Web client homer

New Feature in HOMER Pro Energy Modeling Software Strengthens Client Presentations

August 11, 2020

Boulder, Colo – August 11, 2020 – HOMER Energy by UL, the global leader in the development of standard-setting energy modeling software, released a new HOMER Pro feature that eases the creation of information-rich proposals. Through its new proposal writer, system designers can quickly and efficiently produce professional reports that illustrate cost savings from distributed renewable energy projects, as well as technical features of the system simulated.

Compiled from the data in a HOMER Pro modeling run, the proposals facilitate communication between multiple stakeholders in a distributed energy project including clients, engineers, construction professionals, financiers, regulators and others.

HOMER Pro software creates graphics in the context of streamlined, well-organized and highly customizable proposals that help demonstrate cost-savings, key proposed hybrid microgrid elements and clear cost comparisons to technical and non-technical audiences. For example, users can graphically view the relative contributions of solar and battery storage in a hybrid system, identify when backup generation might be required and compare different dispatch algorithms or visualize system performance during different seasons. HOMER Pro also includes intuitive graphs that represent capital and operating expenses, allowing a user to view and compare different payback periods and energy cost savings.

The HOMER Pro proposal writer can be customized to produce reports branded with the user logo and profile and allows users the ability to include their choice of graphs and charts output from HOMER Pro software.

“With HOMER Pro’s new proposal writer feature, it is much easier for our customers to demonstrate the value of a distributed renewable energy system to their customers,” said Peter Lilienthal, founder of HOMER Energy, who leads microgrid software and advisory services for UL. “HOMER Pro compares all potential system combinations in a single run, generating a tremendous amount of information about an energy project. The proposal writer consolidates that information and puts it into an attractive, readable format that highlights key points, such as lifetime cash flows and key technical details of the system. Essentially, it helps make the results of an energy simulation understandable to everyone.”

The proposal writer consolidates that information and puts it into an attractive, readable format that highlights key points, such as lifetime cash flows and key technical details of the system. Essentially, it helps make the results of an energy simulation understandable to everyone.”

HOMER Pro has set the standard for modeling energy systems in the global marketplace for over a decade. The software models complex hybrid energy systems and microgrids that can include solar, wind, batteries, generators, combined heat and power, hydro, biomass and other resources. By simulating operations for potentially hundreds of systems over a period of a year, this software identifies least-cost options. Using this tool, project developers can help reduce financial risk through the discovery of important technical issues revealed during the software’s thorough pre-feasibility analysis and identification of the most economically optimal systems.

HOMER Pro software is integrated with Helioscope and PVsyst, allowing users to import files from those photovoltaic design programs directly into other applications of HOMER Energy by UL for further analysis. The software is also integrated with Utility API when working with a participating utility which allows users to import high resolution load data into HOMER Pro and design more accurate distributed energy systems to meet those loads.

The software is also integrated with Utility API when working with a participating utility which allows users to import high resolution load data into HOMER Pro and design more accurate distributed energy systems to meet those loads.

For more information about the HOMER Pro proposal writer feature, please visit homerenergy.com.

About UL

UL helps create a better world by applying science to solve safety, security, and sustainability challenges. We empower trust by enabling the safe adoption of innovative new products and technologies. Everyone at UL shares a passion to make the world a safer place. All of our work, from independent research and standards development, to testing and certification, to providing analytical and digital solutions, helps improve global well-being. Businesses, industries, governments, regulatory authorities and the public put their trust in us so they can make smarter decisions. To learn more, visit

UL.com. To learn more about our nonprofit activities, visit UL. org.

org.

Press Contacts:

Tricia Fitzpatrick

HOMER Energy by UL

[email protected]

1+(720) 565-4046

Steven Brewster

Corporate Communications

UL

1+(847) 664-8425

[email protected]

Share:Dr. Homer T. Caston - Ballard-Sunder Funeral & Cremation

Dr. Homer T Caston was born on January 1, 1925, in Los Angeles, California, to Samuel and Ruth Darlene Cox-Caston. He died peacefully at home with family at his side, in Prior Lake, Minnesota, on October 22, 2022, at the age of 97.

Homer was the seventh born of eleven children. He grew up on a farm in the east San Fernando Valley of Southern California. His father was a sweet potato farmer, and along with his siblings, Homer learned how to farm at a young age, which included picking crops at surrounding ranches. He attended school in the San Fernando Valley and graduated from San Fernando High School.

Homer enlisted in the United States Army Air Corp. at the age of eighteen and served as an officer and pilot during World War Two. After completing his training in the states, he flew B-25 and A-26 bombers, doing search and rescue missions in Fukuoka, Okinawa, and Japan. After the war he joined the Reserves and retired in 1956 with the rank of First Lieutenant, United States Army Reserve.

After returning from Japan, Homer attended the School of Veterinary Medicine at the University of California, Davis, with the help of the G.I. Bill. It was there he met his first wife, Diane Tiedemann, who was also a student at U.C. Davis studying to be a teacher. Homer and Diane married in 1952, and they lived in campus housing until they had both graduated.

After graduation, Homer and Diane moved to Napa, Idaho, where he worked mostly with large animals. From there they moved back to California to El Centro, where he opened his first small animal clinic. He was instrumental in minimizing a rabies epidemic in the area, working tirelessly at containing and treating the affected animals. After leaving El Centro, California, in 1963, he and Diane moved to the Conejo Valley, where he eventually opened Anza Animal Clinic, located in Thousand Oaks, California and practiced until his retirement in the late 1980’s. They moved to Thousand Oaks Ranch where Diane purchased property in Lynn Ranch where they built their home and raised their daughters Amy and Carolyn.

