When did s&p 500 start

What Is the History of the S&P 500 Stock Index?

The S&P 500, which is short for Standard & Poor's 500, was introduced in 1957 as a stock market index to track the value of 500 corporations that have their stocks listed on the New York Stock Exchange (NYSE) and the Nasdaq. Standard & Poor's provides financial data, credit ratings for investments, and various equity indexes. A market index is a collection of investments, such as stocks, that are grouped to track the performance of a particular segment of the financial market.

The collection of stocks that make up the S&P 500 is designed to represent most of the composition of the U.S. economy. As a result, the value of the S&P and various stocks within the index is closely watched by market participants since their performance represents a gauge of the health of the U.S. economy.

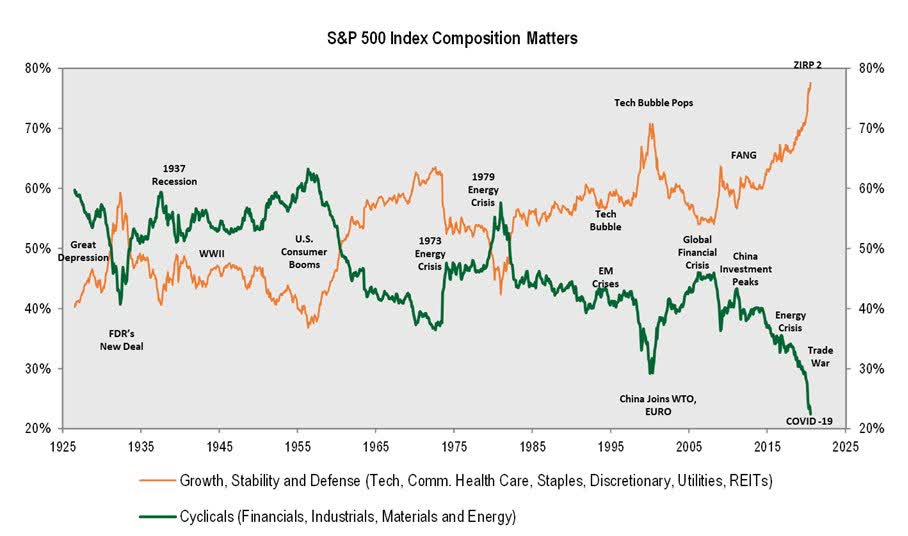

The exact combination and weightings of the various constituencies within the S&P 500 are adjusted as the economy changes, and some stocks have been added and removed from the index over the years.

Key Takeaways

- The S&P 500 was introduced in 1957 as a stock market index to track the value of 500 large corporations listed on the New York Stock Exchange.

- From 1969 to 1981, the index gradually declined while the U.S. economy endured stagnant growth and high inflation.

- During the 2008 financial crisis and the Great Recession, the S&P 500 fell 46.13% from October 2007 to March 2009 but recovered all of its losses by March 2013.

- In 2020, the coronavirus pandemic sent the world into a recession and equity markets reeling as the S&P 500 plummeted nearly 20%.

- The S&P bounced back in the second half of 2020 and reached several all-time highs in 2021.

Investopedia / Sabrina Jiang

Requirements for Inclusion in the S&P 500

The components of the S&P 500 are selected by a committee and are determined to be representative of the industries that make up the U.S. economy. To be added to the S&P, a company must meet certain liquidity-based size requirements—including a market capitalization of $14. 6 billion or greater.

6 billion or greater.

To calculate the value of the S&P 500 Index, the sum of the adjusted market capitalization of all 500 stocks is divided by a factor, usually referred to as an index divisor. For example, if the total adjusted market cap of the 500 component stocks is $13 trillion and the divisor is set at 8.933 billion, then the S&P 500 Index value would be 1,455.28.

The adjusted market capitalization of the entire index can be accessed from the S&P website. The exact number of the divisor is considered to be proprietary to the firm, although its value is approximately nine billion.

S&P as a Bellwether for the U.S. Economy

The S&P is widely thought of as a bellwether representation of the U.S. stock market. The term bellwether stock refers to a stock that's considered a leading indicator of the direction of the economy.

