Pic of goldilocks

Goldilocks and the Three Bears Picture Cubes Made in China

Etsy is no longer supporting older versions of your web browser in order to ensure that user data remains secure. Please update to the latest version.

Take full advantage of our site features by enabling JavaScript.

Click to zoom

Rare find

Price: CA$40. 26

Loading

Only 1 available

Star Seller. This seller consistently earned 5-star reviews, dispatched on time, and replied quickly to any messages they received.

Gift wrapping available.

See details

Gift wrapping by notesfromtheattic

Please select preferred paper for your gift wrap. Your gift will be wrapped and tied with an appropriate colored ribbon.

Explore more related searches

Listed on 14 Dec, 2022

3 favourites

Report this item to Etsy

Choose a reason…There’s a problem with my orderIt uses my intellectual property without permissionI don’t think it meets Etsy’s policiesChoose a reason…

The first thing you should do is contact the seller directly.

If you’ve already done that, your item hasn’t arrived, or it’s not as described, you can report that to Etsy by opening a case.

Report a problem with an order

We take intellectual property concerns very seriously, but many of these problems can be resolved directly by the parties involved. We suggest contacting the seller directly to respectfully share your concerns.

If you’d like to file an allegation of infringement, you’ll need to follow the process described in our Copyright and Intellectual Property Policy.

Review how we define handmade, vintage and supplies

See a list of prohibited items and materials

Read our mature content policy

The item for sale is…not handmade

not vintage (20+ years)

not craft supplies

prohibited or using prohibited materials

not properly labelled as mature content

Please choose a reason

Tell us more about how this item violates our policies. Tell us more about how this item violates our policies.

Tell us more about how this item violates our policies.

Moving toward the ‘Goldilocks’ comfort level with COVID-19

I have never listened to Joe Rogan.

I’ve heard a few Neil Young songs over the years, but I am not a fan.

I don’t make my health decisions based on a for-profit entertainment venue or the value systems of celebrities.

I am also in one of what the fine folks at the Centers for Disease Control define as a “high risk group” as I’m closing in on 66 years of age.

I’ve been vaccinated, I’ve signed up for a booster, and I’ve never had a COVID test.

At least two days a week I spend a significant time around someone whose immune system is compromised. I’m careful to take precautions.

I wear a mask when required to go into stores, restaurants, other offices, or to meet someone face-to-face for an interview.

In public places where masks aren’t required and I’m going to be in close proximity to someone I always try to remember to ask if they want me to put on my mask. That is particularly true when they are wearing a mask.

That is particularly true when they are wearing a mask.

My original aversion to donning a mask is long gone.

Mine wasn’t a “don’t tread on me” reaction although I get the sentiment.

It happened perhaps the 14th time I had a mask on in March 2020. It was the first time being masked while having needles in both arms during a platelet donation. I suddenly had a sensation that last popped up when I was 9 years old when a brother being a complete jerk — I have a more accurate description but it’s inappropriate for these pages — forced my head underwater and restrained my hands in a swimming pool. He thought it was funny. After 30 seconds or so I was terrified.

I was surprised to find myself hyperventilating for a moment at the blood bank. After I realized the mask with my arms being immobile for the donation process triggered a flashback of sorts, I calmed down. I was irked at myself for creating a ruckus of sorts with my reaction.

Not being dismissive of those who feel claustrophobic with masks or may have anxieties triggered for a wide variety of reasons, but those among of us who have been in a rage since the words “pandemic” and “COVID-19” became the part of our daily conversations almost on an hourly basis need to chill out.

This is not meant to downplay the reality that 887,780 Americans are among the 5.6 million people who have died worldwide from COVID-19. But there are more signs with each passing day that people are generally becoming “comfortable” with the reality COVID is here to stay.

It is clearly a notch or two above the flu.

At the same time it is clear most of us have created routines that allow us to live with the threat without acting like we’re preparing for nuclear Armageddon and constructing bunkers.

The trick is not to lower our guard, not to be careless, but to pay heed to our health and well-being and not to have complete disregard for the welfare of others either on a small scale or in a wanton manner.

If you think about it that applies to just about everything we do from how we drive to how we dispose of trash.

The truth is we have more control of variable factors that can determine our fate and the fate of those close to us and even the fate of random strangers than do Dr. Anthony Fauci, President Biden, Donald Trump, Neil Young, Joe Rogan, London Breed, or Gavin Newsom.

Anthony Fauci, President Biden, Donald Trump, Neil Young, Joe Rogan, London Breed, or Gavin Newsom.

Our selective hearing in the vast echo chamber of sound and fury known as the Internet that often times signifies nothing aside, what matters is what works for us.