After leaving El Centro, California, in 1963, he and Diane moved to the Conejo Valley, where he eventually opened Anza Animal Clinic, located in Thousand Oaks, California and practiced until his retirement in the late 1980’s. They moved to Thousand Oaks Ranch where Diane purchased property in Lynn Ranch where they built their home and raised their daughters Amy and Carolyn.

Coming from a farming family, Homer made certain there was always a garden for his young family, to produce fruits and vegetables year-round. He also continued his love for farming by purchasing 95 acres in the Santa Rosa Valley of Camarillo, California, and called it the Star Christmas Tree Farm. He grew and sold Christmas trees as well as pumpkins on this family run farm and donated a percentage of the sales to the Conejo Valley YMCA.

He and Diane spent a considerable amount of time in Yosemite National Park, before they were married and continued their visits after their girls came along. He was also involved with Thousand Oaks Toastmasters, was a leader in Timber 4-H, taught Veterinary Science, was a member of the Ventura County Sheriff’s Posse, and a member of the International Coalition for Advocacy on Nutrition (the organization focuses on saving and improving lives through better nutrition).

In 1999 Homer’s wife, Diane, passed away from a lengthy illness.

Over the years, Homer had several outside interests which included flying glider airplanes, golfing, horseback riding, and hiking with daughters Amy and Carolyn, and mountain climbing with his good friend Russell Huse. Together he and Huse, climbed Mt. San Gorgonio, Mt. San Jacinto, and Mt. Whitney. Homer personally climbed Mt. Whitney five times. He also went on several white-water rafting trips with his dear friend Dr. Charlie Nelson, who was a fellow veterinarian and classmate from the University of California at Davis.

Homer married Helen Winick on March 11, 2000, on his beautiful farm in Camarillo, California. Helen had been a veterinary client of his many years earlier. They reconnected while on a medical mission trip to Morazán Honduras. In 2006, Helen took him to her home state of Minnesota. He fell in love with the place and the people, and they eventually became snowbirds dividing time between Minnesota and California. The two of them spent time traveling to Europe and around the United States and immensely enjoyed their golden years together. They were extremely active, and everyone was surprised when they found out their ages!

The two of them spent time traveling to Europe and around the United States and immensely enjoyed their golden years together. They were extremely active, and everyone was surprised when they found out their ages!

Homer was always adventurous. At the age of 82, he and his brother John, (age 84), built an ultra-light airplane which they flew together for several years. One of Homer’s big dreams was to experience a winter in Minnesota, which finally happened in 2021-22, and he absolutely loved it. A couple of highlights were enjoying his Rotary club members, caroling at the house, and for his 97th birthday he crossed his fingers and hoped the temperature would not go above zero. That night the low temperature was 13 degrees below zero and the high during the day did not go above zero.

Homer was a member of Rotary International for over 65 years. He was initially a member of the Westlake Village Rotary Club, having served as president and being very involved over the years with Conejo Valley Days (an annual celebration of Conejo Valley’s rich heritage and volunteer spirit). However, once he began attending meetings with the Prior Lake Rotary Club, they joyfully welcomed him as an honorary member.

However, once he began attending meetings with the Prior Lake Rotary Club, they joyfully welcomed him as an honorary member.

Through Rotary, he was able to contribute financially to help with the eradication of polio. This was a cause near and dear to his heart, going back as far as 1935, when his sister introduced him to her friend Cecil, who had been a polio victim for 35 years. Over the years the memory of Cecil had touched Homer’s heart and was his inspiration. Homer not only donated money to end Polio, but he also spent time vaccinating people in Central and South America on medical mission trips that he went on over the years with Helen.

Another of Homer’s greater accomplishments was a paper he wrote in the 1970’s on feline cystitis, which was not only published in Veterinary medical journals, but also continues to be referenced worldwide in Veterinary schools to this day.

Homer is preceded in death by his parents, his brothers, Sam, Arthur, and Clinton; his sisters, Dorothy, Ernestine, Roberta, Thursel, and Darlene; and his first wife Diane Caston.

He is survived by his brother, John Caston, and sister Julie Ann Keith; his wife Helen, his loving daughters; Amy Robertson, and Carolyn Wright. Grandchildren; Ryder Robertson, Carlie, and Delanie Wright. Stepchildren; Mark (Myrna) Winick, Patricia Winick, Mike (Carol) Winick, Karyn (Gary) Perkins, and Kathy Kerner. Step-grandchildren; Karis (Seth Colegrove) Craig, Siri (Michael) Wilhelm, Justin (Shannon Halbach) Winick, Matthew (Devaki) Winick, Brianna (Bien) Paulino. Step-great-grandchildren: Kiersten and Anna Winick, Theo and Rowen Wilhelm, Kaiya and Suri Winick, Kinsey Gopher, Evelyn, Trey, and Vivian Paulino.

Homer was a loving, generous, witty, and hardworking man, husband, father, and friend. He made many friends along the way during his life’s journey, and never said a bad thing about anyone. He will be greatly missed by all who were blessed to know him.

Memorial Services:

Shepherd of the Lake Lutheran Church, Prior Lake, MN, November 10, 2022, at 2:00 PM

Ascension Lutheran Church, Thousand Oaks, CA, will be determined later.