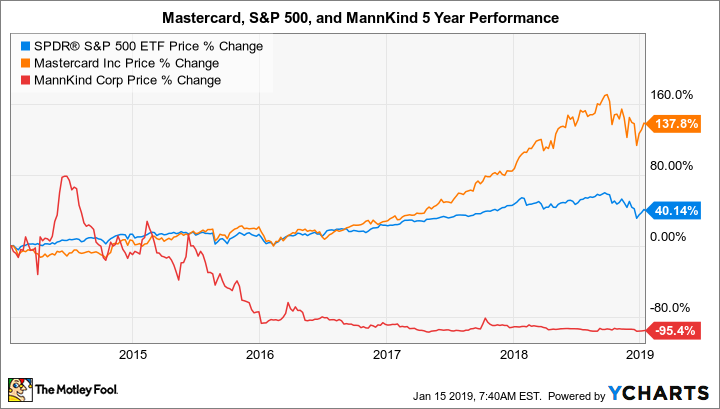

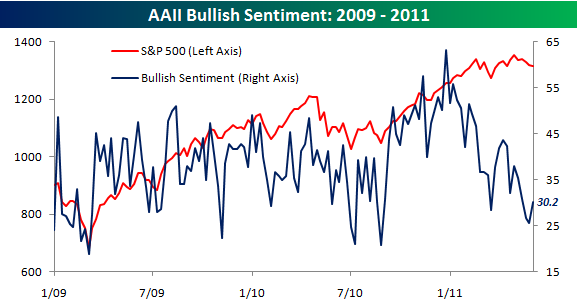

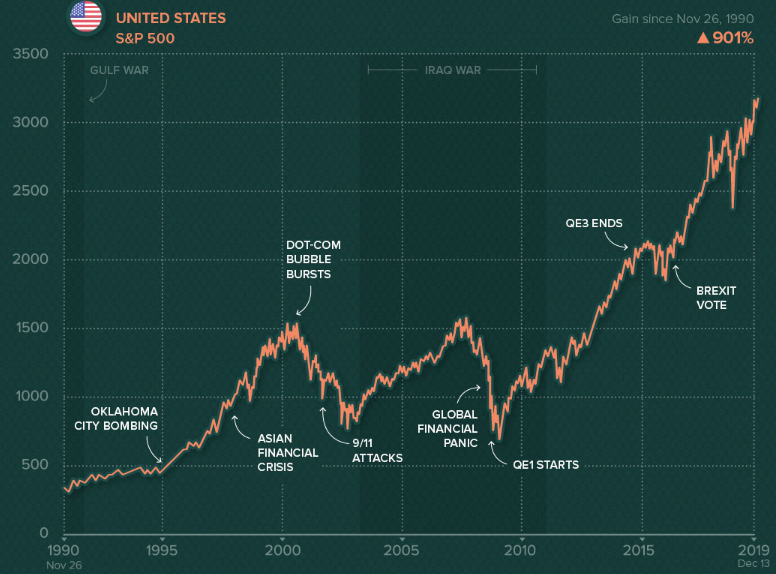

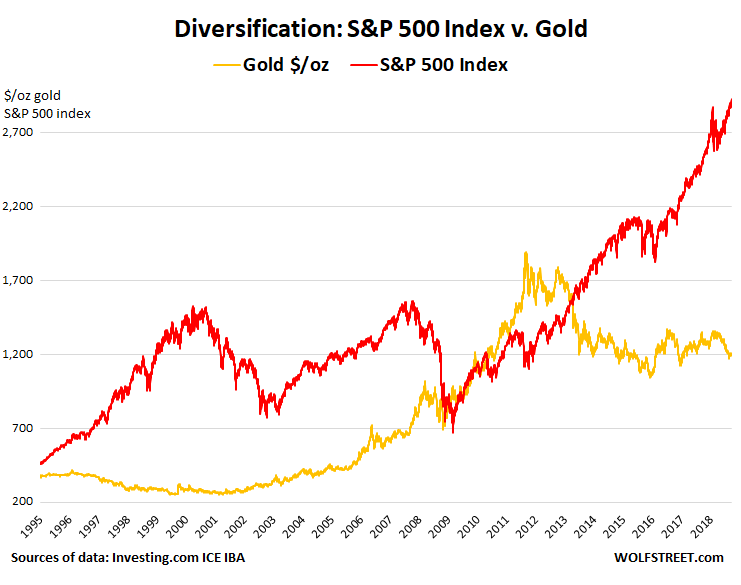

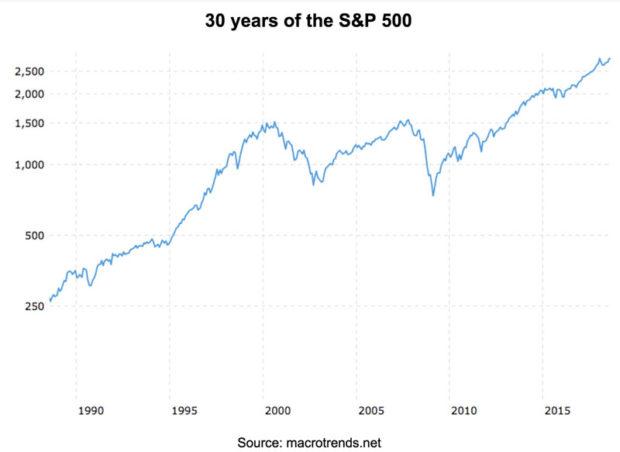

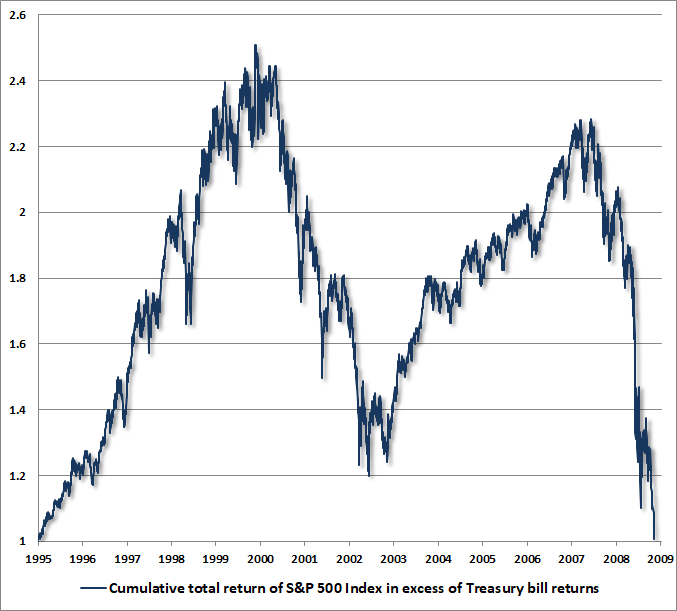

The S&P is also a key vehicle for investors who want exposure to the broad U.S. market index funds. The price appreciation of the S&P 500 tends to track the growth of the U.S. economy. Price swings in the S&P 500 also tend to accurately reflect the turbulent periods in the U.S. economy. As a result, the long-term chart of the S&P 500's price history doubles as a reading of investor sentiment about the U.S. economy.