You aren’t entitled to access Costco unless you have a membership card. A business requiring masks to enter is no different.

Yes, you can argue businesses may be forced to have a mask requirement by the government but there are clear signs we are moving beyond that. The reason is simple. More and more of us — even those galloping at top speed on their high horses to create a stampede to trample those that don’t tow the official line regardless of what their dissent is rooted in — are following the examples and not the words of leaders such as Gov. Newsom and San Francisco Mayor London Breed.

Ironically the gatekeepers on government payrolls and self-anointed guardians of the power structure they embrace because they align with their thinking are downplaying the value of masks.

The same people who once thought touching groceries with our bare hands was a COVID-19 death sentence based on “educated guesses” they were making at the time are now being borderline dismissive of masks.

The official line has now evolved into masks “have minimum” impact in slowing down the spread of COVID.

That seems like masks are on the verge of losing the Good Housekeeping seal of approval.

But if masks are border line useless that doesn’t account for two straight years in the drop off of other respiratory transmitted illnesses such as colds and the flu.

While I rarely get colds or the flu, I usually have a runny nose due to allergy issues at various times throughout the year. But in the past 22 months my purchase of facial tissue has plummeted significantly. The only thing I’ve done different is wear a mask when COVID protocols call for it.

That said concerns about being around potential carriers of COVID have prompted me to change my habits.

The best example is daily jogs in the past five months taking me down the Tidewater and past the far southeastern corner of the Manteca Transit Center parking lot where they do COVID testing.

Three weeks ago as I was nearing the station I noticed a large group of people standing on the bike path. As I got closer I realized the testing line that usually was short and contained to the parking lot had spilled out onto the Tidewater.

There were close to 70 people in line. Most of them were creating a nice obstacle blocking the bike path. While they were fully masked I turned my head away as I passed given I do not wear a mask when I jog.

I have not passed by the transit center since during a jog unless it has been on a Saturday, Sunday, or holiday when the testing site is closed.

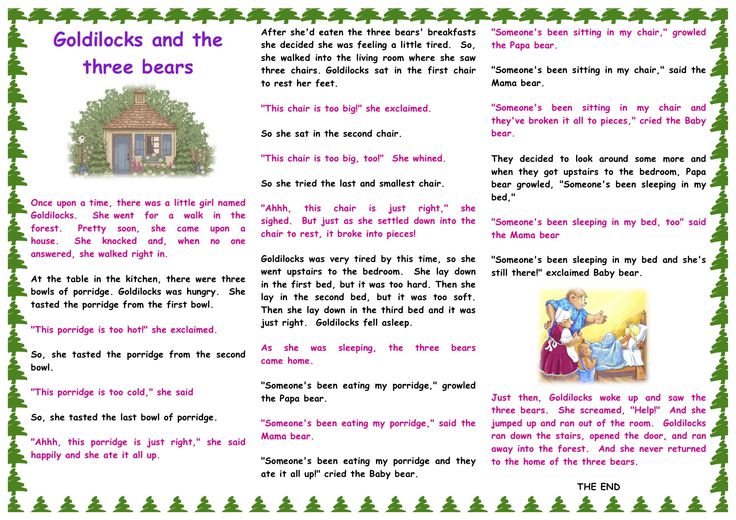

It’s clear that I have developed a comfort level that Goldilocks could appreciate when it comes to COVID.

I don’t like measures or behaviors that I view as too restrictive or those not restrictive enough. I am comfortable with measures that are just right for me.

When most of us find that comfort zone and as immunity by herd, vaccinations or both hit what society and not government determines is a reasonable level, we will have found the acceptable level of annual COVID deaths.

That, however, doesn’t mean all caution will be thrown to the wind.

We may very well find that just like others across the globe have known for years masks are an effective way based on personal decisions and not government edicts to reduce our chances even to a small degree of being stricken with a cold, flu or now possibly even COVID.

It is irrelevant whether Joe Rogan or Neil Yong agree.

This column is the opinion of editor, Dennis Wyatt, and does not necessarily represent the opinions of The Bulletin or 209 Multimedia. He can be reached at [email protected]

Seeds Curly beans Goldilocks: variety description, photo

Eastern Hellebore Double Epricot Spotid

Code: 25576

Pack quantity: 1 pc.

Availability: Spring

Shipping date: From 17.04

319

Red Grace herbaceous peony

Code: 6177

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

839

Delphinium Cha Cha

Code: 4952

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

569

Hydrangea paniculata Phantom

Code: 5724

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

469

Honeysuckle Dobrynya

Code: 4292

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

329

Standard rose Louise Clements

Code: 32477

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

2999

Oriental Hellebore Double Picoty Pink

Code: 11721

Pack quantity: 1 pc.