Offer Condolence for the family of Dr. Homer T. Caston

Print Obituary & Condolences

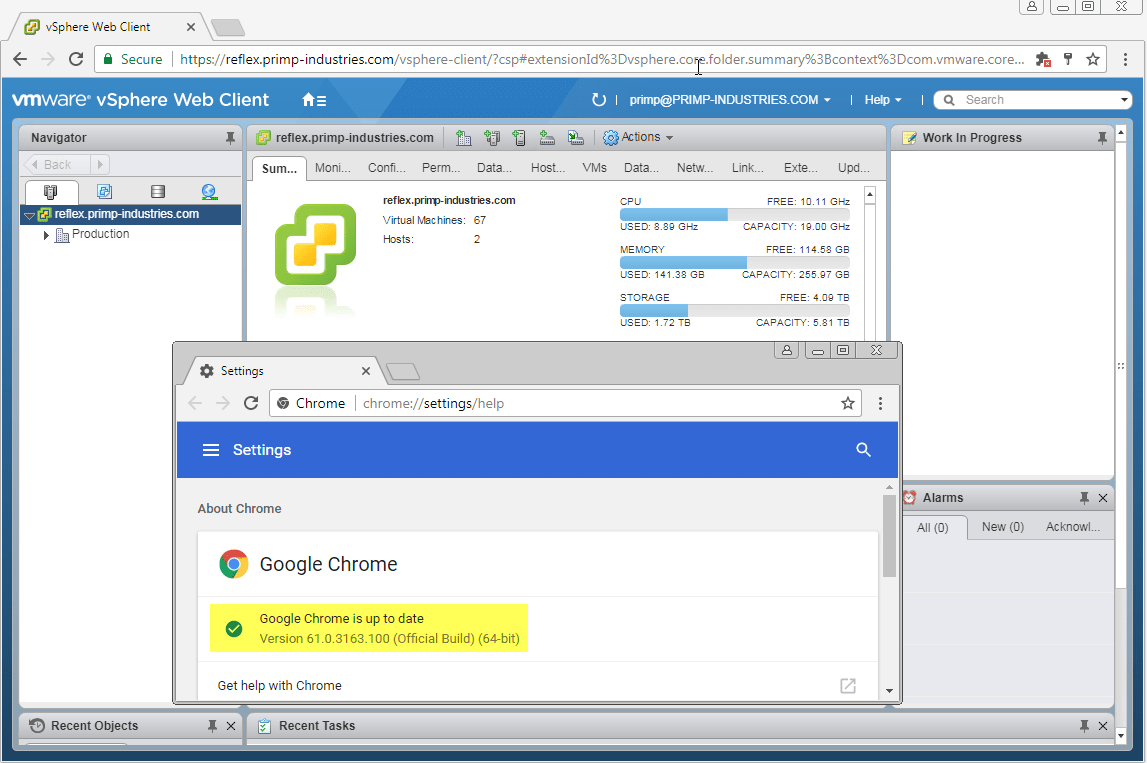

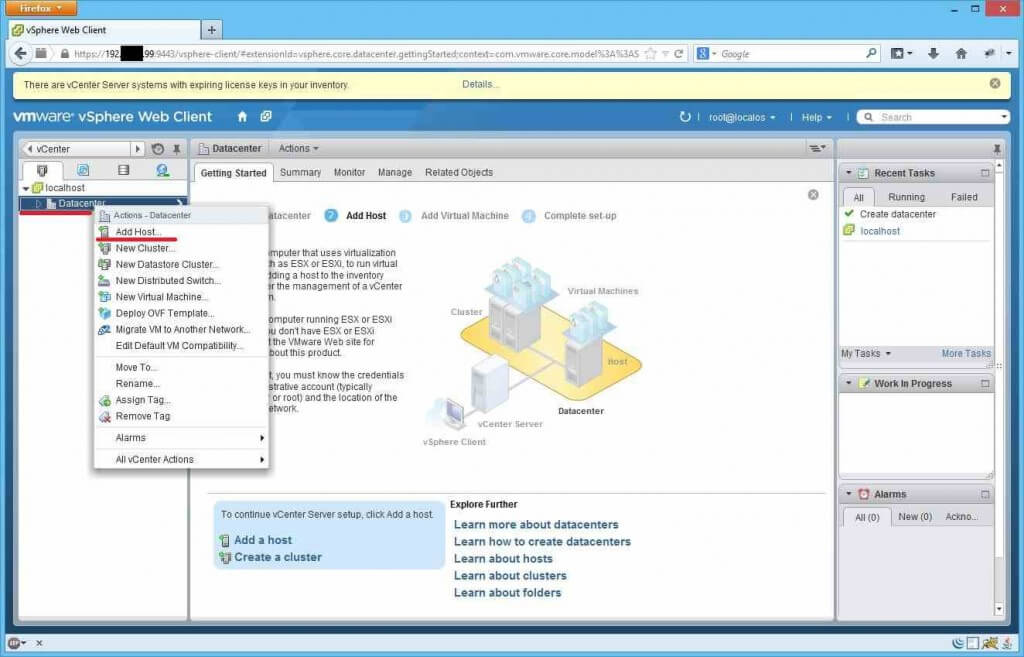

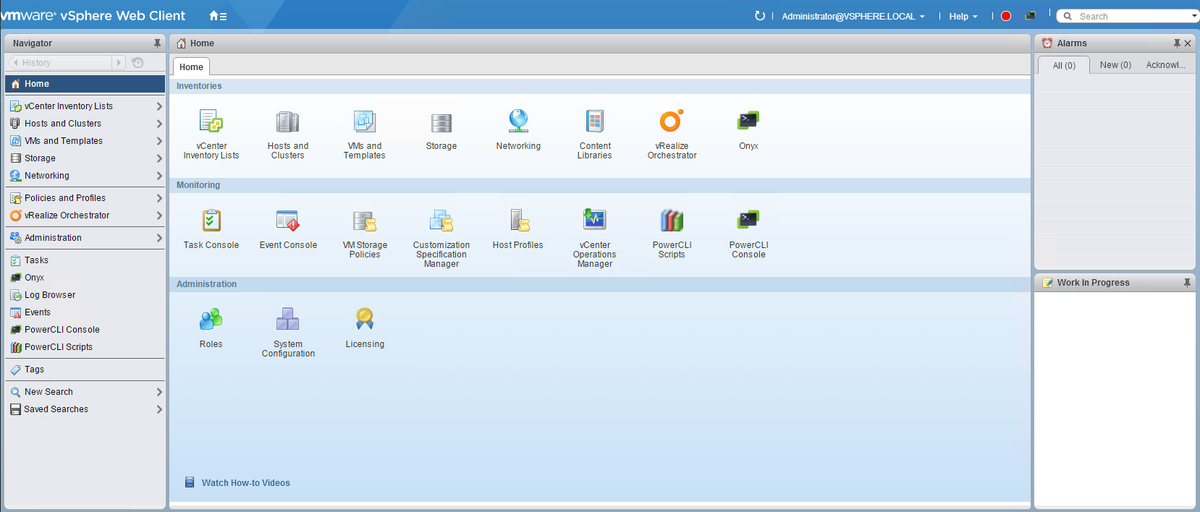

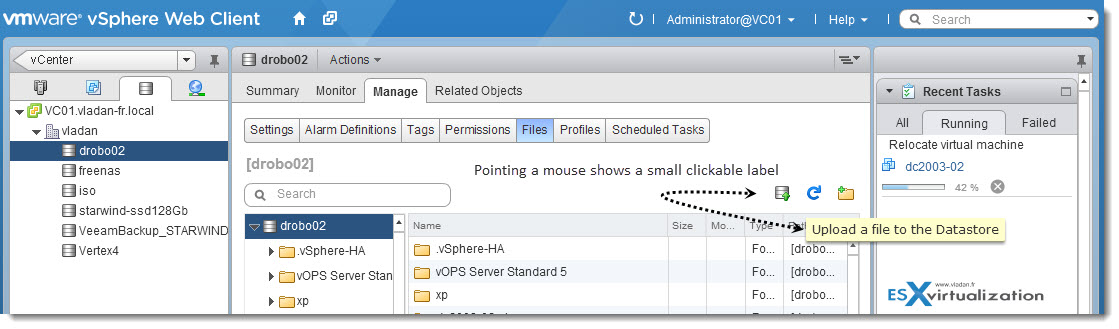

program for employees and clients, web client home credit, portal capabilities (functionality and main advantages), types and modes of service, authorization

Among banking organizations that specialize in lending and other services to individuals, Home Credit Bank occupies a prominent place. Prominent, because the institution enjoys considerable popularity among ordinary users. Like every self-respecting bank, Home Credit maintains and constantly develops its web banking service. It's called Homer Home Credit. We will talk about it in our article.

Content

- 1 Opportunities of the portal Homer

- 1.1 Functionality

- 1.2 Main pluses

- 2 types and modes of service

- 2.1 types

- 2.2 Modes

- 3 Registration

- 9 5 Conclusion

Features of the Homer portal

What functionality does Homer's online banking have? What are its main advantages? Let's answer these questions.

Functionality

The most important circumstance of a web service is the remoteness of its maintenance and use. The client has the opportunity to carry out any transactions without leaving his home.

Modern examples of online banking from various organizations, be it Sberbank, Tinkoff or some other Russian bank, have identical tools. The differences are usually minimal and come down mainly to the amount of commission fees. Homer does not lag behind his peers either in terms of the arsenal of options or in terms of fees.

Within Homer, the client can:

- open deposits and deposits;

- make transfers from one of your accounts to another, as well as to third parties;

- receive information about all products provided by Home Credit Bank;

- pay for housing and communal services, mobile communication services, Internet and TV;

- cover existing loans;

- make requests and receive information on the balance of the account and the latest transactions.

In addition, you can apply for a loan online using a special form directly on the site. Although, if the application is approved, you still have to come to the bank office to receive a loan. But you will save time.

Important! The card blocking function is available in the personal account.

If your payment instrument is lost or stolen, you can and should block it remotely.

Key benefits

The main advantages of the Homer portal are:

- A wide range of functions and options.

- An interface that can be quickly understood. Moreover, even if you are not a very experienced user of online banking, this circumstance is almost completely leveled by an intuitive menu.

- Complete account management remotely. Web services of not all banks give customers the opportunity to carry out any operations with accounts: sometimes some actions are not available. Homer does not limit the user in this regard.

A complete list of features can be viewed in the personal account of the portal.

Types and modes of service

To consider the issues of how registration and authorization in the service takes place, you need to briefly understand the types of Home Credit online applications and Homer operating modes.