The price appreciation of the S&P 500 tends to track the growth of the U.S. economy. Price swings in the S&P 500 also tend to accurately reflect the turbulent periods in the U.S. economy. As a result, the long-term chart of the S&P 500's price history doubles as a reading of investor sentiment about the U.S. economy.

Price Movements in the S&P

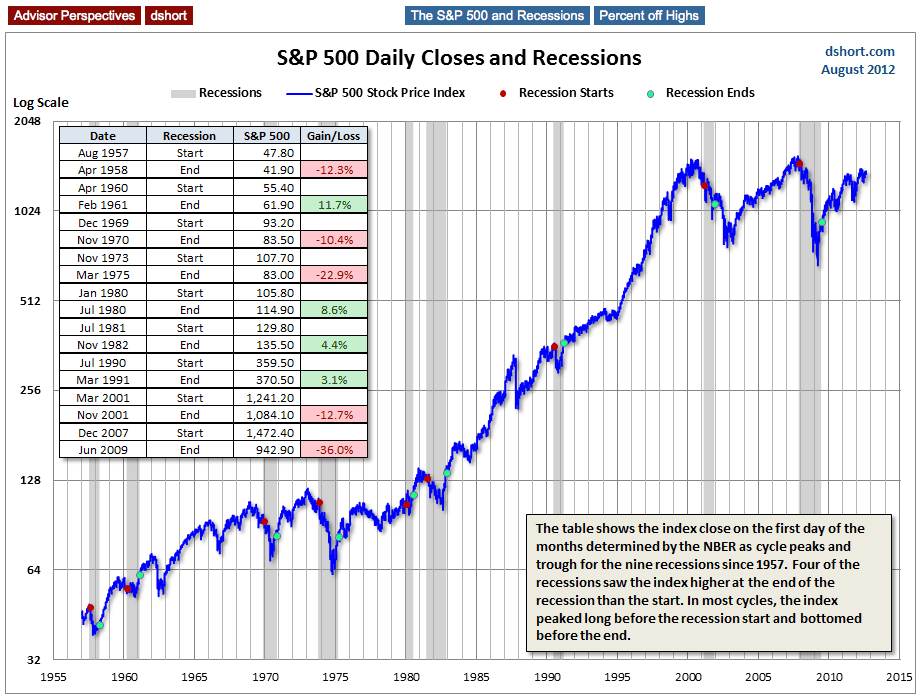

The S&P 500 started trading in 1957. During its first decade, the value of the index rose to slightly over 100, reflecting the economic boom that followed World War II. From 1969 to early 1981, the index gradually declined. During this period, the U.S. economy grappled with stagnant growth and high inflation.

On Dec. 27, 2021, the S&P 500 closed at a record high of 4,766.18 points.

The Oil Crisis and 1980-1982 Recession

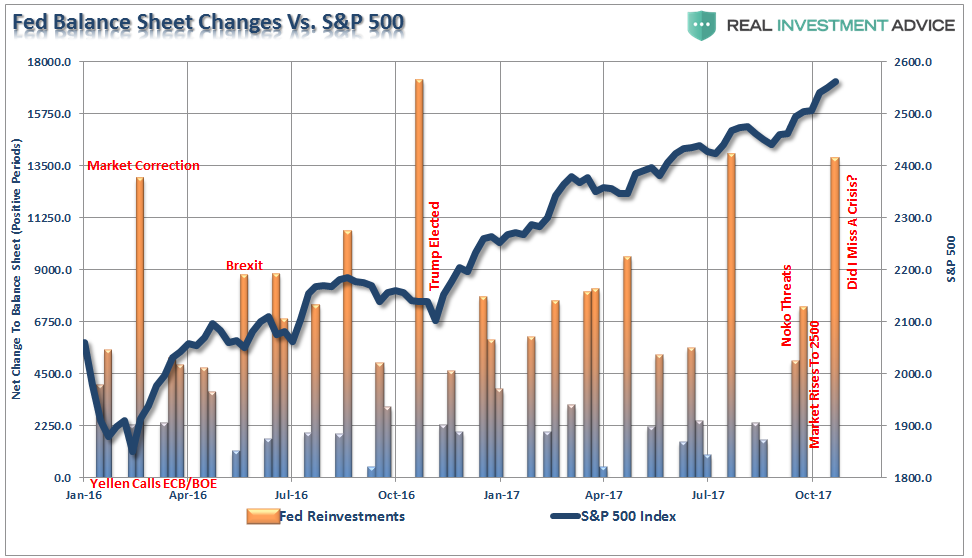

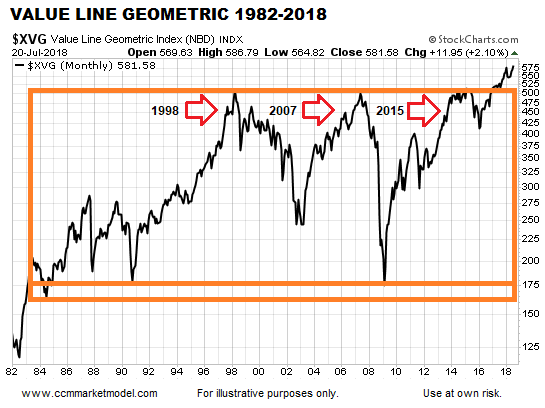

Through the Federal Reserve's raising of interest rates and intervention, inflationary pressures were successfully eased. This contributed to the bull market from 1982 to 2000, when stock market prices rose and the S&P 500 soared.