Availability: Spring

Shipping time: From 17.04

330

Triumph northern apricot

Code: 3133

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

439

Hydrangea macrophylla Miss Saori

Code: 5062

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

499

Cranberry Stevens

Code: 5681

Pack quantity: 1 pc.

Availability: Summer

Shipping date: May 10

379

Clematis Mazowsze Vulcano

Code: 207

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

359

Hydrangea paniculata Lydia Samara

Code: 7710

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

469

Hosta Limoncello

Code: 7219

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

719

Putinka Cherry

Code: 7075

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

379

Hydrangea paniculata Polar Bear

Code: 7485

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

469

Clematis Kiri te Kanava

Code: 6903

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

359

Standard Rose Super Trooper

Code: 32480

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

2999

Biological product for cesspools and septic tanks

Article: 46078

Quantity per package: 75 gr.

Availability: In stock

Shipping time: 1-3 business days

139

Tree peony Jin Huang

Code: 8618

Pack quantity: 1 pc.

Availability: Spring

Shipping time: March 20 to May 30

1399

Strawberry F1 Russian Size®

Code: 1586/5

Pack quantity: 5 pcs.

Availability: Spring

Shipping Time: 03/20 to 05/30

499

Goldman Sachs Predicts Commodity Goldilocks Stage Coming

Commodities Have the Best Outlook of All Asset Classes in 202 with an Ideal Environment in 203 critically low stocks for almost every type of raw material, according to Goldman Sachs

Photo: PASCAL ROSSIGNOL / Reuters

Investors in commodities have good opportunities to make money in 2023. The reason is the “Goldilocks stage” that is expected in commodity markets this year, Bloomberg reported.

The reason is the “Goldilocks stage” that is expected in commodity markets this year, Bloomberg reported.

Commodities have the best outlook of any asset class in 2023, with an ideal macro environment and critically low inventories in almost every commodity, according to Geoffrey Curry, Head of Commodity Research at Goldman Sachs.

This year began with a pullback in commodity prices, caused by warm weather in some regions and rising interest rates. But demand in China is starting to recover, and investments in the production of raw materials remain too low. This means that for commodities this year as a whole there will be a "Goldilocks stage", which will lead to higher prices, said Jeffrey Curry.

www.adv.rbc.ru

"You can't think of a more bullish environment for commodities," Curry said. “The lack of supply is evident in every market you look at. Inventories are at critical levels and capacity is being depleted.”

The "Goldilocks stage" or "Goldilocks economy" (from the English Goldilocks) is characterized by the state of economic performance, when growth does not accelerate or slow down too much. The economy is growing at a pace sufficient to prevent recession , but not so high that inflation accelerated too much. In this state, unemployment and interest rates remain low, while GDP and asset values rise steadily.

The economy is growing at a pace sufficient to prevent recession , but not so high that inflation accelerated too much. In this state, unemployment and interest rates remain low, while GDP and asset values rise steadily.

A Goldman Sachs expert drew parallels to the record highs in commodity prices that occurred between 2007 and 2008. The only exception, he said, could be the price of natural gas in Europe, which appears to have enough supplies to make it through this year.

"Does anyone remember what happened to oil prices between January 2007 and July 2008?" Curry asked. During the first half of 2008, quotes rose by 50%, and in June 2008 oil prices soared to a record high of $140 per barrel. At that time, oil rose in price against the background of the Fed's rate hike, the dollar's decline and the growth of the Chinese economy.

Oil prices will continue to rise if a strong recovery in demand in China is combined with an end to interest rate hikes in major Western economies, Curry said. The price of a barrel of Brent, according to his forecasts, could reach $110 by the third quarter of this year.

The price of a barrel of Brent, according to his forecasts, could reach $110 by the third quarter of this year.

Goldman Sachs also raised its aluminum price forecast, noting that rising demand in Europe and China could lead to supply shortages. The metal is likely to rise in price by more than 20% and will average $3,125 per ton on the LME this year, analysts said. The metal, used to make everything from beer cans to aircraft parts, will rise to $3,750 a ton in the next 12 months, Goldman Sachs predicts.

A macroeconomic term for a significant decline in economic activity. The main indicator of a recession is the decline in GDP for two quarters in a row. Investment is the investment of money to generate income or to preserve capital. There are financial investments (purchase of securities) and real ones (investments in industry, construction, and so on). In a broad sense, investments are divided into many subspecies: private or public, speculative or venture, and others.