Views

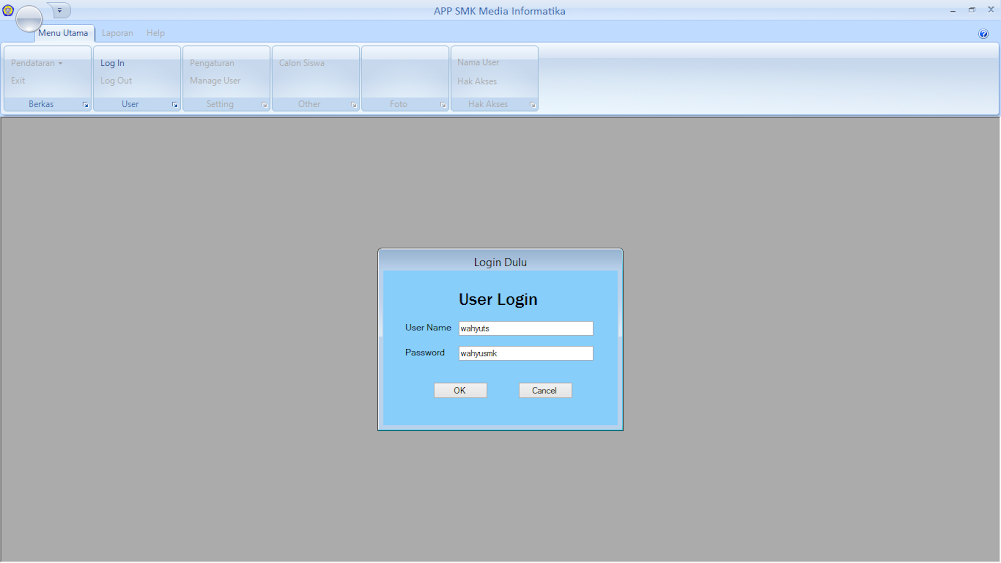

An important point: web client Homer for bank employees is a separate application, it is not available to customers. Do not confuse the Sales program with the user version of online banking: it has a different functionality.

Of course, an ordinary user will not be able to register in the service for banking specialists, but you need to understand the difference between Sales and client web banking.

Modes

You can work with Homer in two modes: “Turbo” and “Standard”.

The range of features, the functions are the same. But, as is clear from the names, the tangible difference lies in the speed of data exchange with Home Credit servers.

“Standard” is a universal mode available for all devices.

"Turbo" is associated with much faster data exchange. But just because of this, it can lead to Homer freezing and errors if it is run on a relatively weak computer. The system configuration may simply not be enough for turbo mode.

Registration

There are several conditions that are extremely important to comply with in order to register in Homer:

- you must be a Home Credit bank customer;

- must be a credit card or debit card holder of this organization.