Other factors that contributed to the rise in stock prices were interest rates trending lower, strong global economic growth as a result of increasing levels of globalization, a rise in the middle class, technological innovations, a stable political climate, and falling commodity prices.

The Tech Bubble

In 2000, the stock market experienced a bubble. This period was marked by overvaluations, excess public enthusiasm for stocks, and speculation in the technology sector.

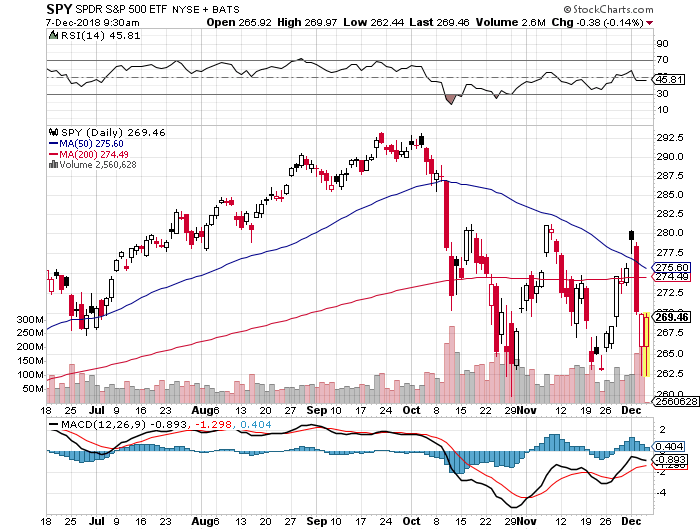

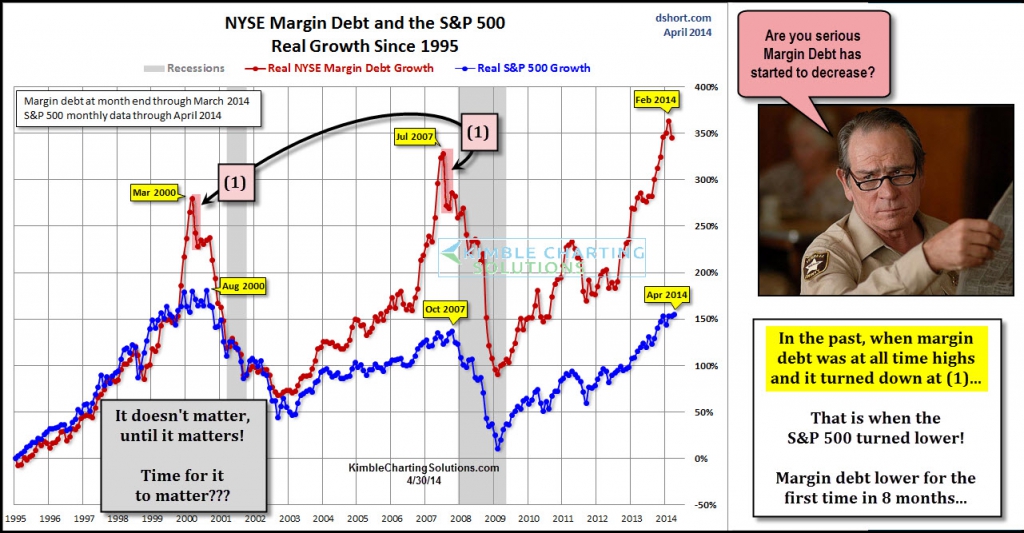

When the bubble burst between 2000 and 2002, the technology-centric Nasdaq took a major hit, while the S&P 500 also took a lesser hit. The S&P recovered, eventually reaching new highs in 2007. This period was fueled by growth in housing, the financial sector stocks, and commodity stocks.

The S&P 500 is a capitalization-weighted index, so its components are weighted according to the total market value of their outstanding shares.

The 2007-2008 Financial Crisis and Great Recession

Many of the previous decade's gains were reversed after a decline in housing prices. Widespread debt defaults created an environment of intense fear, and distrust of stocks as a trustworthy investment.

Widespread debt defaults created an environment of intense fear, and distrust of stocks as a trustworthy investment.

The S&P 500 bottomed out in March 2009 during the financial crisis that has come to be known as the Great Recession. The decline was the largest drop in the S&P index since World War II.

The 10-Year Bull Market

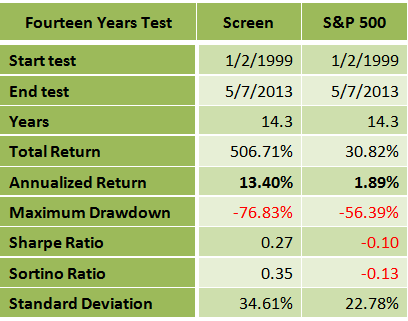

By March 2013, the S&P recovered all of its losses from the financial crisis soaring past the highs from 2007 and the prior highs from the tech bubble of 2000. To put the move in perspective, it took the S&P 500 nearly 12 years to break the tech bubble highs of 2000 and hold onto those gains. However, the rally didn't end in March 2013 and the S&P continued higher for nearly another seven years.

