD - design documentation for the assembly of a house kit.

| Description | Description | Cost, | |

|---|---|---|---|

| Foundation construction | Foundation on reinforced concrete piles. Driven piles are reinforced concrete products that are rods with a square section and one pointed end. Piles are driven into the ground by the impact method; this type of pile is a reliable and stable base for the foundation with maximum bearing capacity. For foundations, we use reinforced concrete piles with dimensions of 150x150x3000 mm nine0010 Driven piles are reinforced concrete products that are rods with a square section and one pointed end. Piles are driven into the ground by the impact method; this type of pile is a reliable and stable base for the foundation with maximum bearing capacity. For foundations, we use reinforced concrete piles with dimensions of 150x150x3000 mm nine0010 | 136 300 | |

| Installation of house kit ** | Unloading and storage of the house kit on the site, assembling the house on the finished foundation is carried out by a full-time, professional team of the SIPWALL company. More details about the construction conditions can be found here. | 214 166 | |

| Fasteners *** | A set of necessary fasteners for assembling a house kit (SPAX screws, mounting foam, wood screws, mounting plates, studs, nuts, etc.) | 99 864 | |

| Roof | |||

| Membrane roof installation *** | Installation of PVC membrane + installation, from | 208 675 | |

| Doors and windows | |||

| Installation of windows, balcony doors *** | Energy-efficient double-glazed windows (class A +) VEKA WHS 72 mm, 5-chamber profile thickness of the double-glazed window -40 mm. from from | 161 500 | |

| Front door installation*** | Entrance door BULDORS + installation, from | 25,000 | |

* extended warranty upon signing a contract for the construction of a house with exterior finish (foundation, roof, windows, facade)

** more than 400 km. from the city of Ivanovo - the cost of installing a house kit along a warm circuit will increase to 2700 rubles / m².

*** The final cost for these items must be clarified immediately before ordering this type of service. nine0276

Total price:

House project

as a gift

Warranty

10 years

Landing house

on the site for free

Pile foundation project

free of charge

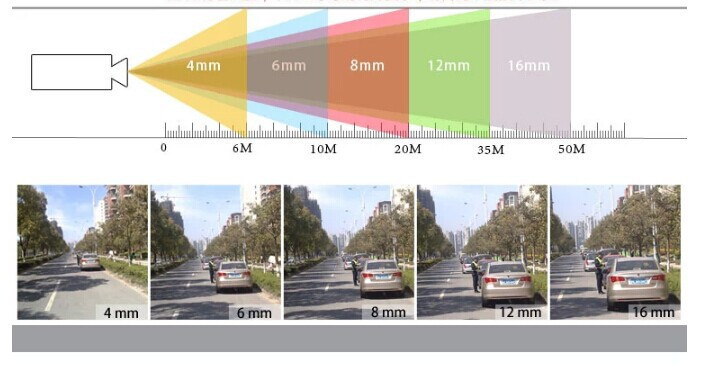

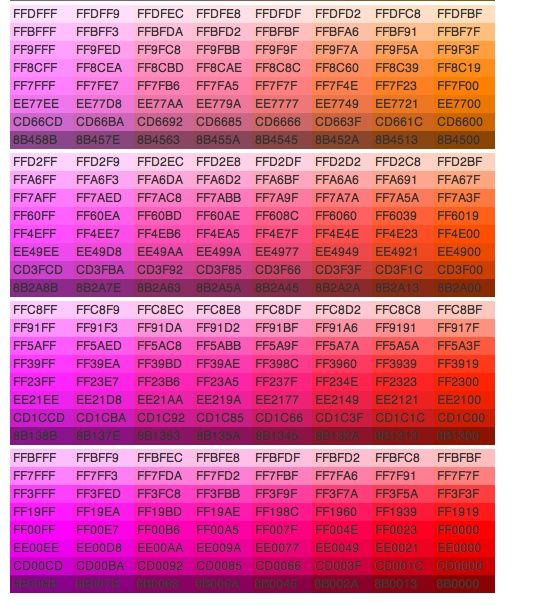

MC Zenitar 2.8/16 lens for Sony E NEX

The MC Zenitar 2. 8/16 lens is an interchangeable short throw ultra-wide-angle compact Fisheye (or Fisheye) lens designed for SLR cameras with a frame size of 24x36 mm. The angle of view of the lens is 180 degrees, but this will only be true for film and full frame cameras. On cameras with an APS-C sensor, the Zenitar turns into a fast wide-angle lens, losing most of the optical distortion (most pronounced at the edges of the frame) that gives this lens its uniqueness. A ten-lens design with small dimensions and weight guarantees excellent image quality and color reproduction, high glare protection, and the ability to convey fine details of an object. The multi-layer anti-reflective coating applied to the objective lens increases transmission and reduces light scattering, thus helping to eliminate flare. nine0276

8/16 lens is an interchangeable short throw ultra-wide-angle compact Fisheye (or Fisheye) lens designed for SLR cameras with a frame size of 24x36 mm. The angle of view of the lens is 180 degrees, but this will only be true for film and full frame cameras. On cameras with an APS-C sensor, the Zenitar turns into a fast wide-angle lens, losing most of the optical distortion (most pronounced at the edges of the frame) that gives this lens its uniqueness. A ten-lens design with small dimensions and weight guarantees excellent image quality and color reproduction, high glare protection, and the ability to convey fine details of an object. The multi-layer anti-reflective coating applied to the objective lens increases transmission and reduces light scattering, thus helping to eliminate flare. nine0276

The Zenitar lens belongs to the type of diagonal Fisheye, that is, the resulting frame will be completely occupied by the image. However, the viewing angle of 180 degrees corresponds only to the diagonals of the frame. Of all the horizontal lines in the image, only the line through the center of the frame will be straight. Horizontal lines that are above the center of the frame will bend up, those below will bend down. The lens allows you to get original pictures, provides unique creative opportunities for artistic photography. It is compact and easy to use despite the lack of autofocus. The wide angle allows you to shoot at close range, providing a greater depth of field. The non-standard image created by the Zenitar lens emphasizes the unusual nature of the shots. nine0276

Of all the horizontal lines in the image, only the line through the center of the frame will be straight. Horizontal lines that are above the center of the frame will bend up, those below will bend down. The lens allows you to get original pictures, provides unique creative opportunities for artistic photography. It is compact and easy to use despite the lack of autofocus. The wide angle allows you to shoot at close range, providing a greater depth of field. The non-standard image created by the Zenitar lens emphasizes the unusual nature of the shots. nine0276

The lens is attached to the camera using an adapter M42 - Sony NEX.

Features:

| Focal length: | 16 mm |

| Relative aperture (maximum): | 1:2.8 nine0010 |

| Relative bore (minimum): | 1:22 |

| Focusing: | manual |

| Resolution (center/edge): | 60/23 lines/mm nine0010 |

| Field of view angle (on the diagonal of the frame): | 180° |

| Frame size: | 24x36mm |

| Largest frame diameter: | 63 mm | nine0023

| Enlightenment type: | multilayer |

| Number of lenses/components: | 10/7 |

| Number of aperture blades: | 6 |

| Hood type: | built-in |

| Minimum Shooting Distance: | 0. |