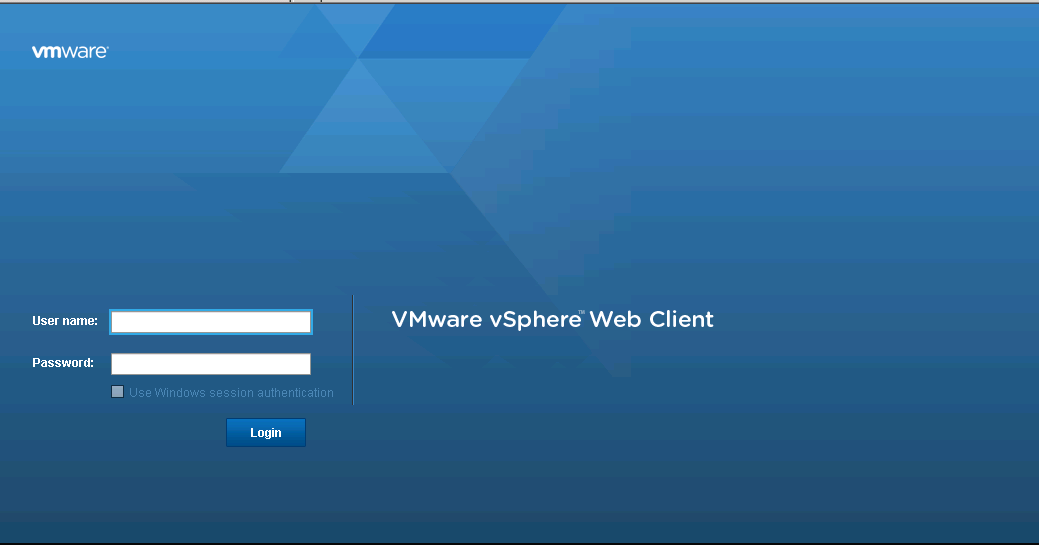

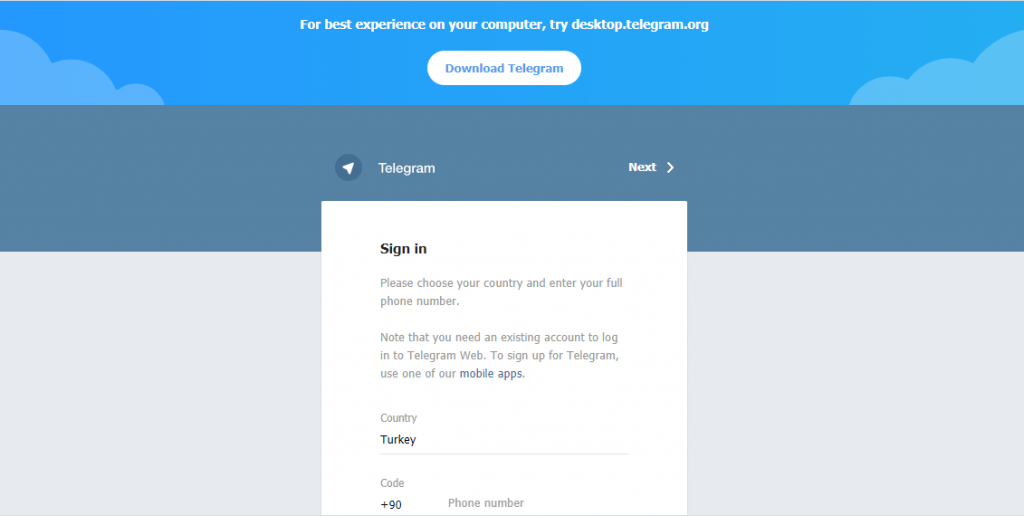

There is a special page for entering the portal, which has fields for entering a username and password.

- Homer Home Credit Registration Page

To obtain authorization data, you can call 8 800 700 80 06. This is hotline of Home Credit Bank. The operator will need to inform:

- last name, first name, patronymic;

- number or your plastic, or contract;

- is a verification (control) word, which is invented at the stage of card design.

The control word is in the contract.

Important! The registration process in the “Turbo” mode is similar in terms of the contents of the registration in the “Standard” mode.

After receiving the data requested from the client, the specialist creates a user account. Authorization data will be sent to your phone via SMS.

The login-password pair is classified as confidential information. There are cannot even be shared with Home Credit employees, let alone other third parties.

Bank employees do not have the right to request authorization information from the client.

Authorization

If the registration was successful, you should open the Homer portal and enter the login-password pair in the fields provided for them.

On a new page, subject to correct entry of authorization data , a personal account will open. There, the user will be able to apply any tools he needs to manage his finances.

Conclusion

Homer Online Banking from Home Credit Bank is a typical representative of this kind of service. The whole set of options is not much different from the corresponding tools of other, larger banks. Homer allows his clients to manage their finances remotely. With its help, the user can quickly carry out transactions and transfer funds, and pay for a variety of services and goods.

Homer home credit registration in the system

If you have any questions, you can chat with a lawyer for free at the bottom of the screen or call 8 800 350-81-94 (free consultation), we work around the clock.

Among banking organizations that specialize in lending and other services to individuals, Home Credit Bank occupies a prominent place. Prominent, because the institution enjoys considerable popularity among ordinary users. Like every self-respecting bank, Home Credit maintains and constantly develops its web banking service. It's called Homer Home Credit. We will talk about it in our article.

It's called Homer Home Credit. We will talk about it in our article.

Portal features Homer

What functionality does Homer's online banking have? What are its main advantages? Let's answer these questions.

Functionality

The most important circumstance of a web service is the remoteness of its maintenance and use. The client has the opportunity to carry out any transactions without leaving his home. Modern examples of online banking from various organizations, whether it be Sberbank, Tinkoff or some other Russian bank, have identical tools. The differences are usually minimal and come down mainly to the amount of commission fees. Homer does not lag behind his peers either in terms of the arsenal of options or in terms of fees.

As part of Homer, the client can:

- open deposits and deposits;

- make transfers from one of your accounts to another, as well as to third parties;

- receive information about all products provided by Home Credit Bank;

- pay for housing and communal services, mobile communication services, Internet and TV;

- cover existing loans;

- make requests and receive information on the balance of the account and the latest transactions.

In addition, you can use a special form directly on the website to fill out an online application for a loan. Although, if the application is approved, you still have to come to the bank office to receive a loan. But you will save time. If your payment instrument is lost or stolen, you can and should block it remotely.

Key benefits

The main advantages of the Homer portal are:

- Wide range of features and options.

- An interface that can be quickly understood. Moreover, even if you are not a very experienced user of online banking, this circumstance is almost completely leveled by an intuitive menu.

- Complete account management remotely. Web services of not all banks give customers the opportunity to carry out any operations with accounts: sometimes some actions are not available. Homer does not limit the user in this regard.

A full list of features can be viewed in the personal account of the portal.

Types and modes of service

To consider the issues of how registration and authorization in the service goes, you need to briefly understand the types of Home Credit online applications and Homer operating modes.

If you have any questions, you can chat with a lawyer for free at the bottom of the screen or call 8 800 350-81-94 (free consultation), we work around the clock.

An important point: web client Homer for bank employees is a separate application, it is not available to customers. Do not confuse the Sales program with the user version of online banking: it has a different functionality. Of course, an ordinary user will not be able to register in the service for banking specialists, but you need to understand the difference between Sales and client web banking.

Modes

You can work with Homer in two modes: “Turbo” and “Standard”. The set of features, functions do not differ in any way. But, as is clear from the names, the tangible difference lies in the speed of data exchange with Home Credit servers. “Standard” is a universal mode available for all devices. "Turbo" is associated with much faster data exchange. But just because of this, it can lead to Homer freezing and errors if it is run on a relatively weak computer. The system configuration may simply not be enough for turbo mode.