The index went on a nearly 10-year bull market. A bull market is a rising stock market that doesn't experience a price correction of 20% or more. Stable economic growth and low-interest rates helped to keep equity prices on the rise during the 10-year run.

Some investors typically opt for more stable, income-producing investments, such as bonds that pay a steady interest rate. However, during extended periods of low interest rates, as was the case following the Great Recession, bond yields become less attractive since yields tend to move in tandem with market interest rates.

As a result, many investors poured their money into the stock market including buying up dividend-paying stocks. Dividends are cash payments made to shareholders by companies as a reward for owning the stock.

During periods of low rates and steady economic growth, equity markets sometimes become the only game in town where investors can earn a steady yield—which can lead to a prolonged bull market.

The Coronavirus Pandemic of 2020 and 2021

The global spread of Covid-19 in early 2020 led to many countries issuing quarantines in which individuals were ordered to stay home and businesses were ordered to shut down. The expected negative impact on economic growth sent equity markets, such as the S&P 500, into a tailspin.

On Feb. 19, 2020, the S&P 500 closed at 3,386.15, which was an all-time high at that time. By March 23, 2020, the index plummeted to 2,237.40—falling 34% decline in just over a month. The impact on the U.S. economy was also severe. In the second quarter of 2020, U.S. economic growth, as measured by gross domestic product (GDP), declined by 32.9% from one year earlier.

By August 2020, hope sprung anew pushing the S&P past the prior all-time highs from February. Many factors led to the euphoric optimism throughout the equity markets, including trillions of dollars in fiscal stimulus by the U.S. government, loan programs for struggling businesses, the Fed's monetary policy of low interest rates, and vaccine production.

The positive impact on the economy was again recorded in the U.S. GDP figures for Q3 2020 when GDP grew by 33.4% from a year earlier. In Q4 2020, GDP grew by 4.3% from the same period the year prior.

The S&P 500 surged from the March pandemic low of 2,237. 40 to close out 2020 at 3,756.07 on Dec. 31, 2020. The S&P continued its positive trend into 2021. On Dec. 27, 2021, the index closed at yet another all-time high of 4,766.18 points. As of April 20, 2022, the index was trading at 4,462.21. The index showed some decline, closing the Oct. 4, 2022, trading day at 3,790.93.

40 to close out 2020 at 3,756.07 on Dec. 31, 2020. The S&P continued its positive trend into 2021. On Dec. 27, 2021, the index closed at yet another all-time high of 4,766.18 points. As of April 20, 2022, the index was trading at 4,462.21. The index showed some decline, closing the Oct. 4, 2022, trading day at 3,790.93.

Key dates and milestones in the S&P 500's history

By Caroline Valetkevitch

7 Min Read

NEW YORK (Reuters) - Standard & Poor’s, initially known as the Standard Statistics Company, created its first stock market index in 1923. It consisted of the stocks of 233 companies and was computed weekly.

Three years later, it developed a 90-stock composite price index computed daily. That was expanded over the years.

On March 4, 1957, the Standard & Poor's 500 .INX.SPX was introduced.

The S&P 500 index has became synonymous with the term “U.S. stock market.” It is one of the leading benchmarks for the market, even though others, including the Russell and Wilshire indexes, are broader measures of the market. Still, investors use the S&P 500 as the main index to measure their portfolios’ performance, with roughly $5.6 trillion benchmarked to the S&P 500.

Still, investors use the S&P 500 as the main index to measure their portfolios’ performance, with roughly $5.6 trillion benchmarked to the S&P 500.

The S&P’s 500 companies represent the U.S. market more broadly than the Dow Jones industrial average, which includes the stocks of only 30 companies.

American Telephone and Telegraph was the heaviest-weighted stock in the index in 1957. The company, now known as AT&T T.N, is the 11th-largest company in the S&P 500 index.

Today the S&P 500 index has a total market cap of about $14.96 trillion. Sixty-nine of the 500 original companies remain in the S&P 500 today.

Below are some key dates and milestones in the history of the S&P 500.

1923: Standard Statistics Company, as S&P was formerly known, develops its first stock market index consisting of the stocks of 233 U.S. companies, computed weekly.

1926: Standard Statistics creates a 90-stock composite price index, computed daily.

March 4, 1957: The Standard & Poor’s 500 index is introduced, tracking the performance of the stocks of 500 leading U.S. companies. With a total market capitalization of $172 billion, the S&P 500 followed the performance of 425 industrial, 15 rail and 60 utility stocks.

1958: S&P 500 ends the year up 38.06 percent, its best year in terms of percentage gain.

June 4, 1968: S&P 500 closes above 100 for the first time.

August 31, 1976: Vanguard introduces the first retail index mutual fund, the Vanguard First Index Investment Trust, which tracks the S&P 500, allowing individual investors for the first time to buy into the broad market with a single purchase. The fund, now known as the Vanguard 500 Index Fund VFINX.O, has $125 billion in assets.

April 21, 1982: The Chicago Mercantile Exchange begins trading futures based on the S&P 500.

July 1, 1983: Options contracts based on the S&P 500 index begin trading on the Chicago Board Options Exchange.

Oct 19, 1987: S&P 500 registers its worst daily percentage loss, falling 20.47 percent. The one-day crash, known as “Black Monday,” was blamed on program trading and those using a hedging strategy known as portfolio insurance. Despite the losses, the S&P 500 still ended up that year.

January 22, 1993: State Street's Standard & Poor's Depositary Receipts, or the SPDR S&P 500 SPY.P, an exchange-traded fund (ETF) that tracks the S&P 500's performance, begins trading on the American Stock Exchange. It was the first ETF to trade in the United States. The first SPDR and the many variations that followed are commonly referred to as the "spiders." The fund currently has about $133.8 billion in assets, making it the largest exchange-traded fund in terms of assets.

September 9, 1997: CME introduces the S&P E-mini futures, which is valued at $50 multiplied by the price of the S&P 500, or one-fifth of the size of the “big” S&P futures contract. It has since become the most heavily traded futures contract on the CME.

February 2, 1998: S&P 500 closes above 1,000 for the first time.

March 24, 2000: The S&P 500 index reaches an all-time intraday high of 1,552.87 during the dot-com bubble.

March 24, 2004: Trading begins in futures on the VIX .VIX, the CBOE Volatility Index measuring implied volatility of S&P 500 index options. The VIX is known as the market's "fear gauge." It tends to rise when stocks fall. It recently fell to levels not seen since April 2007.

March-September 2005: The index is transitioned from simply market-value weighted to float adjusted, where the market capitalization is calculated using only the number of shares available for public trading.

October 9, 2007: Index closes at a record high of 1,565.15.

October 11, 2007: S&P 500 hits intraday record high of 1,576.09.

Oct 13, 2008: S&P 500 marks its best daily percentage gain, rising 11.58 percent. It also registers its largest single-day point increase of 104.13 points.

2008: For the year, S&P 500 falls 38. 49 percent, its worst yearly percentage loss. In September 2008, Lehman Brothers collapsed as the financial crisis spread.

49 percent, its worst yearly percentage loss. In September 2008, Lehman Brothers collapsed as the financial crisis spread.

March 9, 2009: S&P 500 closes at 676.53, its closing low after the onset of the 2008 financial crisis and the Lehman Brothers’ bankruptcy.

August 20, 2012: Apple AAPL.O becomes the biggest U.S. company and takes over as the market capitalization leader in the S&P 500, pushing Exxon Mobil XOM.N into the No. 2 spot. Since then, Exxon and Apple have gone back and forth between the two spots, but Apple is currently No. 1 with a market cap of about $409 billion. Exxon's market cap is about $396 billion.

March 28, 2013: S&P 500 ends at 1,569.19, surpassing its previous record closing high set in 2007.

April 10, 2013: S&P 500 hits new all-time intraday record high at 1,589.07, surpassing previous record of 1,576.09 set in October 2007.

April 10, 2013: S&P 500 closes at a record high of 1,587.73 - eclipsing the record reached on March 28, when it climbed above the October 9, 2007, milestone of 1,565. 15.

15.

April 29, 2013: S&P 500 ends at a record high of 1,593.61.

April 30, 2013: S&P 500 climbs to an all-time intraday high of 1,597.57 in the final moments of trading - and ends at that level, which also represents another record closing high.

May 2, 2013: S&P ends at a record high of 1,597.59, just off a fresh intraday high of 1,598.60.

May 3, 2013: S&P 500 closes above 1,600 for the first time - finishing at 1,614.42 after a much better-than-expected April U.S. non-farm payrolls report. The index also hit an all-time intraday high of 1,618.46.

May 6, 2013: During the session, the S&P 500 hits an all-time intraday high 1,619.77.

May 6, 2013: S&P 500 ends at a record high of 1,617.50.

Sources: S&P Dow Jones Indices Senior Index Analyst Howard Silverblatt, the Standard & Poor’s book, “Innovation & Evolution, The S&P 500,” CME, CBOE, Vanguard Group Inc, State Street Global Advisors, Thomson Reuters.

Reporting by Caroline Valetkevitch; Editing by Jan Paschal and Nick Zieminski

S&P 500 history for 135 years, daily data with dividend reinvestment - Finance on vc.

ru

ru For those who are not interested in the methodology and need only data, here is a table. The rest of the article is for those who want to test me or, by analogy, build data for another index.

30,896 views

Motivation

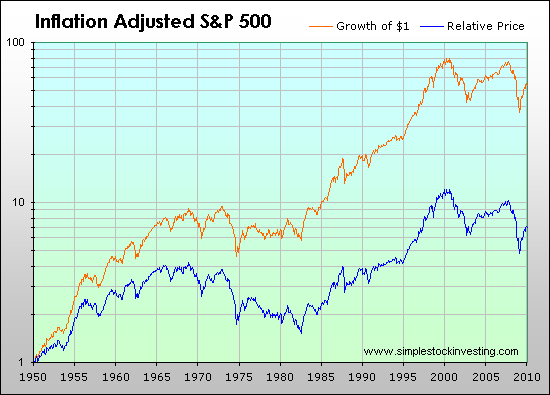

The S&P 500 is the most popular and well-known index in the world, which is often used as a benchmark for comparing investment results or as a typical asset in a portfolio. Easily accessible data on the Internet, as a rule, either for just a few decades, or without reinvestment of dividends, or with monthly granularity - all this is not suitable if we are talking about the behavior of a portfolio over an interval of decades, because dividends are an integral part of the financial result of the portfolio, and daily data is needed for accurate calculations.