The set of features, functions do not differ in any way. But, as is clear from the names, the tangible difference lies in the speed of data exchange with Home Credit servers. “Standard” is a universal mode available for all devices. "Turbo" is associated with much faster data exchange. But just because of this, it can lead to Homer freezing and errors if it is run on a relatively weak computer. The system configuration may simply not be enough for turbo mode.

Registration

There are several conditions that are extremely important to comply with in order to register in Homer:

- must be a Home Credit bank customer;

- must be a credit card or debit card holder of this organization.

A special page is provided for entering the portal, which has fields for entering a username and password. To get authorization data, you can call 8 800 700 80 06. This is hotline Home Credit Bank. The operator will need to inform:

The operator will need to inform:

- last name, first name, patronymic;

- number or your plastic, or contract;

- is a verification (control) word, which is invented at the stage of card design.

The control word is in the contract.

If you have any questions, you can chat with a lawyer for free at the bottom of the screen or call 8 800 350-81-94 (free consultation), we work around the clock.

After receiving the data requested from the client, the specialist creates a user account. Authorization data will be sent to your phone via SMS. The login-password pair is classified as confidential information. Their cannot even be shared with Home Credit employees, let alone other third parties. Bank employees do not have the right to request authorization information from the client.

Authorization

If the registration was successful, you should open the Homer portal and enter a login-password pair in the fields provided for them.

On the new page, subject to correct entry of authorization data , a personal account will open. There, the user will be able to apply any tools he needs to manage his finances.

Conclusion

Homer online banking from Home Credit Bank is a typical representative of this kind of service. The whole set of options is not much different from the corresponding tools of other, larger banks. Homer allows his clients to manage their finances remotely. With its help, the user can quickly carry out transactions and transfer funds, and pay for a variety of services and goods. Home Credit Bank has long held a leading position in the field of consumer lending among commercial banks. This result was achieved due to the following factors:

- the analytical section constantly monitors the competing offers of banks and the needs of customers, which is accompanied by the release of innovative tariff plans;

- software solutions are able to provide the client with additional functionality, which can be used without leaving home.

The company was one of the first on the market to launch a personal account, which can be used by clients of various services.

The company was one of the first on the market to launch a personal account, which can be used by clients of various services.

The proposed Home Credit registration in the virtual payment system is available completely free of charge, according to the terms of the official service agreement. In this article, we will consider the features of the registration and authorization process, pay attention to the basic functionality and user feedback on the system.

"Homer": registration in the system

The modern technical offer "Homer" entered the market of banking services as a possibility of remote management of new and existing loan offers. The site is under reconstruction, and since the release there have been many updates that have contributed to the launch of many unique features. This state of affairs indicates the relevance of the system today, making it necessary to study the issue of passing the registration and authorization process in the system. The developers took into account the technical features of the devices from which clients log in. So, users of personal computers and smartphones with a modern browser will be able to access the site. 2 versions of the project are available for work - "Full" and "Simplified". The difference lies only in the design and technology used, the functionality is identical in both cases.

The developers took into account the technical features of the devices from which clients log in. So, users of personal computers and smartphones with a modern browser will be able to access the site. 2 versions of the project are available for work - "Full" and "Simplified". The difference lies only in the design and technology used, the functionality is identical in both cases.

If you have any questions, you can chat with a lawyer for free at the bottom of the screen or call 8 800 350-81-94 (free consultation), we work around the clock.

Using "Homer" Home Credit, registration can be made by any client absolutely free of charge, which is included in the terms of the basic service packages of tariff offers. The ongoing technical work is aimed at creating a single solution for all devices, and you can find out about the latest updates by subscribing to the bank's official email newsletter. In this way, you will be able to learn not only about technical changes, but also about current promotional offers, which can lead to significant financial savings.

Registration in the Web client of Home Credit Bank

As we have already indicated above, registration in the system is available for any client of the organization absolutely free of charge. To do this, you need to follow the appropriate link and specify the desired login and password to enter. For additional confirmation, the mobile phone number that you indicated when concluding the official contract will be used. If you do not have access to this phone, or have third-party issues, you can solve them in the following ways:

- by contacting the nearest service office in your region, where a qualified specialist will inform you about the features of working with the system and the subtleties of registering;

- by leaving a request in the billing system on the official website of the banking organization. Be sure to leave a valid mobile phone number for feedback, which will allow a specialist to contact you at any time;

- by calling the toll-free 24/7 support service number, stating "homer homecredit ru" as the reason for contacting.

The specialist will promptly analyze your request and try to give a detailed answer on troubleshooting.

The specialist will promptly analyze your request and try to give a detailed answer on troubleshooting.

Returning to the registration process, the Homer system requires the following parameters to be observed when entering data:

- combinations must be unique and have no analogues among active users;

- the use of Latin letters and numbers is allowed;

- as a password, a combination of letters and numbers of different case must be set, which will complicate the hacking process for intruders. Keeping your account secure is a promising direction for developers.

Homer login

If the registration offered by Homer Home Credit in the system was successful, you can proceed to the authorization process. To do this, enter the previously specified data, after which an SMS message with a short one-time code will be sent to the mobile phone number. Enter the received combination in the appropriate field and sign in. If everything is done correctly, you will be redirected to the main page of the project site, where you can start learning and actively using the functionality. If you have forgotten your login information, you can restore them in the classic way. To do this, enter your username and e-mail, where further instructions will be sent. Among the available functionality, the following proposals can be separately noted:

If everything is done correctly, you will be redirected to the main page of the project site, where you can start learning and actively using the functionality. If you have forgotten your login information, you can restore them in the classic way. To do this, enter your username and e-mail, where further instructions will be sent. Among the available functionality, the following proposals can be separately noted:

- view current debt, interest rate and other additional information about current loan offers;

- the ability to issue a detailed statement with information about the latest transactions;

- prompt execution of an application for a new loan;

- receiving information about new tariff plans with the possibility of feedback from the operator;

- interest-free transfer of funds between a personal account and access to full-fledged Internet banking.