So for my own purposes I had to calculate by hand the return on investment in the S&P500 over the past 135 years, with dividend reinvestment, to the nearest day. SPX). Daily data only appears from 1885-02-17.

SPX). Daily data only appears from 1885-02-17.

If necessary, missing data for the last few trading days can be found here: SPDR S&P 500 ETF Trust (SPY), Historical Prices.

This is the S&P 500 daily price chart since 1885-02-17:

Both sources above include the price of the S&P 500 without reinvestment of dividends, so additionally it is necessary to find the most accurate historical data on dividend payments.

Dividend payment history

Historical data on dividends since January 1871 can be taken from the online DATA study by robert shiller, at the link U.S. Stock Markets 1871-Present and CAPE Ratio, from the “Data” tab in the table. The “Dividend” column contains monthly data (on an annual basis):

The table above lacks the most recent dividend data: at the time of writing, the latest data was for March 2020, although it was July 2020. Some of the missing data between March and July can be taken from the Historical Data tab on the Yahoo! Finance website: SPDR S&P 500 ETF Trust (SPY), Mar 1, 2020 - Jul 12, 2020, Dividends Only.

The data above contains only quarterly payments, and we need monthly data for more accurate calculations. A better approximation would be to divide the quarterly dividend by 3 months, proportional to the value of the S&P 500 at the end of each month, for example: + Price(2020.05) + Price(2020.06))

Worst of all in terms of data accuracy are the dividends for the current month, July. Let's assume that they will change in proportion to the value of the S&P 500, based on the average values for the last 4 months:

AnnualizedDividend(2020.07) = Price(2020.07.12) / Sum(Price(2020.04) + Price(2020.05) + Price(2020.06)) * Sum(AnnualizedDividend(2020.04) + AnnualizedDividend(2020.05) + AnnualizedDividend(2020.0))

To make sure we don't have gaps in the data, let's separately calculate the difference between the current and previous dates for each row:

And check how many date differences we got:

As you can see, all numbers are expected: 150 date differences by 0. 89for 150 years, 149 * 11 + 6 = 1645 date differences by one month for 149 years and 6 months. And one date difference with a dash, the very first one, since there is nothing to calculate the difference with.

89for 150 years, 149 * 11 + 6 = 1645 date differences by one month for 149 years and 6 months. And one date difference with a dash, the very first one, since there is nothing to calculate the difference with.

There is no more accurate historical data, so the daily dividend payments will have to be calculated independently.

History of trading days

To calculate the dividend payout for each trading day, divide the dividend payout for a calendar month (on an annualized basis) by the number of trading days in that calendar year, for example:

DailyDividend(2020.04.01) = AnnualizedDividend(2020.04) / TradingDays(2020)

The number of trading days is used instead of calendar days, since in the future it will be necessary to reinvest dividends every trading day. Reinvestment every calendar day is technically impossible.

The number of trading days for a calendar year is used instead of a month, because monthly dividend payments in the historical data from online DATA robert shiller are calculated on a year scale and not a month scale.

We take the number of trading days for the last few calendar years from Wikipedia: Wikipedia: Trading day.

For previous years, we take the number of trading days from the actual S&P 500 prices, summing the number of closing prices for each calendar year:

The number of trading days in each calendar year will allow you to calculate the amount of dividends paid on each trading day.

Reinvestment of daily dividends

Dividends received every day from the S&P 500 will be reinvested, taking into account taxes of 13%:

S&P 500 with dividend reinvestment(Day(1)) = S&P 500(Day(1)) X)) = S&P 500 with dividend reinvestment(Day(X-1)) * (S&P 500(Day(X)) + DailyDividend(Day(X)) * (1 - Tax=13%)) / S&P 500(Day (X-1))

Plot the S&P 500 with dividend reinvestment:

Specific values at the beginning and end of the period, as well as in two local minima at 1932nd (Great Depression) and 1942 (Great Patriotic War) years:

Data

A table with the original data, including a separate tab with S&P 500 prices on the last trading day of each month, can be downloaded here: Ilya Roslyakov — S&P 500 History for 135 years, daily data with dividend reinvestment — table.

What is the S&P 500

The S&P 500 is an index that tracks the value of the 500 largest publicly traded companies in the US

The set of stocks included in the S&P 500 index is designed to reflect the overall structure of the US economy - which is why market participants closely monitor the value of the S&P 500 index and individual stocks included in it, as their financial condition reflects the situation in the US economy as a whole .

The combination and weight of the various components of the S&P 500 are adjusted as the situation in the global and US economies changes. As a result, some stocks have been added to and removed from the index over the years.

Requirements for inclusion in the S&P 500

The components of the S&P 500 are selected by a special committee and reflect the industries that make up the US economy. To be included in the S&P, a company must meet certain size requirements based on liquidity. In particular, the market capitalization must be greater than or equal to $11. 8 billion, there must be at least 10% of traded shares in free float, as well as the profit for the last quarter and the sum of earnings for four consecutive quarters must be positive.

8 billion, there must be at least 10% of traded shares in free float, as well as the profit for the last quarter and the sum of earnings for four consecutive quarters must be positive.