The convenient Internet system Homer Home Credit has recently become very popular in Russia. This is a service that allows you to make virtual payments. Its advantage is that the services are provided free of charge. Homer is constantly being improved, becoming more convenient and accessible to the mass consumer.

This is a service that allows you to make virtual payments. Its advantage is that the services are provided free of charge. Homer is constantly being improved, becoming more convenient and accessible to the mass consumer.

What is the system Homer from Home Credit?

The system was developed specifically for Home Credit Bank. The financial company, taking care of its customers, decided to introduce convenient service for making virtual payments. It allows you to provide international work, because it brings all banks into one network. You can find out how to start using the system from employees of any bank branch or by calling +7 495 785-82-22. Home Credit specialists will answer any questions related to the operation of the Homer web client.

Homer portal features

Service Homer is a standard platform that allows the client to remotely manage with your accounts. This enables a person to save his precious time. Now he can perform most of the operations:

This enables a person to save his precious time. Now he can perform most of the operations:

- Without visiting bank branches.

- At any time of the day or night.

- Without the need to seek expert advice.

Homer helps perform any operations with its accounts as simply and quickly as possible. It is not difficult for users of the Homer system to remotely in a matter of minutes:

- Open new deposits.

- Transfer money to other accounts.

- Perform registration of additional services.

- Pay for utilities, communications, internet.

- Make obligatory payments on loans.

If you have any questions, you can chat with a lawyer for free at the bottom of the screen or call 8 800 350-81-94 (free consultation), we work around the clock.

To apply for a loan from Home Credit, you do not need to visit a bank branch. All applications are processed remotely. This requires just fill out a special form on the website. You will have to visit the office of the company only in order to collect the amount you need. A very important function of the Homer service from Home Credit Bank is card blocking. This feature allows the client to quickly establish a lock on their own. To do this, you just need to click on a special button in your personal account. This handy feature is used when the card is lost or stolen.

All applications are processed remotely. This requires just fill out a special form on the website. You will have to visit the office of the company only in order to collect the amount you need. A very important function of the Homer service from Home Credit Bank is card blocking. This feature allows the client to quickly establish a lock on their own. To do this, you just need to click on a special button in your personal account. This handy feature is used when the card is lost or stolen.

Operating modes in the system

To date, Web client from Home Credit is two kinds . The first is for customers, and the second is for employees of the company. It is impossible for a simple client to access the service intended for bank specialists. You can work with the program in two modes - "Standard" and "Turbo". The first is universal. Its is recommended to use , because it does not throw errors. You can use the Homer system in this mode on any device. The "Turbo" mode allows you to perform operations several times faster . However, because of this, errors sometimes occur in the Homer system. Therefore, you need to use it only on a powerful computer.

You can use the Homer system in this mode on any device. The "Turbo" mode allows you to perform operations several times faster . However, because of this, errors sometimes occur in the Homer system. Therefore, you need to use it only on a powerful computer.

Registration in the Homer Home Credit Bank system

In order to start using the convenient service, you need to register in it. This can be done either by an existing client of Home Credit Bank, or by a person who has debit or credit cards of this company. Registration in the Home Credit system is carried out at homer.homecredit.ru. On the page you must enter a password and login.

This is how the registration page on the portal looks like To find out the login data, the client needs to contact the bank's specialists . You can get them by calling the hotline at +7 495 785-82-22. The employee will prompt this information after the person dictates to him:

- Your last name, first name and patronymic.

- Contract or card number.

- Check word.

Often people forget their test word. You can learn it from the prisoner with the company agreement to provide a card or loan. The registration process in Turbo mode is no different.

If you have any questions, you can chat with a lawyer for free at the bottom of the screen or call 8 800 350-81-94 (free consultation), we work around the clock.

Based on all the information received from the client, the specialist creates a personal account for him on the portal https://homer.homecredit.ru/paru/index.do. He sends the data necessary to enter it to the person in SMS.

Homer web client login

If the registration process is completed successfully, then the client will be authorized on the portal without much difficulty. To do this, you need to open the Homer system, enter your login and secret password in the appropriate fields . Almost instantly, a personal account of the Home Credit web client will open. A person can also perform various operations immediately. The user can control his accounts, make bank transfers, manage his finances.

Almost instantly, a personal account of the Home Credit web client will open. A person can also perform various operations immediately. The user can control his accounts, make bank transfers, manage his finances.

Advantages of the Homer system from Home Credit Bank

The convenient Homer program from Home Credit Bank is becoming incredibly popular among the population of our country. In fact, it allows you to minimize the need for the client to visit branches. The user is able to perform almost all tasks independently through Homer. The advantages of the service include:

- Lots of convenient features and options.

- Easy and understandable interface for everyone.

- Ability to fully manage accounts.

Homer has no restrictions . Through it, the client can carry out any banking operations when it is convenient for him.

Conclusion

The Home Credit Homer Bank program is a convenient modern web service that helps to significantly simplify the client's work with a financial institution.