To calculate the value of the S&P 500 index, the sum of the adjusted market capitalization of all 500 stocks is divided by a factor commonly referred to as a divisor. For example, if the total adjusted market capitalization of the 500 constituent stocks is $13 trillion and the divisor is 8.933 billion, then the S&P 500 index value would be 1455.28. The adjusted market capitalization of the entire index can be found on the Standard & Poor's website. The exact value of the divisor is considered the property of Standard & Poor's - despite this, its value is known and is about 8.4 billion.

S&P as an indicator of the health of the US economy

The S&P is viewed by most analysts as an indicator of the overall health of the US stock market. It is also the main tool for passive investors who want to access the US economy through index funds.

The rise in prices of the S&P 500 accurately tracks the growth of the US economy in terms of its nature and size. S&P 500 price fluctuations also accurately reflect periods of turbulence in the US economy. As a result, the long-term price history chart of the S&P 500 is also an indicator of investor sentiment towards the US economy.

S&P 500 performance

The S&P 500 opened on January 2, 1957 at 46.20. During the first decade, the index rose to over 800 points, reflecting the economic boom that followed World War II. From 1969 to early 1981, the index gradually declined and eventually fell to below 360. During this period, the US economy faced stagnation and high inflation.

Oil crisis and recession of 1980-1982

Thanks to higher interest rates and intervention by the Federal Reserve, inflationary pressures have been successfully eased. This contributed to the development of a bull market in the US from 1982 to 2000, when stock market prices rose and the S&P 500 rose over 840%. Other factors that contributed to the rise in stock prices were lower interest rates, strong global growth as a result of increasing levels of globalization, a growing middle class, technological innovation, a stable US political climate, and falling commodity prices.

Other factors that contributed to the rise in stock prices were lower interest rates, strong global growth as a result of increasing levels of globalization, a growing middle class, technological innovation, a stable US political climate, and falling commodity prices.

What is your price prediction for US500?

4010.8

Up

or

Down

Vote to see!

Market Sentiment

Rise Decrease

57% 42%

You voted for the price to fall. You voted for the price increase.

Try trading US500?

View demo

View demo

Technology Bubble

In 2000, the so-called technology "bubble" appeared on the stock market. This period was characterized by inflated valuations, public over-enthusiasm for equities, and speculation in the technology sector. When the bubble burst in 2000-2002, the tech-focused NASDAQ index fell nearly 63% and the S&P 500 fell nearly 25%. The S&P bounced back, eventually making new highs in 2007. This period was fueled by the growth of housing construction, shares of the financial sector and commodity companies.

The S&P bounced back, eventually making new highs in 2007. This period was fueled by the growth of housing construction, shares of the financial sector and commodity companies.

The financial crisis of 2008-2009 and the Great Recession

However, many of these gains were reversed by falling house prices. Widespread debt defaults have created a climate of fear and distrust of stocks as safe investments. The S&P 500 fell 49.17% from its new high in October 2007, bottoming out in March 2009 during the financial crisis, also referred to as the "Great Recession". This fall was the largest since World War II.

COVID-19 Pandemic (2020-2021)

The global spread of the COVID-19 virus in early 2020 resulted in lockdowns and business shutdowns in many countries. The expected negative impact on economic growth led to a fall in stock markets - the S&P 500 index fell as a result of this collapse.

On February 19, 2020, the S&P 500 closed at 3386.15, a record high at the time. However, by March 23, 2020, the index fell to 2237.40 - its value decreased by almost 34% in one month. The impact of the pandemic on the US economy has also been significant. In the second quarter of 2020, US GDP fell by 32.9% compared to the previous year.

However, by March 23, 2020, the index fell to 2237.40 - its value decreased by almost 34% in one month. The impact of the pandemic on the US economy has also been significant. In the second quarter of 2020, US GDP fell by 32.9% compared to the previous year.

By August 2020, hopes for an economic recovery flared up with renewed vigor, pushing the S&P to repeat its February record highs. Many factors led to euphoria in the stock markets, including trillions of dollars of US government fiscal stimulus, credit programs for struggling businesses, low interest rate Fed monetary policy, and expanded vaccine production.

The recovery of the US economy was again recorded in the 3rd quarter of 2020, when US GDP grew by 33.4% compared to a year earlier. In the 4th quarter of 2020, the US economy grew by 4.3% compared to the same period last year.

The S&P 500 climbed from its March pandemic low of 2237.40 to 3756.07 on December 31, 2020, up almost 68%.

S&P continues its positive momentum in 2021. On November 18, 2021, the index closed at another all-time high of 4712.02 points.

On November 18, 2021, the index closed at another all-time high of 4712.02 points.

FAQ

What is the S&P 500?

The S&P 500 is an index that tracks the value of the 500 largest publicly traded companies in the US. The set of stocks included in the S&P 500 index is designed to reflect the overall structure of the US economy - which is why market participants closely monitor the value of the S&P 500 index and individual stocks included in it, as their financial condition reflects the situation in the American economy.

Which companies are in the S&P 500?

The components of the S&P 500 are selected by a special committee and reflect the industries that make up the US economy. To be listed on the S&P, a company must meet certain size requirements based on liquidity: a market capitalization of greater than or equal to $11.8 billion, a free float of at least 10% of the shares traded, and the most recent quarter earnings and earnings should remain positive for four consecutive quarters.